Render: Why $5 could be a feasible target for RNDR bulls

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- RNDR climbed above a resistance level from May.

- The rally was going strong and chances of a deep retracement appeared weak.

Render [RNDR] has trended upward on the one-day price chart since the 15th of September. Early in 2023, RNDR flipped the $0.92 level to support. In early November, the $2.23 level was retested as support and was a huge achievement for the bulls.

This set the stage for the next leg above $2.8, which has served as resistance since May. The network growth has slowed in recent days, which could be reflected in a short-term bearish move for the token.

The impulse move above $2.8 and $3 has not halted yet

After the $2.23 level was retested as support earlier this month, the bulls charged forward once again and successfully drove prices past the $2.8 resistance. At the time of writing RNDR traded at $3.616 and has flipped the $3.3 level to support.

Therefore, a pullback to the $3 or $2.8 zone appeared unlikely, although it can’t be ruled out. The RSI was back above the 70 mark to show strong bullish momentum. The On-Balance Volume (OBV) has trended higher since March.

It saw a substantial jump in the past few days to underline continued buying pressure. The Chaikin Money Flow (CMF) also signaled strong capital inflows with a +0.18 reading.

The market structure of RNDR was bullish. The liquidity pocket at $2.8 would be an ideal buying opportunity, but possibly unlikely to pull back so deep.

Hence the $3.3 and $3 could also be attractive to buyers. To the north, $4.26, $4.85, and the $5.45 resistance levels presented bullish targets for the coming weeks.

Should buyers be afraid of profit-taking activity?

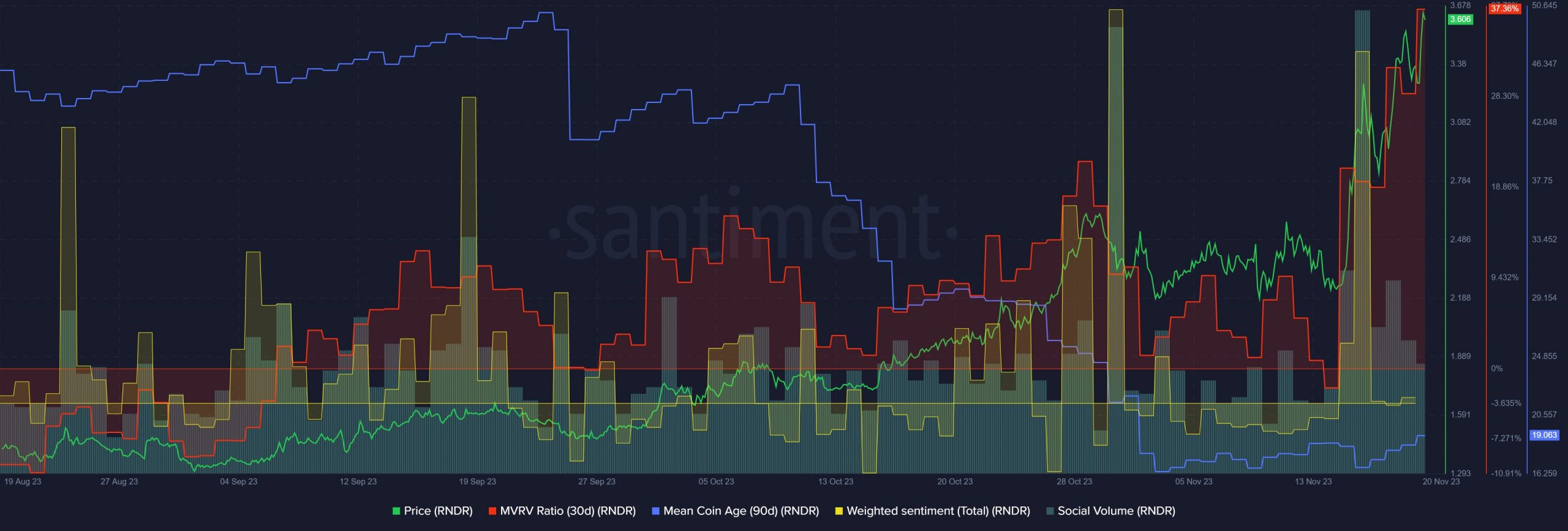

Source: Santiment

The 30-day MVRV ratio jumped above the mid-August highs in the past week. This meant that holders were at a profit and could look to sell some of their RNDR tokens. It was unclear how deep the prices could dip in the event of a wave of selling pressure.

Read Render’s [RNDR] Price Prediction 2023-24

Surprisingly, the mean coin age trended downward from late September to early November. It has remained flat in the past two weeks, which meant that RNDR holders were moving their tokens en masse even as prices trended higher.

This raised concerns that bullish conviction was weak. The weighted sentiment and social volume have spiked recently, which was good for the bulls in the short term.