MicroStrategy’s Bitcoin buys continue – But why things are different this time

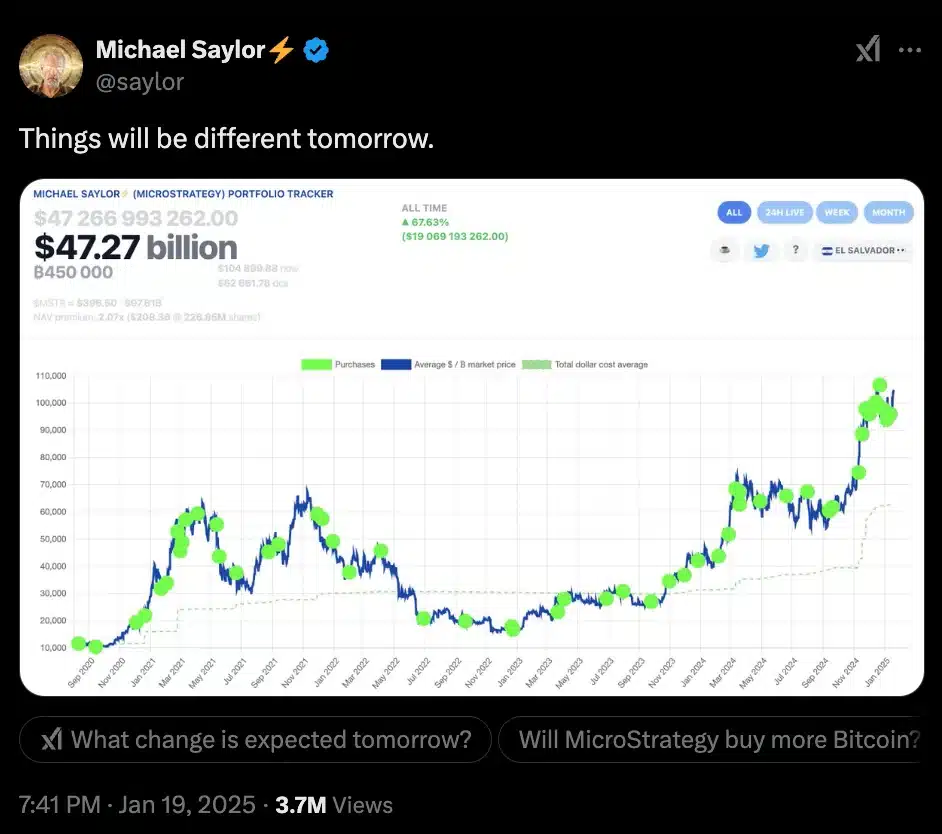

- MicroStrategy hints towards adding 2,530 BTC, bringing its total holdings to 450,000 BTC.

- Regulatory shifts under Trump may boost crypto policies, fueling optimism for Bitcoin investors.

Amid the buzz surrounding Bitcoin [BTC] reserves and Trump memecoins, MicroStrategy’s co-founder Michael Saylor has once again captured attention with his consistent Bitcoin advocacy.

On the 19th of January, Saylor hinted at yet another BTC purchase, marking the 11th consecutive week of such signals.

As the crypto world watches closely, MicroStrategy’s unwavering commitment to expanding its Bitcoin holdings continues to fuel discussions about institutional confidence in the leading cryptocurrency.

Saylor and his plan for MicroStrategy

Taking to X, Saylor noted,

On the 13th of January, MicroStrategy added 2,530 BTC to its holdings, a purchase valued at approximately $243 million.

This acquisition brings the company’s total Bitcoin reserves to an impressive 450,000 BTC, solidifying its position as the largest corporate holder of the cryptocurrency.

The purchase aligns with MicroStrategy’s ambitious 21/21 plan, aiming to raise $42 billion through equity and fixed-income securities to fund Bitcoin acquisitions.

This relentless accumulation underscores the firm’s long-term confidence in Bitcoin’s potential as a strategic asset.

What lies ahead?

Despite facing a stringent regulatory environment under SEC Chair Gary Gensler and President Joe Biden’s administration, MicroStrategy, under the leadership of Michael Saylor, has remained unwavering in its Bitcoin-focused strategy.

Last year, the company unveiled an ambitious plan to raise $42 billion over the next three years to invest exclusively in Bitcoin.

However, the feasibility of this plan hinges on the company’s ability to secure funds through equity and fixed-income securities.

Having already raised $10 billion in debt, MicroStrategy finds itself navigating significant financial challenges.

With rising inflation, climbing interest rates, and Bitcoin’s notorious volatility compounding the uncertainties in the stock market, the firm faces mounting risks as it deepens its commitment to the leading cryptocurrency.

However, the landscape for cryptocurrencies may shift significantly with Donald Trump taking office and Paul Atkins leading the SEC.

Top Republican officials, including commissioners Hester Peirce and Mark Uyeda, are reportedly preparing to overhaul the agency’s cryptocurrency policies.

Potential changes include issuing guidance on when cryptocurrencies qualify as securities and reassessing pending enforcement cases.

Market trends

This optimism aligns with recent market movements, as Bitcoin climbed 2.00% to $107,106.89 in the last 24 hours, according to CoinMarketCap.

Meanwhile, MicroStrategy’s stock (MSTR) surged 8.04%, reaching $396.50, as per Google Finance—suggesting strong investor confidence in both Bitcoin and the firm’s strategy.