Solana edges out competition, carves niche in DEXes

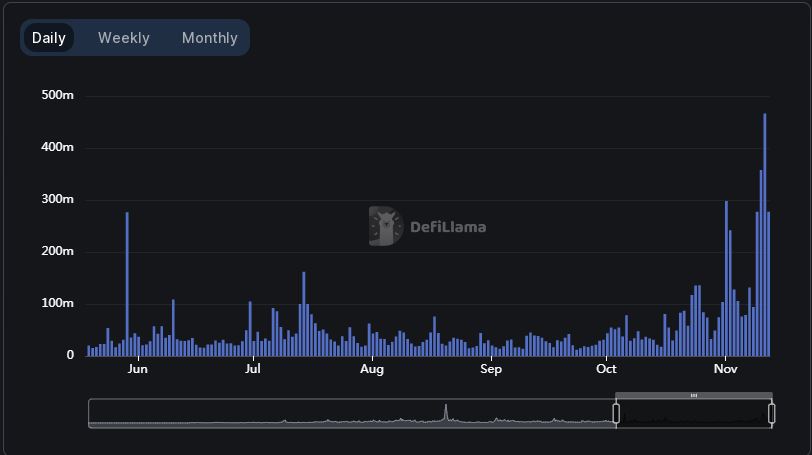

- The DEX volume leaped to a yearly peak of $466 million on the 11th of November.

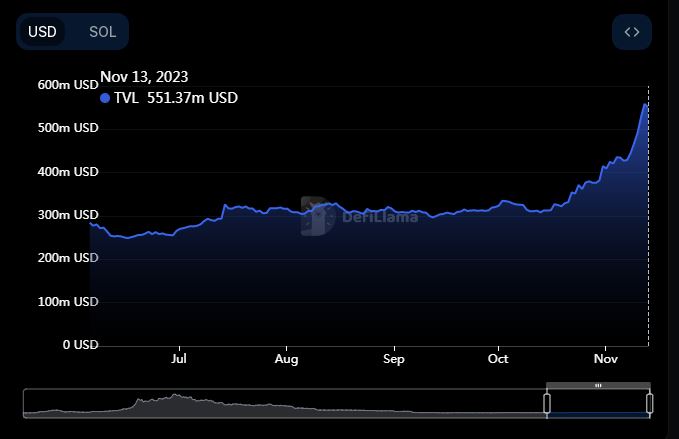

- The TVL rose by 81% over the last month.

Solana [SOL] recorded one of its best feats in terms of decentralized exchange (DEX) volumes in the last 24 hours.

Solana’s DEX volumes on the rise

According to a recent post by popular on-chain analyst Patrick Scott, Solana climbed to the number two position in 24-hour DEX volume by chain on the 12th of November. As per Scott, this was the first time that Solana bagged the second rank.

Major changes to DEX volume by chain this week. Solana jumped to number 2. ThorChain jumped to number 3. And BSC was pushed all the way to rank 5.

As far as I can tell, BSC has been in the top 3 since September 2020. Solana has never been number 2 before. pic.twitter.com/AWAsQj1YNn

— Patrick Scott | Dynamo DeFi (@Dynamo_Patrick) November 12, 2023

As of press time, Solana slipped to the third position, according to DeFiLlama. But it took nothing away from the impressive run of Solana-based DEXes in the last few days.

Trades worth $2.25 billion were recorded on Solana over the past week, marking an increase of nearly 60%. In fact, the DEX volume leaped to a yearly peak of $466 million on the 11th of November, as shown below.

Sharp jump in TVL

Apart from trading volume, the value of crypto deposited on the Solana blockchain was also soaring to new highs.

The total value locked (TVL) went past $550 million as of press time, representing a whopping 81% jump over the last month. The parabolic surge in TVL followed a sideways trajectory which dominated the greater part of 2o23.

SOL in the middle of a bull run

The surge was largely a result of the gravity-defying movements of native SOL token. The seventh-largest digital asset by market cap has exploded 172% over the past month, trading at $58 at the time of writing, per CoinMarketCap.

The latest rally also sent SOL to its yearly peaks, which otherwise wobbled in a narrow trading range of $20-$30 for most parts.

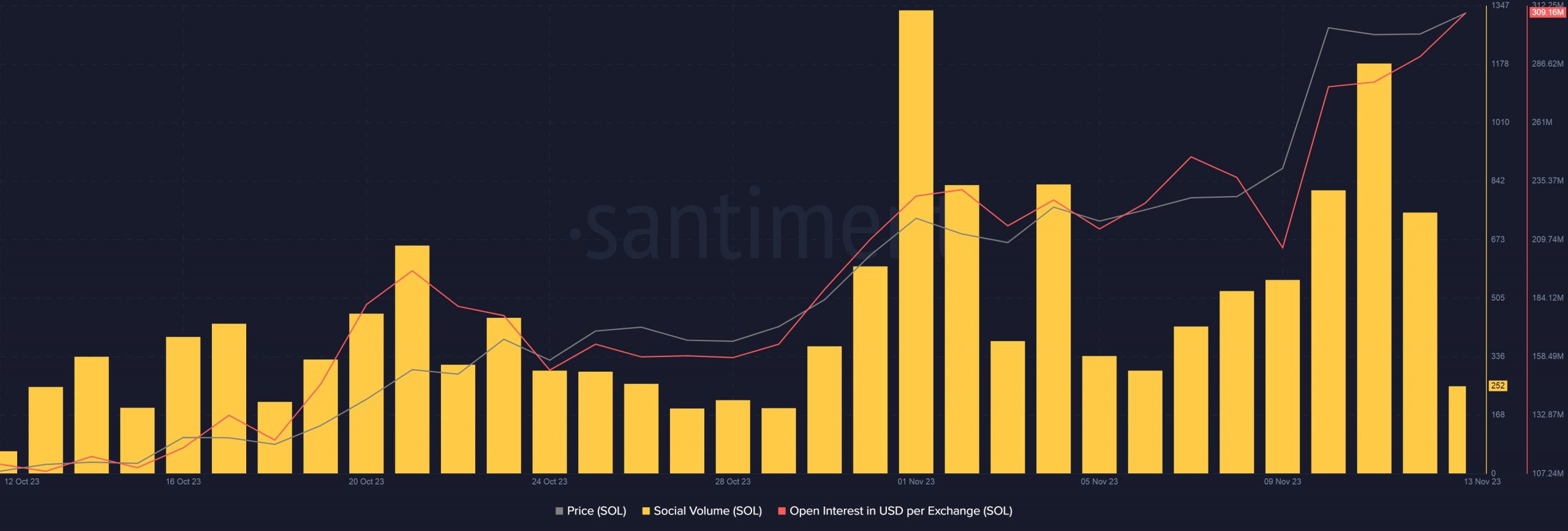

The price rise also resulted in capital inflows. The Open Interest (OI) in Solana futures increased 44% in the last week, according to Santiment.

A rise in OI coinciding with a rise in price of a crypto asset was indicative of bullish market sentiment.

Is your portfolio green? Check out the SOL Profit Calculator

The price pump over the weekend also made SOL a talking point in crypto circles. The number of mentions of the coin on top crypto social media channels jumped, as shown above.

Social chat around a crypto coin has historically played a significant role in attracting new participants. Hence, it’s not surprising to see analysts and traders tracking these to get a good indication of the asset’s next moves.