Lido bulls unable to breach the $2.55 mark – what now?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Lido token maintained its strong uptrend on the higher timeframe charts.

- The $2.2 and $2.55 levels have been critical in the past two weeks, and bears have refused to yield $2.55-$2.7 so far.

Lido Finance [LDO] token has hovered beneath a key resistance level since mid-November. A whale transferred 500k tokens to Binance recently, sparking worries of a spike in selling pressure.

Lido also gained from the rising popularity of Blast, an upcoming layer 2 blockchain. The influx of ETH deposits could elevate Lido’s stake control over Ethereum.

With the technical analysis also pointing toward bullishness, should investors look to buy LDO in anticipation of another rally?

The $2.2 support has been resolutely defended in the past three weeks

The three-day chart showed an unceasing march northward for LDO since mid-October. The $2.55 resistance zone was not yet breached and has been a key level for the bears since April. The recent rejection took Lido prices back toward $2.2.

However, the market structure remained bullish and the RSI showed strong upward momentum on the higher timeframe chart. The On-Balance Volume (OBV) climbed higher in November to denote

The Fibonacci retracement and extension levels (pale yellow) highlighted that $1.91 and $1.71 could be important support levels should $2.2 fail in the coming weeks. On the other hand, a move past the local highs at $2.65 would likely see a rally to $3.4 unfold.

The declining active addresses could cause worry among investors

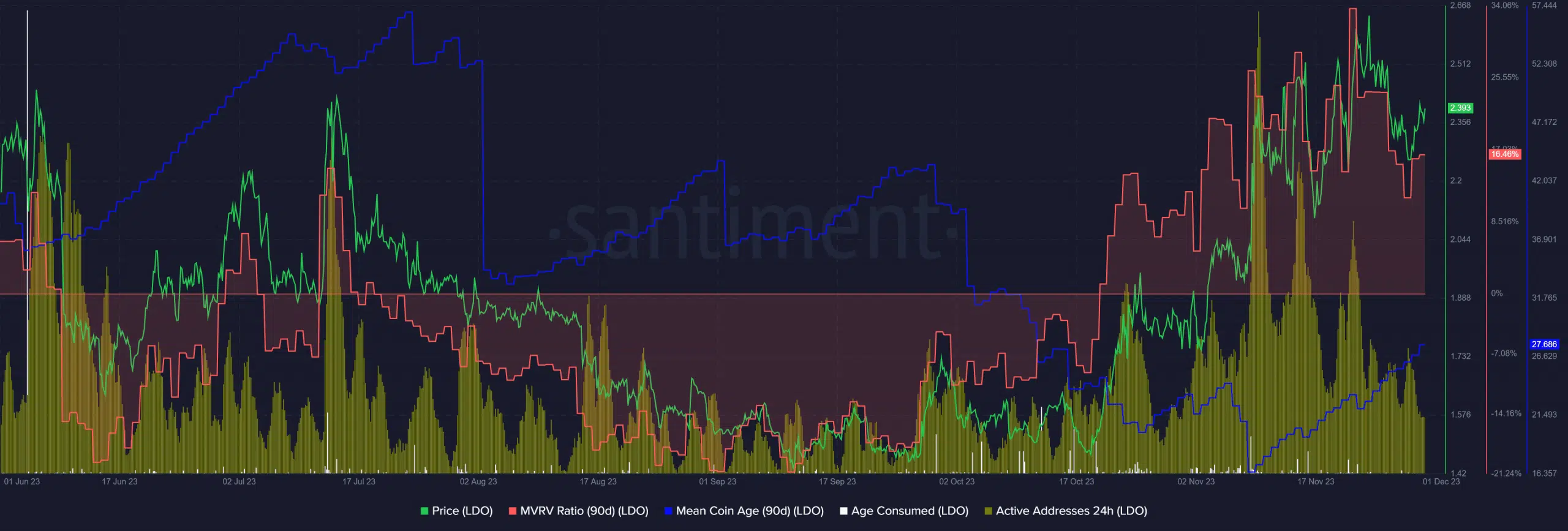

Source: Santiment

The MVRV ratio of LDO reached a high on 22 November not seen since March. This was followed by a wave of profit-taking from holders which saw LDO prices slide to the $2.2 area.

At the time of writing, the MVRV ratio was still high and could tempt more holders to book profits.

Is your portfolio green? Check the LDO Profit Calculator

The mean coin age has trended higher since early November, showing network-wide accumulation. At the same time, the age-consumed metric remained quiet.

This showed a surge in the movement of dormant tokens that has not been seen so far. A significant spike would be an early sign that holders could begin to sell their LDO holdings which would lead to a drop in prices.