MicroStrategy reports $670M in net loss: Can Bitcoin save MSTR?

- MicroStrategy, now rebranded as “Strategy,” has dubbed itself the first “Bitcoin Treasury Company” with 471K BTC in its stash.

- It is a risky bet that could pay off big if Bitcoin continues its bullish run.

Bitcoin [BTC] and MicroStrategy [MSTR] have become a power duo – one can’t thrive without the other. But what happens if either one falls apart?

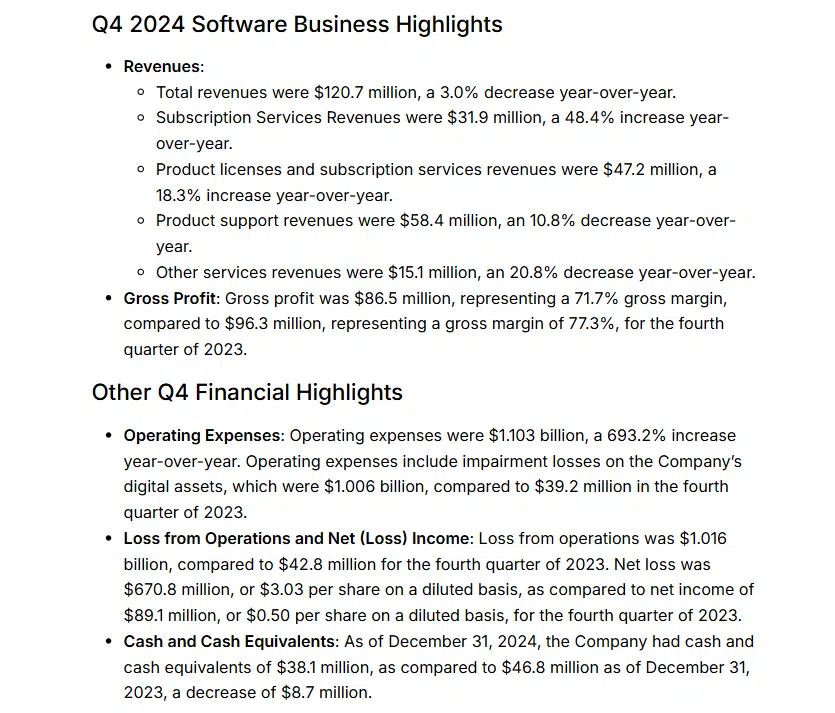

Strategy’s Q4 report under the spotlight

MicroStrategy rebranded as “Strategy” ahead of its Q4 earnings report, dubbing itself the first “Bitcoin Treasury Company.” The name seems fitting with 471,107 BTC in its stash, including a whopping 194,180 bought in Q4 alone.

Q4 was a huge bullish phase for Bitcoin, with billions flowing in during the election. MicroStrategy didn’t waste the opportunity, making three massive Bitcoin buys costing $11.5 billion in just three transactions.

The company has released its Q4 financials, revealing a 74.3% BTC yield for 2024, all from its 447,470 BTC stashes, with an average cost per Bitcoin of $62,503.

However, that’s one part of the story. MicroStrategy’s expenses shot up to $1.103 billion, mostly due to a $1.006 billion loss on their digital assets, resulting in a net loss of $670.8 million or $3.03 per share.

Bitcoin’s sudden dip from $108K to $92K – triggered by the Fed’s cautious stance on interest rates – cost MicroStrategy billions.

Its gross profit took a hit, dropping to $86.5 million from $96.3 million last year.

What does this mean for Bitcoin and Microstrategy’ future?

MicroStrategy and Bitcoin are now inseparable, but Bitcoin’s performance is crucial. With 2025 looking volatile, the ongoing trade war might just be the beginning.

In such a climate, predicting Bitcoin’s next top or bottom is anyone’s guess, leaving MicroStrategy in a tricky spot. The chances of two rate cuts this year are shrinking fast.

Despite MicroStrategy’s $2.543 billion Bitcoin buys in January, Bitcoin’s price has only risen 4% since the start of the year, even dipping below $93K twice.

Still, MicroStrategy is aiming high, targeting a $10 billion BTC gain for 2025—a significant jump from the 140,538 BTC gain in 2024.

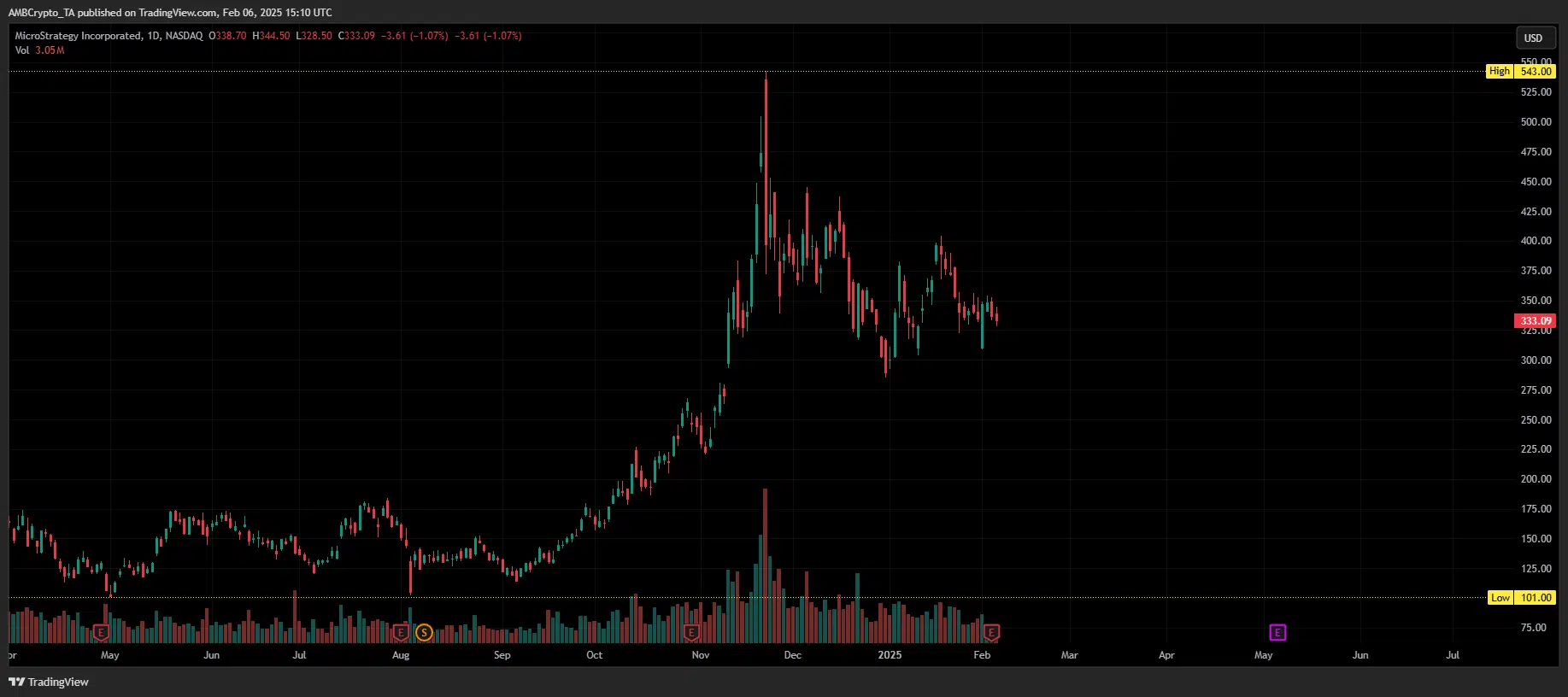

However, its stock has taken a hit, with a 15.26% decline in market cap from its all-time high of $8.71 trillion in mid-December last year, just before the FOMC meeting.

Read Bitcoin’s [BTC] Price Prediction 2025-26

As MicroStrategy turns to debt for future Bitcoin buys, the tough economy, unpredictable stock prices, and mounting losses put the company at risk.

If things don’t go as planned, it might feel the impact first, putting Bitcoin’s rally in serious jeopardy.