Altcoins

SOL/BTC ratio hits key turning point: Crucial weeks ahead for Solana?

Tracking SOL’s recovery odds? Here’s what SOL/BTC suggests could happen next…

- SOL/BTC hit a pivot level that suggests a rebound could be imminent.

- But SOL faced intense short-term sell pressure below $200.

Like most altcoins, Solana [SOL] has erased nearly all New Year gains following recent macro headwinds in the U.S. It briefly topped $220 during the early January pump but lost a $200 psychological level as negative market sentiment intensified.

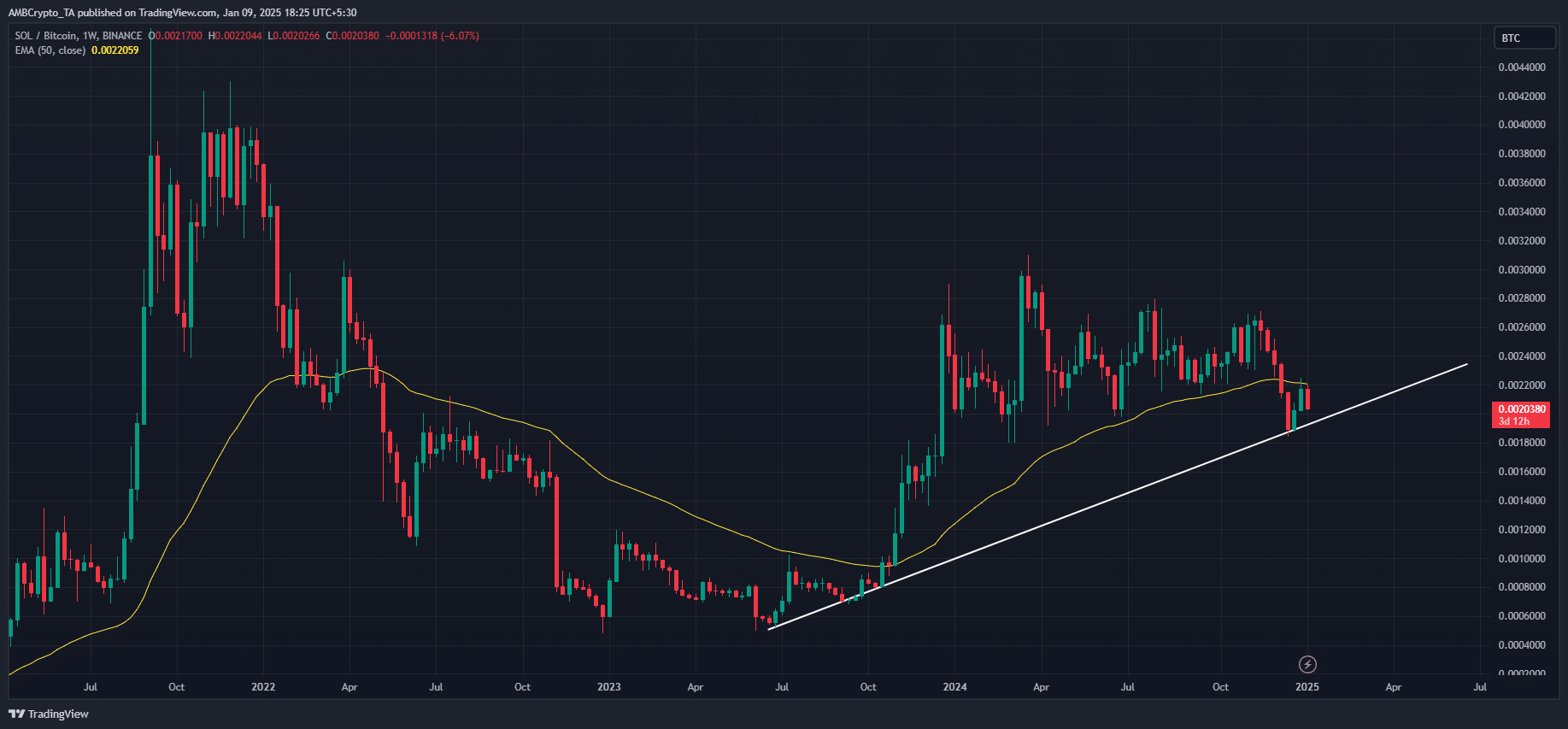

However, the SOL/BTC ratio, an indicator that gauges SOL’s relative price performance to Bitcoin, was at a pivotal point that suggested the altcoin could front a strong rebound.

Is SOL/BTC ratio recovery imminent?

A surge in SOL/BTC implies that SOL has outperformed BTC and vice versa. During the holiday sell-off, the ratio declined by 30%, indicating that SOL underperformed BTC.

However, the ratio has now tapped long-term trendline support, signaling a potential rebound and SOL’s outperformance in the coming weeks. Yet, a hurdle needs to be cleared first.

Despite the recent small bounce, the ratio was below a key Moving Average(MA) in yellow. SOL began its massive cycle run when the ratio reclaimed the MA in late 2023. If the trend repeats, such a move could bolster SOL’s outlook and may outperform BTC again.

In the meantime, the altcoin faced intense selling pressure. According to Coinglass data, over $300 million worth of SOL has been transferred to exchanges for offloading.

This was indicated by the positive spot netflow, showing that more SOL tokens were moved to centralized exchanges to be sold.

The dumping has dragged SOL below its yearly open of $189, at press time. It was valued at $185, and the December lows of $175 could be within reach if the plunge extended.

On the price charts, the key support levels were $175 and $160. On the upside, SOL bulls had to blast above the trendline resistance to reinforce the market edge.