Should Avalanche investors be worried about the upcoming token unlock?

- After a comfortable month-long rally, Avalanche’s daily chart turned red.

- AVAX’s funding rate declined along with its price.

Avalanche [AVAX] displayed a commendable bull rally last week as its price surged by nearly 25%. However, the good days came to an end as the token’s daily price chart turned red.

Things can get worse for AVAX as it is expecting a fresh round of token unlocks, which can further push its price down over the coming days.

Avalanche investors must be cautious

AVAX surprised investors last month as its price rallied by more than 125%, allowing it to increase its market capitalization. But the trend came to an end in the recent past.

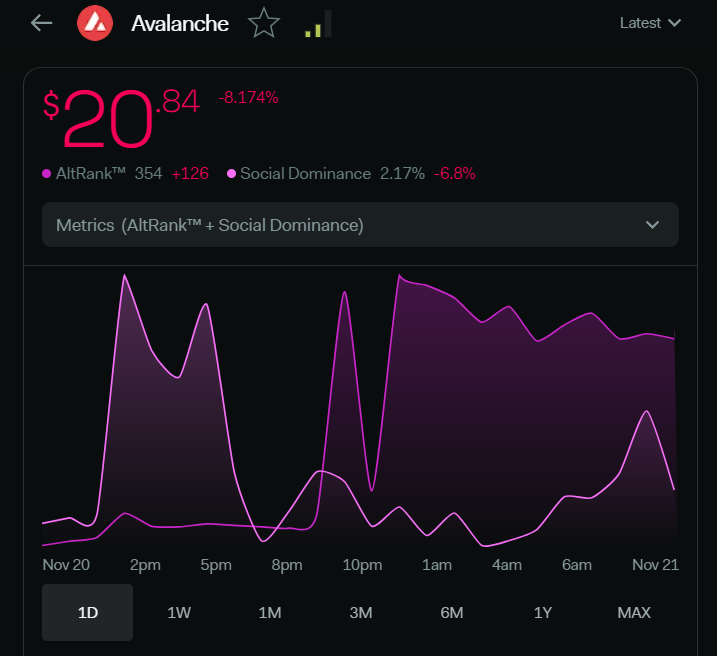

According to CoinMarketCap, AVAX’s price dropped by nearly 8% in just the last 24 hours. At the time of writing, it was trading at $20.83 with a market cap of over $7.4 billion.

The price decline caused the token’s social metrics to drop.

Upon checking, AMBCrypto found that Avalanche’s social dominance fell by 6.8% in the last 24 hours. Another bearish metric was the Altrank, which increased of late.

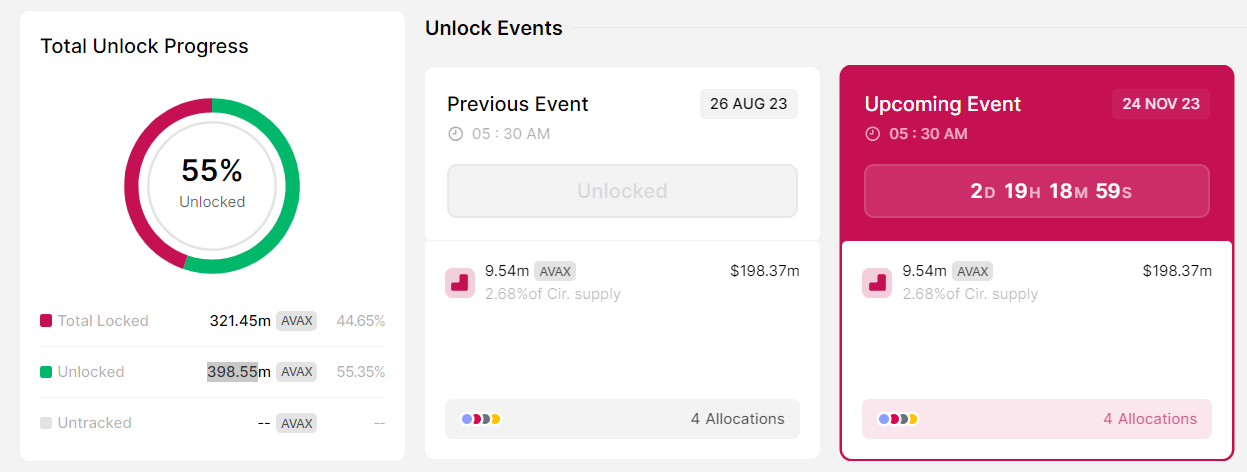

Things can get worse for Avalanche as it is expecting its next round of token unlocks on 24th November 2023. Token Unlocks recently posted a tweet highlighting this upcoming event.

$212M $AVAX Unlocks in Only 3 Days! ?

Save the Date: 24 Nov

Unlocking 9.54M $AVAX – that's a massive 2.68% of Cir. supply.Who benefits? Here's the lineup:

1. Strategic Partners

2. Foundation

3. Team ?

4. AirdropStay ahead with real-time updates and expert insights.

For… pic.twitter.com/veBjfaHH5t— Token Unlocks (@Token_Unlocks) November 20, 2023

Two days from now, 9.54 million AVAX will be released, which is worth over $189 million.

The upcoming unlock will increase the token’s circulating supply by 2.68%. As of now, AVAX has unlocked 55% of its total supply, and the remaining 398.55 million tokens will be unlocked over the coming years.

AVAX investors must be cautious as typically token unlocks are followed by price declines because of the demand and supply theory. An asset’s price drops whenever its supply increases as such episodes reduce the asset’s demand in the market.

Does Avalanche have other concerns?

AMBCrypto checked the token’s on-chain metrics to see if there were any other red flags for investors apart from the upcoming token unlock.

A positive thing was that AVAX’s development activity remained high throughout the last week. Its 1-week price volatility also dropped sharply, decreasing the chances of a further price decline in the near term.

Read Avalanche’s [AVAX] Price Prediction 2023-24

AMBCryptro’s analysis of Coinglass’ data revealed that the token’s funding rate dropped sharply when its price plummeted. This meant that derivatives investors were reluctant to buy AVAX at a lower price. Therefore, there were changes of a trend reversal.

Things in terms of network activity also looked robust for Avalanche. Over the last seven days, the blockchain’s daily transactions spiked. A similar trend was also seen in terms of AVAX’s daily active addresses, which looked optimistic.