Quant crypto surges 8% in 24 hours – Will QNT break 2024’s high soon?

Key Takeaways

QNT crypto hit a roadblock around $140, but bulls appeared confident they could clear it. Should they fail, the pullback could ease at $113 or $103.

Quant [QNT] rallied 8% during the intra-day session on the 21st of July.

This extended its recovery from June low of $85 to over $130, marking a 47% gain, effectively reversing all losses last month.

But the token was still 35% away from its 2024 peak of $170, giving bulls more space to conquer. But there were pending hurdles to watch out for.

QNT crypto retest $130

Source: QNT/USDT, TradingView

The immediate obstacle for bulls was around $140 (red zone), which could attract selling pressure.

In fact, the daily RSI had tagged the overbought territory, at press time, suggesting a cool-off or price rejection couldn’t be overruled near the $140.

However, based on the trend-based Fibonnaci retracement tool (yellow), QNT could rally to above $160 and tag the 2024 high if the recovery momentum extends in the next few weeks.

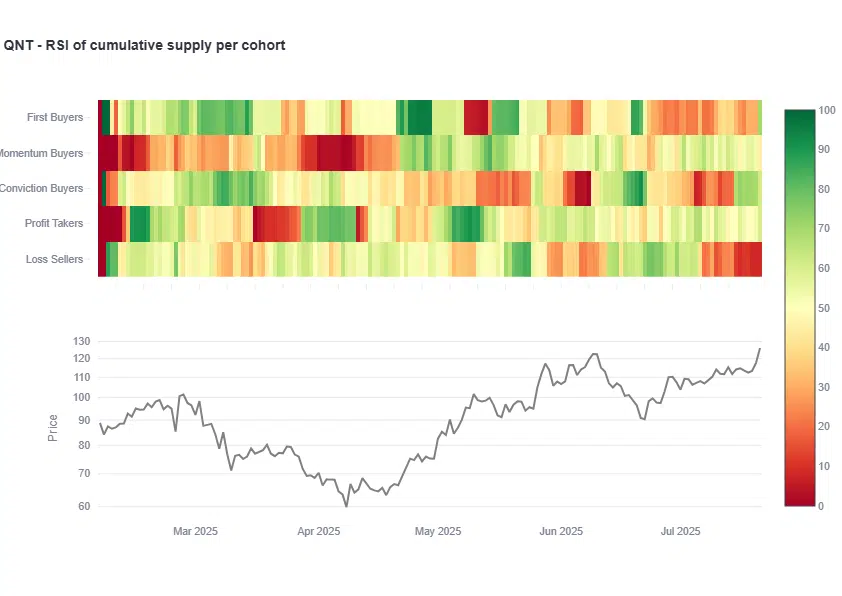

Apart from the RSI, AMBCrypto evaluation of QNT supply category didn’t flag warning signs, as of press time.

Although there was FOMO from first-time buyers (green), momentum buyers were neutral while conviction buyers were yet to turn into profit takers.

This meant that the recovery could extend if overall market sentiment remains positive.

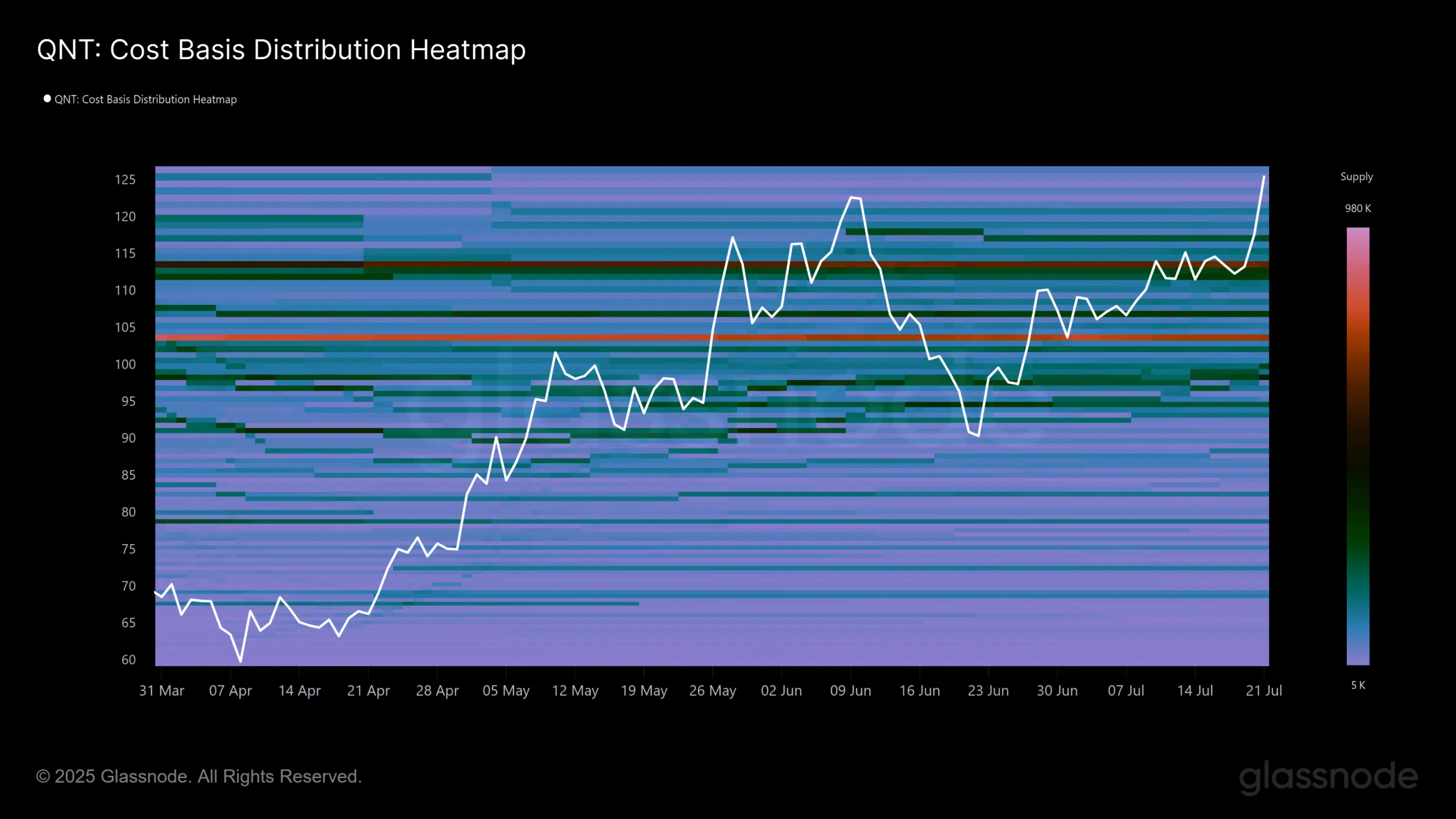

On the other hand, any short-term cool-off could ease around $113-$114. About 661K QNT supply was bought at this price level and acted as the springboard for the recent surge to $130.

Besides, another crucial supply was bought at $103-$104, marking these two as key potential support zones in case of a pullback.

Source: Glassnode

From market positioning, 60% of top smart traders on Binance exchange were long QNT, further suggesting the bullish outlook despite price hitting an obstacle.

This meant bulls expected the token to rally higher above $130.

Source: CoinGlass

Overall, QNT crypto has rallied over 47% since June, reversing recent losses.

While the asset hit an overhead obstacle ($140) at press time, market positioning suggested bulls were confident of extending the recovery.

However, should they be rebuffed at $140, any pullback to $113 or $103 could ease the dump and offer new market entry opportunities.