Bitcoin’s Crash Isn’t Over, Says JP Morgan

Analysts at JP Morgan, a leading US financial institution, have expressed their view that the cryptocurrency Bitcoin (BTC) still has room for further price declines. This assessment comes after Bitcoin recently hit new highs earlier this month but has since entered a downward trend.

According to data from CoinGecko, Bitcoin’s price has fallen by 7.2% over the past week. However, JP Morgan analysts believe that the cryptocurrency remains overbought, even after the sharp drop experienced last week. Their analysis is based on futures trading conditions, particularly the premium of futures prices to spot prices and the current positioning in the futures market.

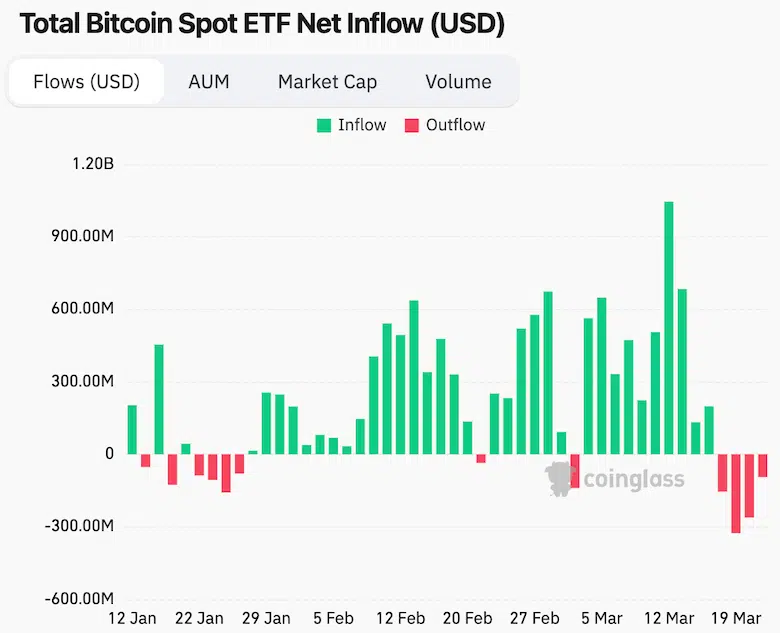

In addition to the overbought conditions, analysts have also noted a decrease in inflows into Bitcoin spot ETFs (exchange-traded funds). In fact, net outflows have been ongoing since March 18th, with the largest single-day outflow of $320 million occurring on March 19th.

The combination of overbought conditions and diminishing investor interest, as evidenced by the outflows from Bitcoin ETFs, has led JP Morgan analysts to conclude that there is potential for further downside in the Bitcoin price. As the cryptocurrency market continues to evolve, investors will be closely monitoring these developments to assess the future trajectory of Bitcoin and other digital assets.

As Bitcoin’s price continues to face downward pressure, analysts at JPMorgan have expressed their belief that profit-taking selling is likely to persist in the coming weeks. This prediction comes as the cryptocurrency market prepares for the highly anticipated Bitcoin halving event, scheduled to occur in April.

The Bitcoin halving, which occurs approximately every four years, is a key feature of the cryptocurrency’s design. During this event, the reward given to Bitcoin miners for verifying transactions is cut in half, effectively reducing the rate at which new Bitcoins are introduced into circulation.

Historically, Bitcoin halvings have been associated with increased price volatility and speculation. JPMorgan analysts suggest that many investors who have benefited from Bitcoin’s recent price surge may be inclined to sell their holdings and secure profits ahead of the halving. This profit-taking behavior could contribute to further downside pressure on the cryptocurrency’s price.

Bitcoin Price Prediction by JP Morgan

JPMorgan Predicts Bitcoin Price Could Drop to $42,000 Post-Halving.

In a recent analysis, JPMorgan has forecasted that the price of Bitcoin could potentially fall to around $42,000 following the upcoming halving event in April. This prediction is based on the bank’s assessment of Bitcoin’s production costs, also known as mining costs.

JPMorgan analysts have observed that historically, the cost of producing Bitcoin has served as a lower bound for its price. In other words, the price of Bitcoin tends to remain above the cost incurred by miners to produce new coins. This relationship is attributed to the fact that miners are unlikely to sell their Bitcoin holdings below the cost of production, as doing so would result in a financial loss.

Looking ahead to the impending halving event, JPMorgan analysts estimate that the reduction in mining rewards will effectively lower the cost of producing Bitcoin to around $42,000. This projection suggests that the Bitcoin price could potentially decline to this level, as it would represent the new lower bound based on mining costs.

Current data from MacroMicro indicates that the present cost of producing Bitcoin is slightly below $50,000. This implies that the halving event could lead to a significant decrease in production costs, which in turn may exert downward pressure on the Bitcoin price.

Conclusion

In conclusion, JPMorgan analysts have painted a cautionary picture for Bitcoin’s near-term price outlook. By highlighting the cryptocurrency’s overbought conditions, declining investor interest, and the potential for continued profit-taking ahead of the April halving, they have signaled the possibility of further downside pressure on Bitcoin’s price. Moreover, the bank’s analysis of the historical relationship between production costs and Bitcoin’s price floor suggests that the upcoming halving could lead to a significant decline in the cryptocurrency’s value, with a potential target of $42,000 based on projected mining costs.