Solana crosses $70 for the first time in over a year – What next?

- SOL is now trading at over $76.

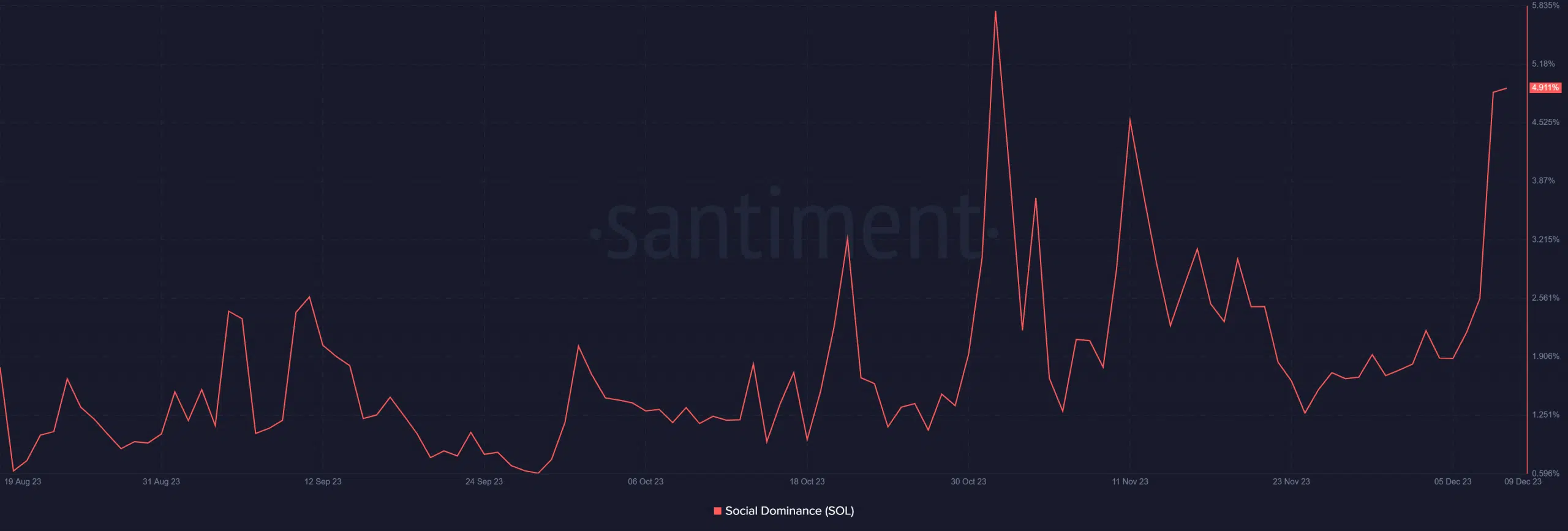

- Its social dominance has risen to one of the highest points.

Solana [SOL] continues to experience a steady upward trend, sparking increased discussions around it in recent times.

Solana finds a new price range

Recently, Solana surpassed the $70 price range, marking the first time in months. A detailed analysis of the daily timeframe chart revealed significant uptrends in the past few days.

On 7th December, it experienced a 9.57% surge, reaching over $67. The subsequent trading session on 8th December saw an even higher increase of 10.59%, pushing the SOL price beyond $74.

At the time of writing, it had climbed to over $76, reflecting a 1% increase. The last time SOL traded in similar price ranges was around May 2022.

Furthermore, as of the current assessment, all signals indicate a bullish trend. The Relative Strength Index (RSI) was above 75, signifying a bullish trend in an oversold position with a potential for correction.

Additionally, the Moving Average Convergence Divergence (MACD) was over zero, and the lines were trading above 4, highlighting a robust bull trend. This remarkable trend has also captured the attention of the broader cryptocurrency community.

Solana asserts some social dominance

The recent surge in Solana’s price trend has significantly amplified the volume of discussions about SOL.

Its social dominance chart on Santiment indicated this. An analysis of this chart showed that it has climbed to one of its highest points in nearly five months.

At the time of writing, the social dominance was around 4.9%. The last instance of higher social dominance occurred on 1st November, reaching around 5.7%.

Additionally, the current social dominance level indicates that SOL is presently a subject of discussion in nearly 5% of the crypto space.

This suggests a potential scenario where more individuals might be compelled to buy in due to fear of missing out (FOMO), contributing to further upward pressure on the price.

Solana volume wax stronger

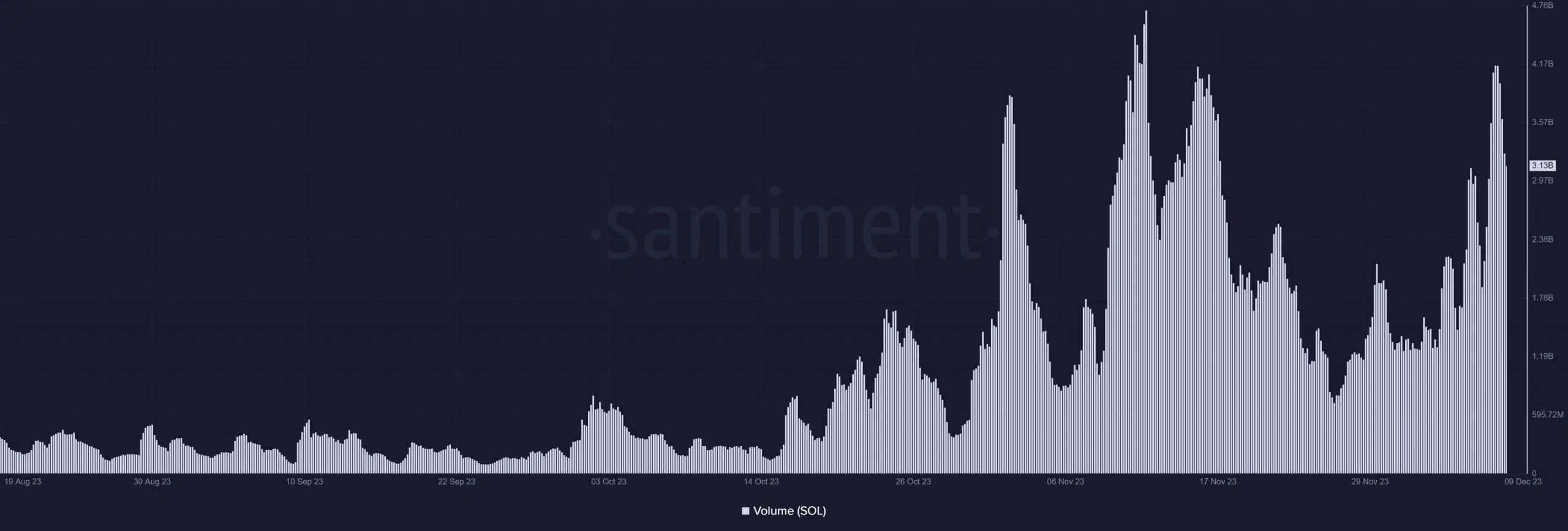

Examining the volume chart on Solana showed a notable convergence between price and volume. The chart illustrates that the volume started to rise simultaneously with the price increase.

Is your portfolio green? Check out the SOL Profit Calculator

Before the price surge, the volume was around $3 billion. However, following the consecutive price increases, the volume went over $4 billion.

As of this writing, the volume was around $3.1 billion. This substantial increase strongly signals heightened trading activity, indicating a potential continuation of the upward price trend.