Over 80% of Ethereum, Dash, Cardano addresses are trading at a loss while Bitcoin, Bitcoin Cash addresses record profit

It has been a tumultuous period for the cryptocurrency industry. Ever since the bull run came to a conclusion on 26 June this year, a majority of the altcoins’ valuation suffered under the hands of the bears. XRP, which is the third-largest cryptocurrency in the market, is currently striding at a valuation which is lower than the one recorded in January. The present situation has inadvertently affected the addresses of these virtual assets.

According to data from intotheblock.com, a majority of the altcoins’ addresses was operating at a loss, at press time.

The profit or loss metric on the website is calculated based on addresses with a positive balance that have acquired a virtual asset at an average price. If the asset’s current price was above the price at which addresses acquired it, it was considered a profit. Otherwise, it was a loss.

Based on this parameter, it was observed that over 70 percent of the addresses that bought into Bitcoin and Bitcoin Cash at an average price were in profit.

Source: intotheblock

As it can be observed, over 19.96 million addresses bought into the largest crypto-asset, before the break-even price of $9,453.76, whereas 6.23 million addresses were operating at a loss. Besides Bitcoin and Bitcoin Cash, other virtual assets were projecting a different scenario.

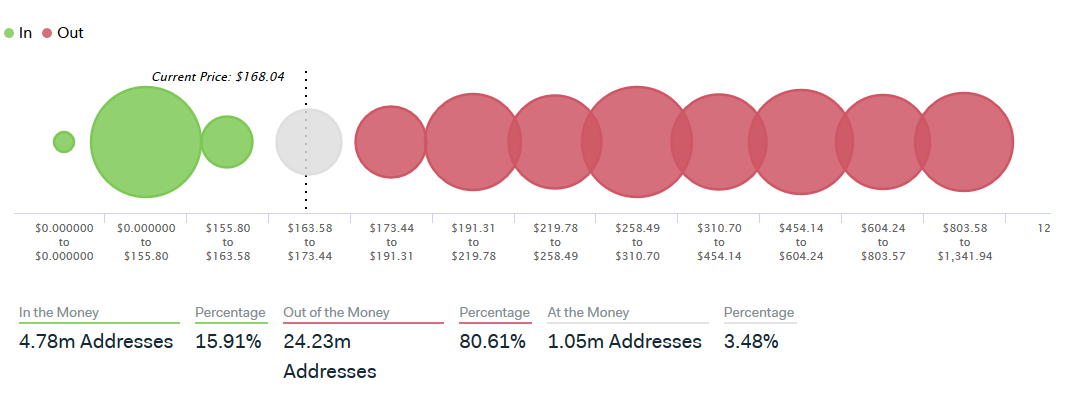

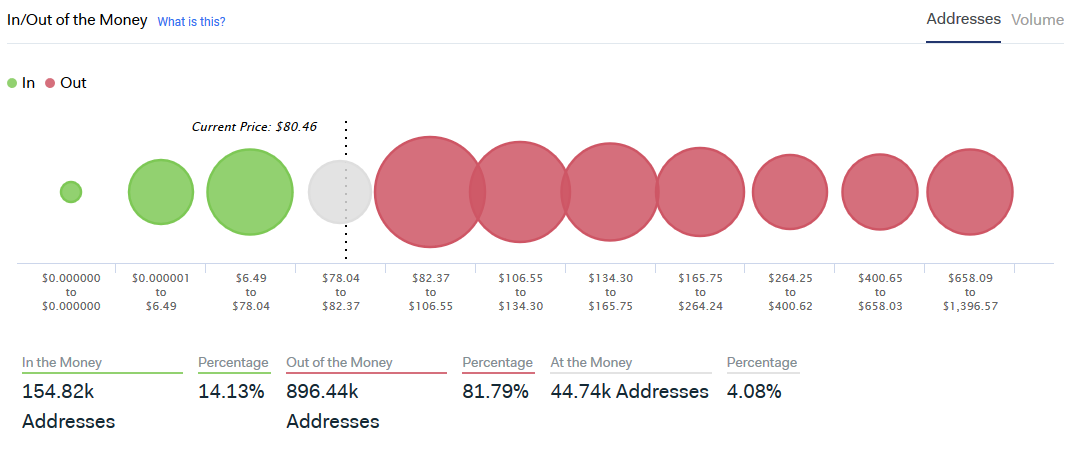

The likes of Ethereum, Cardano, Dash etc. had more than 80 percent of their addresses currently operating at a loss in the market.

Source: intotheblock

Source: intotheblock

From the charts, it can also be observed that 80 percent of Ethereum’s addresses were operating at a loss, while Cardano had 81.79 percent of such addresses, all of which had bought into the token above the break-even price.

The fact that such a significant percentage of addresses is treading at a loss is indicative of the fact that a lot of users bought into the tokens after the bull run. However, the present bearish trend is depleting their profits.