Solana has the crowd behind it: Can SOL hit $100?

- The atmosphere around Solana continued to be bullish at press time.

- SOL has the potential to reach $75 in a few weeks, and $100 in a few months.

Solana [SOL] has jumped above $60 after the cryptocurrency’s value increased by 8.07% in the last 24 hours. But before this recent increase, SOL took some time off its uptrend. During that phase, the token’s price dropped to $56.21.

However, the increase in price this weekend has brought about renewed confidence in traders with love for Solana. AMBCrypto arrived at this inference by looking at the Weighted Sentiment. On the 19th of November, the Weighted Sentiment hit 1.79 before a slight decrease to 1.20.

FOMO may not stop SOL’s sprint

The Weighted Sentiment reading was the highest number since 2023. This indicated that the broader market is bullish on SOL. Also, it was a sign that many market players were having feelings of Fear of Missing Out (FOMO) on a possible SOL uptrend.

In fact, there have been a number of predictions suggesting that SOL may hit $100. There are also some who believe that cryptocurrency will surpass its previous All-Time High (ATH). However, positive sentiment alone is not enough to drive Solana to new highs.

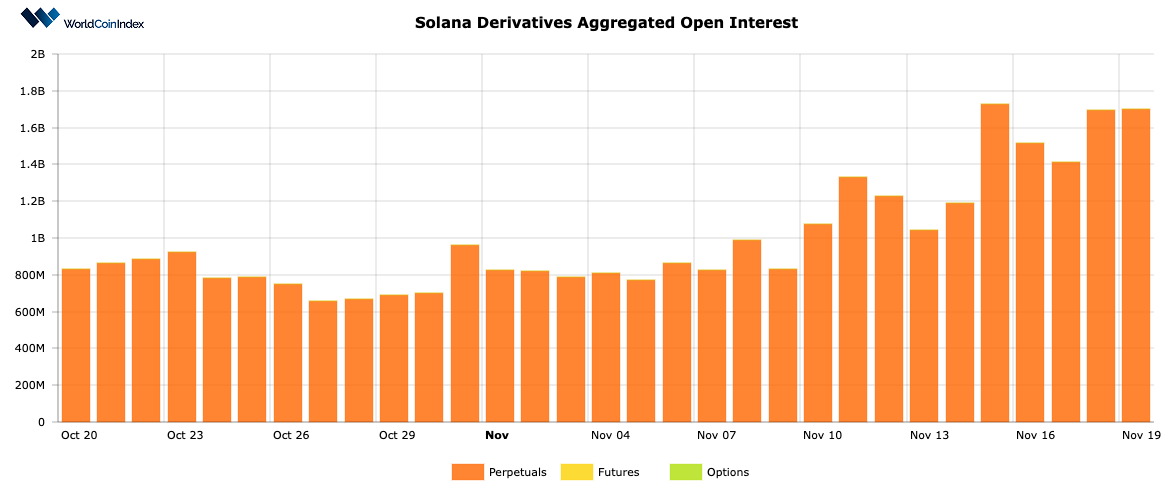

While it may have performed well all year long, it is important to check out its Open Interest. Open Interest is the value of outstanding open contracts in the derivative market. The indicator, when it rises, suggests an increase in open positions.

When the Open Interest falls, it means liquidity doled out to a cryptocurrency’s contract has decreased. At the time of writing, the Open Interest around the Solana token had increased to $1.7 billion.

However, Open Interest is not just a measure of market participation. It can also be an indicator of the potential price movement. Most times, when the Open Interest increases alongside the price, it serves as strength to back the uptrend.

$100 in a few months?

At the same time, the Open Interest decreasing with an increasing price makes the direction weak. So, In SOL’s case, there is a high chance that the price will continue to tilt north. If this is the case, then SOL may hit $70 or $75 within a few weeks.

AMBCrypto analyzed the SOL/USD four-hour chart, using the Exponential Moving Average (EMA). As of this writing, the 20 EMA (blue) was above the 50 EMA (yellow). This is an indication that SOL’s uptrend may continue.

Is your portfolio green? Check out the SOL Profit Calculator

But it might also depend on the Relative Strength Index (RSI). The RSI, at press time, was 54.24. If the reading rises more than that, the SOL’s first stop could be in the $65 region. In the long-term, both the 50 and 20 EMAs had risen above the 200 EMA (cyan).

Like the interpretation above, this is another bullish sign for SOL. In the near future, probably a few months from now, SOL may reach $100. That is, if the sentiment around the project remains on the high side.