Of Blur, Lido, and the ripple effects of Blast

- Blur saw renewed interest from whales as Blast gained popularity.

- Lido also reaped the benefits from the rising interest in Blast.

Blast, the upcoming layer-2 blockchain scheduled to launch in March, has recently attracted over $225 million in staked ETH [stETH]. Despite facing skepticism from some crypto investors, Blast distinguished itself as the first layer-2 network with native staking.

The network’s future plans involve generating yield through Ethereum [ETH] and other assets.

It’s all a BLUR

Heading the project is PacmanBlur, co-founder of the popular NFT marketplace Blur [BLUR]. Blast’s appeal is further amplified by the backing it has received from crypto investment firm Paradigm.

Due to these factors, the price of BLUR witnessed a surge in interest. Lookonchain’s data revealed that machibigbrother.eth, a notable investor, had purchased massive amounts of the token until press time.

The investor spent 415 ETH (equivalent to $856k) and acquired 1.54 million BLUR at $0.56 each. This ongoing buying activity showed how hopeful the investor was about the future of the token.

machibigbrother.eth is buying $BLUR again.

He has spent 415 $ETH($856K) to buy 1.54M $BLUR at $0.56 again in the past 40 mins.

And has bought a total of 2.84M $BLUR($1.56M) at $0.55 in the past 4 days.https://t.co/0Lmd1cjghX pic.twitter.com/EBnvRh2J6c

— Lookonchain (@lookonchain) November 27, 2023

The faith this whale had in Blur was surprising, especially as Blast has been subject to speculations that it was a Ponzi scheme. However, Dan Robinson, a researcher at Paradigm, recently took to X (formerly Twitter) to explain the firm’s perspective on this theory.

A paradigm shift

In his tweet, Robinson said that Paradigm disagreed with the decision to launch the bridge before the L2 and the three-month withdrawal restriction. They believed that these actions set a negative precedent for Blast.

He added that Paradigm originally supported Pacman due to his proven ability to develop successful products like Namebase and Blur. Thus, when the developer presented a vision for scaling Blur and building an L2 chain, Paradigm invested again.

Robinson acknowledged that Paradigm has communicated its concerns to the team. Regardless, he reiterated the company’s responsibility to the crypto industry and expressed it does not sponsor Ponzi schemes.

There are a lot of components of Blast that I’m excited about and would be interested in engaging with people on. That said, we at Paradigm think the announcement this week crossed lines in both messaging and execution. For example, we don’t agree with the decision to launch the…

— Dan Robinson (@danrobinson) November 26, 2023

Impact on BLUR and LDO

Despite the interest shown by whales, the price of BLUR fell materially. At press time, it was trading at $0.528972 and had fallen by 13.14% in the last 24 hours. Only time will tell whether BLUR’s price will decline further, or if this is just a momentary bump in the road.

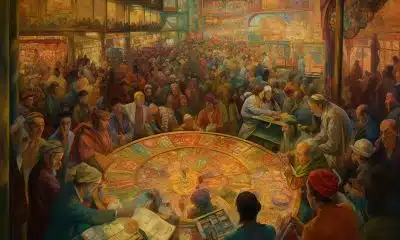

Lido, the liquid staking network, has more to gain from Blast’s popularity.

Blast accumulated an impressive $558M in TVL within six days, mostly in ETH. This positioned Blast as the third-largest holder of stETH, contributing to Lido’s market share reaching 32.15%.

Realistic or not, here’s LDO’s market cap in BTC’s terms

If the current trend continues, an additional $1B influx in ETH deposits could elevate Lido’s stake control over Ethereum to 33%. This would help with Lido’s dominance. However, the staking space could get more centralized.

Could Blast be the catalyst for a Lido monopoly over Ethereum?

In the past six days, Blast has attracted a massive $558M in TVL, with almost $500M in $ETH.

This positions Blast as the third-largest $stETH holder, pushing Lido's market share to 32.15%.

At its current pace, an… pic.twitter.com/F5F443GjgN

— An Ape's Prologue (@apes_prologue) November 26, 2023

At press time, LDO was trading at $2.38, after a price drop of 5.72%. This recent correction may be a good time for bulls to get LDO at a discount.