Altcoins

Lido sees TVL growth, but there’s a catch

- Lido’s TVL climbed by almost 10% in the last week

- However, due to the steady growth in ETH value, Lido recorded net outflows for the first time in months

Leading liquid staking protocol for Ethereum [ETH], Lido Finance [LDO], saw its total value locked (TVL) surge by almost 10% in the past week. This was caused by an uptick in the prices of ETH and Polygon [MATIC], the protocol noted in its latest weekly update on X (formerly Twitter).

? Lido Analytics: October 23 – 30, 2023

TLDR:

– TVL up +7.62%, reaching $15.90b.

– Net ETH deposits outflow of 35,360 ETH.

– stETH APR sees growth with 7d MA at 3.84%.

– wstETH bridged to L2 up by +5.12%, to a total of 147,011 wstETH. pic.twitter.com/W7Uiygr3EB— Lido (@LidoFinance) October 30, 2023

Is your portfolio green? Check out the LDO Profit Calculator

Between 23 and 30 October, the values of ETH and MATIC rallied by 8% and 5%, respectively. At press time, Lido’s TVL stood at around $16.15 billion, with an 11% rally in the last month, data from DefiLlama showed.

Lido sees outflow as ETH investors take profits

In terms of net deposits made to the Ethereum Beacon Chain, Lido had always recorded inflows. Although this had dropped consistently in the past few weeks, the protocol had yet to record outflows until last week.

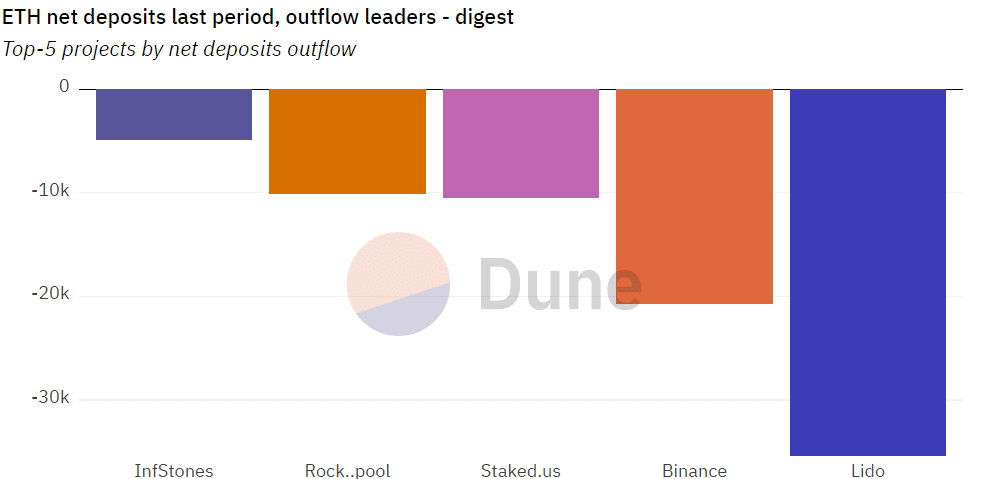

According to data from Dune Analytics, between 23 and 30 October, Lido experienced a net withdrawal of deposits, resulting in a decrease of 35,360 ETH. It ranked as the protocol with the most ETH withdrawals during that period.

The removal of previously staked ETH from Lido could be due to the fears that ETH’s rally in October might not persist after the month ended.

Within the 31-day period, the coin’s value rallied by over 10%, and the withdrawals from Lido could be investors seeking to take profit before the bears regain market control.

Also, it might be attributed to the steady decline in the Annual Percentage Rate (APR) earned from holding the protocol’s staked Ether [stETH]. At press time, Lido’s stETH APR was 3.96%, logging a 101% decline since its 7.17% peak on 12 May.

Realistic or not, here’s LDO’s market cap in BTC’s terms

Apart from the TVL growth recorded during the week under review, the protocol’s deployments on leading Layer 2 (L2) platforms also recorded growth in the form of the amount of bridged stETH.

Data from Dune Analytics showed a 5% and 7% increase in the amount of stETH bridged to Arbitrum [ARB] and Optimism [OP], respectively. On the other hand, Polygon recorded a 5% decline in the amount of bridged stETH during the period under review.