Altcoins

Polygon dominates inscription activity on EVM chains

Polygon emerges as the leader in terms of inscription activity on EVM chains.

- Polygon leads in terms of inscription activity on EVM chains.

- MATIC has seen an uptick in new demand in the past few days.

Polygon [MATIC] has emerged as the leader in inscription activity on Ethereum Virtual Machine (EVM) chains, data from a Dune Analytics dashboard showed.

The Polygon-based nonfungible token (NFT) collection POLS, which launched on the network in November, operates similarly to Bitcoin Ordinals, which has seen increased activity in the past few days.

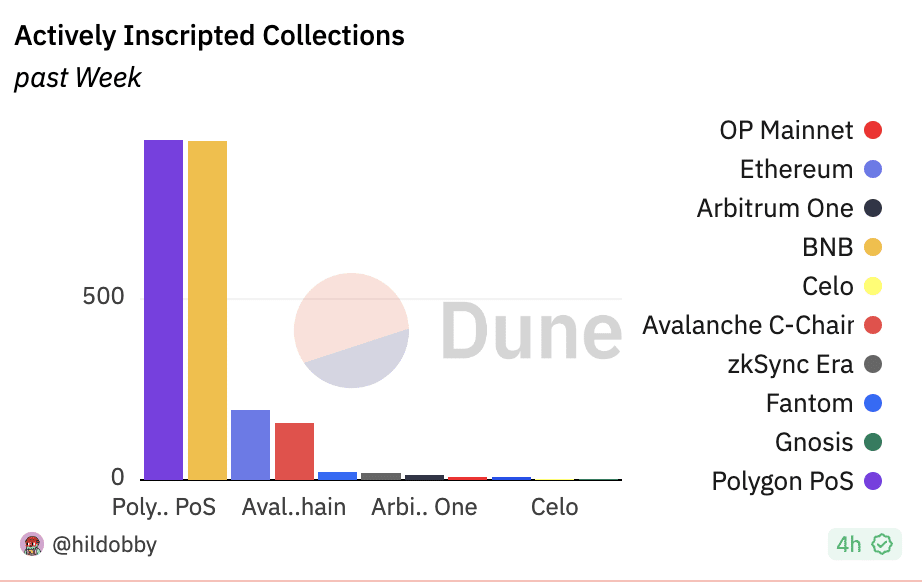

The Dune Analytics dashboard tracks inscription-related activities on EVM-compatible chains such as Polygon, BNB Chain [BNB], Ethereum [ETH], Avalanche C-Chain [AVAX], Fantom [FTM], zkSync, Arbitrum [ARB], Optimism [OP], Base, Celo, and Gnosis.

Of all these chains, Polygon has the highest number of actively inscribed collections in the last week, totaling 938. The Layer 2 (L2) network is closely followed by the BNB Chain, which has seen 936 inscribed collections in the last seven days.

Also, Polygon has seen the highest count of inscription-related activities within the same period. The L2 accounts for 66.46% of all activity involving inscriptions on EVM chains in the last week.

The Polygon network boasts the highest number of inscriptions among EVM chains, with over 109 million made by more than 133,000 users. In comparison, Fantom trails behind in second place, with 26 million inscriptions from 29,000 users.

As expected, the increased demand for POLS in the last week has led to Polygon experiencing the highest amount of gas fees spent on inscriptions among EVM chains.

According to data from the Dune Analytics dashboard, the chain accounts for over 25% of all gas fees spent on inscriptions on EVM chains in the past seven days.

MATIC on the daily chart

After a brief period of decline, MATIC’s Chaikin Money Flow (CMF) reclaimed its spot above the zero line.

The indicator tracks a specific asset’s buying and selling pressure over a certain period. When it rallies above the zero line and returns a positive value, it means that there is more money flowing into the asset than out of it.

Is your portfolio green? Check out the MATIC Profit Calculator

On the other hand, a negative CMF value indicates that more money flows out of the asset than into it. This suggests selling pressure and a potential downtrend.

At press time, MATIC’s CMF trended upward to return a value of 0.08. This signaled an inflow of funds as new demand for the altcoin began to gain momentum.