November records highest losses due to crypto hacks in 2023

- This marked a shocking 11x jump from the losses recorded in October.

- Justin Sun-linked entities witnessed the biggest exploits during the month.

The month of November witnessed the highest losses due to crypto exploits in the year, dampening the spirits of those celebrating the official start of the bull market.

Bulls come and so do hackers

Malicious actors stole $363 million worth of crypto assets during the “most damaging month” of 2023, according to blockchain security firm CertiK. This represented a shocking 11x jump from the losses recorded in October.

An overwhelming 87% of the stolen funds were due to exploits alone, while flash loan attacks resulted in 12.5% of the total losses.

Exit scams, becoming one of the bigger headaches in the decentralized finance (DeFi) space, siphoned $1.1 million worth of cryptos during November.

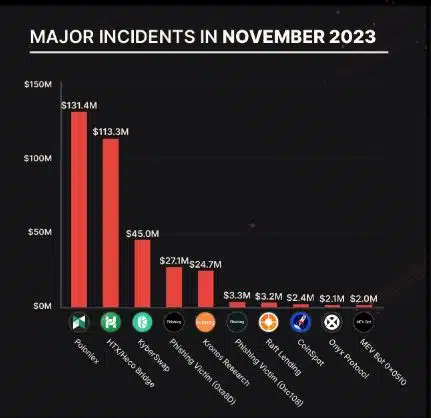

Poloniex and HTX/Heco Bridge were the site of the biggest exploits in the month, resulting in combined losses of more than $244 million.

Interestingly, both the exchanges were linked to popular crypto entrepreneur and founder of the Tron [TRX] blockchain, Justin Sun. CertiK blamed private key compromises as the root cause of these attacks.

Moreover, the flash loan attack inflicted on decentralized exchange KyberSwap was the third-largest security incident in November, with losses to the tune of $45 million. This incident accounted for nearly all of the funds lost in the month due to flash loan vulnerabilities.

The incident of major shock value was the one address losing a whopping $27 million in a phishing scam.

A bigger takeaway?

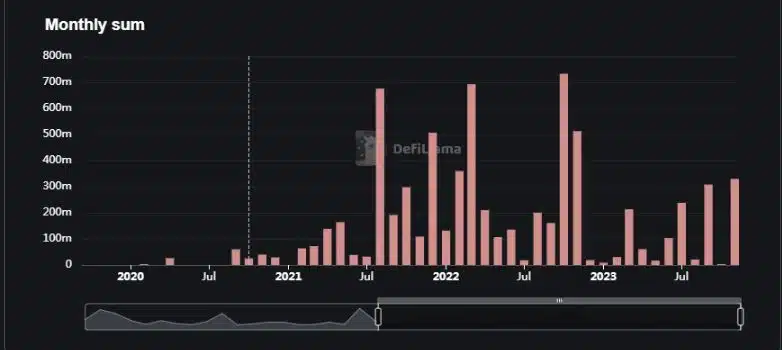

With the November figures, the total losses since the start of 2023 ballooned to $1.7 billion, CertiK’s analysis revealed.

The rise in crypto hacks seemed to have coincided with periods of interest in the crypto industry. AMBCrypto’s analysis of DeFiLlama’s data showed a dramatic rise in total value hacked in the late-2021 to early-2022 bull market.

However, the lull of the bear market slowed the activity down. This left comparatively much less for criminals to target and earn.