Maker – Analyzing impact of $11.4M whale action on MKR prices

![Maker [MKR]](https://engamb.b-cdn.net/wp-content/uploads/2025/07/Gladys-58-1024x576.webp)

Key Takeaways

- Maker Whale offloads 5,420 MKR worth $11.4 million, making a profit of $4.93 million. MKR bulls must reclaim $2165 to keep the uptrend momentum alive.

Since hitting a local high of $2,262 five days ago, Maker [MKR] has struggled to maintain upward momentum. Thus, the altcoin has declined for two consecutive days, reaching a low of $1,985.

As of this writing, Maker was trading at $2,039, marking a 0.26% dip over the past 24 hours. Before this dip, the altcoin had been on a strong upward trajectory, rallying 8.07% over the past week.

Amid the price retrace, holders, especially whales, are becoming impatient and have turned to aggressive selling.

Maker whale dumps 5,420 tokens

Notably, as the market rebounded a month ago, MKR whales made a strong comeback in the market.

According to CryptoQuant, the altcoin’s Spot Average Order Size has mainly been dominated by large whale orders over the last month.

When large orders dominate markets, it indicates increased whale participation in the market. As expected, with the market starting to stagnate, these large entities are now closing positions.

According to Onchain Lens, a Maker whale sold all 5,420 MKR, worth approximately $11.4 million. Following this sale, the whale generated a $4.8 million profit, representing a 74% return on investment.

This whale purchased 5,420 MKR for $6.56 million four months ago. When a whale decides to exit the market, it signals a lack of market conviction and rising bearish sentiment.

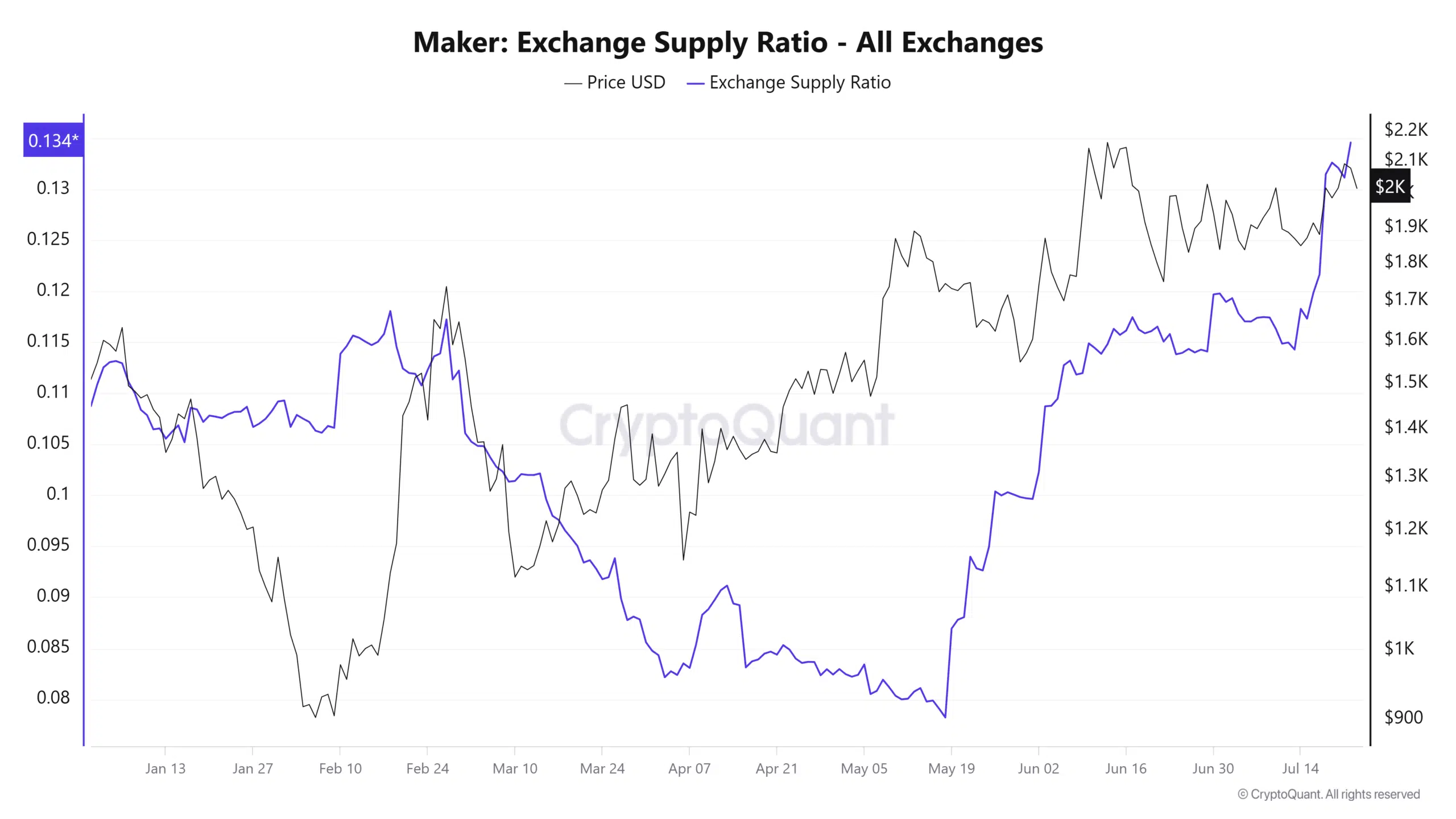

Amid increased whale selling activity, Maker’s Exchange Supply Ratio surged to a monthly high of a YTD high of 0.134, at press time.

Such a massive spike in Supply Ratio suggests that exchanges are recording more inflows than outflows, a clear sign of aggressive selling.

Derivatives are bearish too

Unsurprisingly, when we examine the derivatives market, it appears that investors in the futures have also turned bearish.

According to Coinglass, Derivatives Volume dipped 21.96% to $264 million, at press time, reflecting declining participation in the futures market.

At the same time, the altcoin’s Long Short Ratio dipped below 1 to 0.82, indicating a higher demand for short positions.

Typically, when there’s a higher demand for shorts, it suggests that investors are actively betting on prices to decline further.

Momentum indicators say…

According to AMBCrypto’s analysis, Maker retraced as sellers dominated, displacing buyers from the market.

For that reason, the altcoin’s Stochastic RSI made a bearish crossover to 82 but remains in the overbought zone. At the same time, Maker’s +DI of the Directional Movement Index (DMI) declined from 32 to 27.

Typically, when momentum indicators decline, it signals a weakening of upward momentum and a strengthening of the downtrend.

All the same, if sellers, especially whales, continue to offload, MKR will incur more losses. A continuation of the current trend will see MKR decline to $1952.

On the other hand, for a trend reversal, buyers need to return to the market and absorb the arising selling pressure. By doing so, Maker could reclaim $2165 and keep the upward momentum alive.