Solana and Avalanche follow Ethereum’s lead, reap these benefits

- Solana and Avalanche witnessed a rise in staking.

- Growth in the DeFi sector was observed for both chains even as price movement declined.

In the last few quarters, interest in Ethereum [ETH] staking has reached new heights. With multiple addresses joining the network to stake ETH, liquid staking protocols such as Lido [LDO] also prospered.

However, recently, it was seen that interest in staking wasn’t just limited to Ethereum. Networks such as Solana [SOL] and Avalanche [AVAX] were slowly making their mark in this space as well.

Staking on the rise

Solana has a considerable portion of its available supply locked in staking, which means users hold and store their Solana coins in a special account to support the network.

This contrasts with Ethereum, where a smaller percentage of its circulating supply is used for staking.

The recent price increase of Solana may be largely influenced by this high level of staking activity, indicating strong community support and confidence in the Solana network.

Staking is a way for crypto holders to earn rewards by actively participating in network security and operations, making their coins work for them. This difference in staking dynamics contributes to Solana’s recent surge in value.

An overview of the staking landscape.

Solana actually has significantly more of it's circulating supply in staking, compared to Ethereum. This could largely be the biggest contributing factor to it's recent pump. pic.twitter.com/AMWZNDH2GL

— ImNotTheWolf (@ImNotTheWolf) November 20, 2023

However, it wasn’t just Solana that was seeing growth in this space.

Recently, BenqiFinance on Avalanche experienced growth in liquid staking comparable to what Solana observed in the past month. More people staking on Avalanche is like a team getting stronger. It makes AVAX, the native coin, more secure.

This also attracts people to Avalanche, causing a surge in the token’s price.

An overview of the staking landscape.

Solana actually has significantly more of it's circulating supply in staking, compared to Ethereum. This could largely be the biggest contributing factor to it's recent pump. pic.twitter.com/AMWZNDH2GL

— ImNotTheWolf (@ImNotTheWolf) November 20, 2023

Growth in DeFi

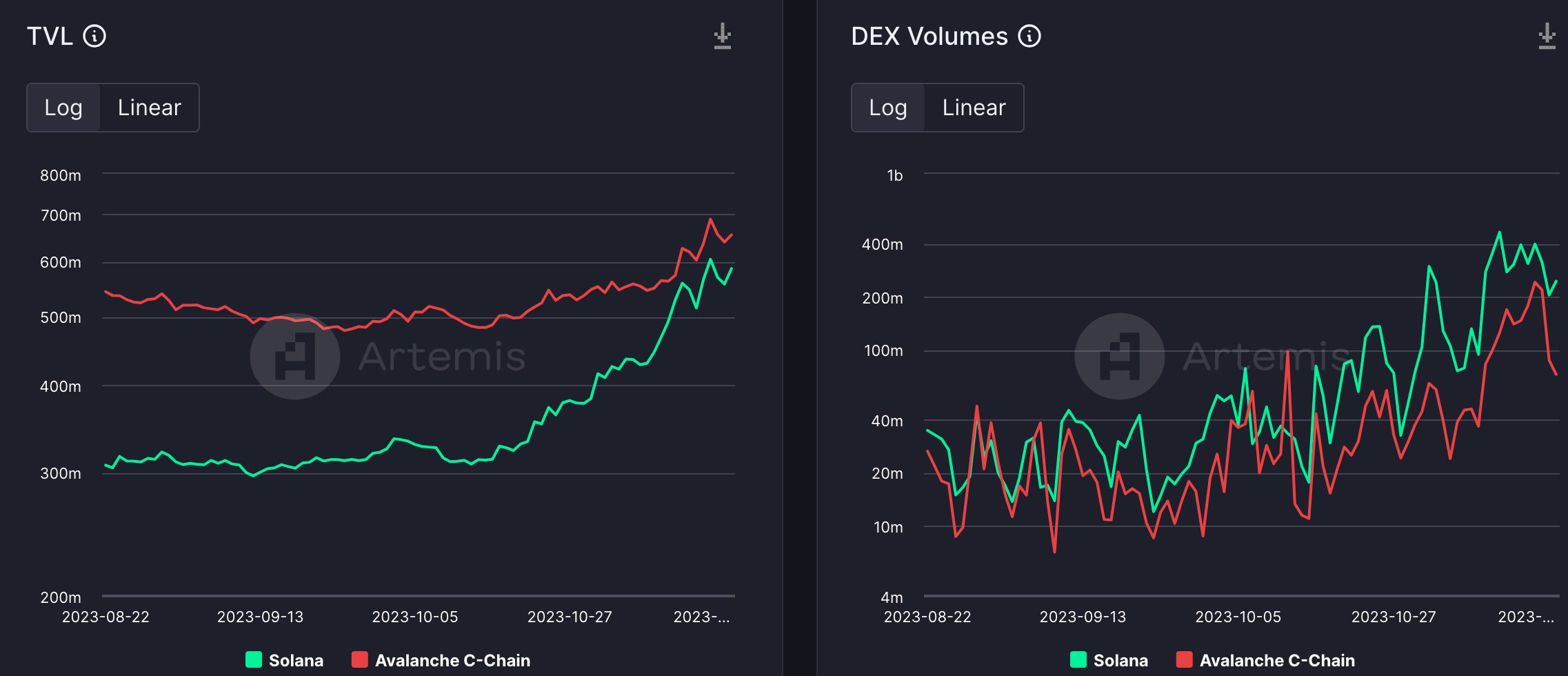

There was also some growth in the DeFi sector. Notably, Solana’s exchanges had a big week, trading at $1.93 billion. This shows a lot of money moving on Solana’s blockchain.

DEXes let people trade crypto directly without a middleman. The high volume means more interest and action in DeFi on Solana. This growth shows that people really like using Solana’s DEXes for crypto trading.

Along with the surge in Solana’s DEX volumes, Avalanche’s DEX volumes also grew. Coupled with that, the TVL on both Solana and Avalanche also rose.

Is your portfolio green? Check out the SOL Profit Calculator

A rising Total Value Locked (TVL) is good for Solana and Avalanche. It means more assets are locked into their networks. This boosts confidence in the platforms. Thus, higher TVL can attract more projects and users.

Despite the protocol’s improvement in terms of staking and DeFi, the growth wasn’t reflected in the price. Over the last few weeks, the overall price of AVAX and SOL fell. At press time, SOL was trading at $9.544 and AVAX was trading at $22.36.