Solana co-founder predicts memecoin evolution – Are tokens the new tech IPOs?

- Solana co-founder Raj Gokal believes most techs will replace IPOs with crypto tokens

- However, there isn’t a clear regulatory framework for such tokens so far

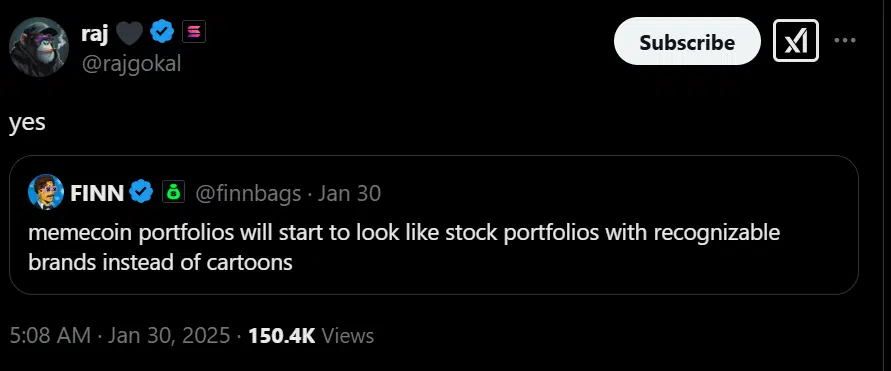

Solana co-founder Raj Gokal and other top crypto investors and analysts believe the memecoins’ craze will evolve into “tech IPOs.”

According to Gokal, instead of issuing traditional stocks during an initial public offering (IPO), most firms will opt for crypto for token issuance to raise capital and drive user engagement.

Source: X

From memecoins to tech IPOs?

Interestingly, Gokal is not the only one who subscribes to this projection. Ryan Watkins, co-founder of crypto VC firm Syncracy Capital, echoed a similar sentiment, terming 2025 as a “dot fun boom.” He stated,

“Dotcom boom = Everyone launches a website. Dot fun boom = Everyone launches a token.”

Watkins referred to the viral official Trump memecoin launch and the pro-crypto U.S administration as an Overton window that would usher new experiments and innovation. Especially SocialFi applications that might join the fray.

In particular, the VC executive cited Vine and Jelly Jelly, which are supposedly socialFi platforms with issued tokens. Watkins added,

“If individuals can launch memecoins, why can’t businesses? This isn’t just a U.S. phenomenon — it’s global. If Vine and Jelly Jelly are any indication, we’re on the verge of an explosion of new “startup” assets on blockchains, especially Solana. Some will have utility. Some will be outright scams, as expected. But a handful may create lasting societal value.”

For context, Vine is a defunct short-video platform similar to TikTok. On the other hand, Jelly Jelly is a video chat service reportedly created by Venmo founder Iqram Magdon-Ismail.

However, some community members have alleged manipulation of the said tokens. For instance, Jelly Jelly dropped by nearly 80% in less than 24 hours after its launch. It fell from a $280M market cap to below $75M on the charts.

Besides, Pump.fun, the memecoin launchpad on Solana, is facing another class action lawsuit, according to Burwick Law.

The firm alleges its clients suffered losses from Griffain, PNUT, and other memecoins marketed by Pump.fun (operated by Baton Corporation). The legal outcome and impact on the token issuers remain to be seen.

That being said, unless there are clear regulatory guidelines to navigate the token-driven “tech IPO vision” touted by Gokal, the firms could face legal pressure.