Is Lido leading the way this altcoin season

- Altcoin prices surged after the BTC rally.

- The Lido protocol saw growth as its TVL increased.

As Bitcoin [BTC] woke up from its slumber, other altcoins followed suit and an uptick in their prices were observed over the last few weeks.

Will LDO prosper?

According to Santiment’s data, altcoins such as Polkadot, Avalanche, and LidoDao have experienced substantial market cap growth while Bitcoin flirts with a potential $40K market value before 2024.

The decrease in BTC’s social volume and increased interest in alternative coins indicate a potential inclination toward crowd greed.

? #Altcoins like #Polkadot, #Avalanche, and #LidoDao have enjoyed nice market cap growth as #Bitcoin continues teasing a possible $40K market value before 2024. Note $BTC's declining social volume & rise in interest in others, which typically hints at a slight crowd greed bias. pic.twitter.com/QIsbDasCj1

— Santiment (@santimentfeed) December 1, 2023

Lido has more in store

The Lid0 DAO token, LDO, could benefit the most from this interest in altcoins.

Lido’s robust growth, evident in the 5.16% increase in Total Value Locked (TVL) to $19.15 billion, bodes well for the LDO token.

As the leading platform in net new Ethereum staking deposits, Lido attracted an impressive 226,229 ETH in just one week. This surge was notably fueled by substantial ETH deposits linked to the Blast initiative, totaling 170,388 ETH.

Additionally, the rise in wstETH bridged to Layer 2 by 0.60%, reaching 172,874 wstETH, which signifies increased activity and engagement.

These positive developments in Lido’s protocol indicate a growing user base and heightened interest in staking and liquidity provision.

The surge in TVL and significant ETH deposits showcase the platform’s appeal and efficiency, potentially driving the demand for LDO tokens.

The seamless bridging of wstETH to Layer 2 further enhances accessibility and usability, contributing to a positive outlook for both Lido’s ecosystem and the LDO token.

? Lido Analytics: November 20 – 27, 2023

TLDR:

– TVL up 5.16% to a new high of $19.15b.

– Lido 1st in net new ETH staking deposits with 226,229 ETH in 7 days.

– Main driver was ETH deposits due to Blast with 170,388 ETH.

– wstETH bridged to L2 up +0.60% to 172,874 wstETH. pic.twitter.com/6fUcHmgSlI— Lido (@LidoFinance) November 27, 2023

Some caution advised

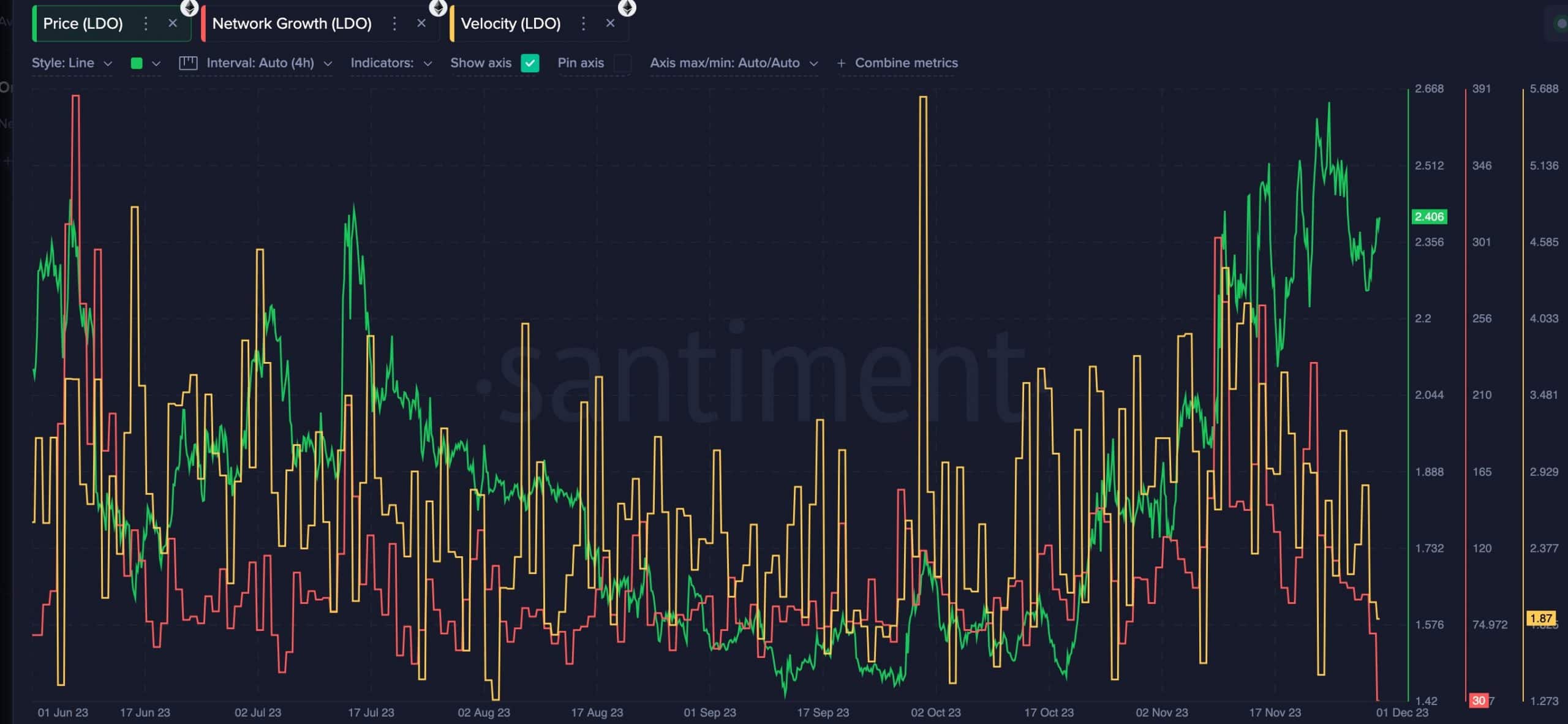

The growth of the protocol may also assist LDO in seeing an uptick in its price. At press time, LDO was trading at $2.40 and its price grew by 3.38%.

How much are 1,10,100 LDOs worth today?

However, the network growth around LDO fell during this period. Moreover, the velocity at which LDO also declined. This implied that new addresses were losing interest in the token, and the price uptick may have been caused by old addresses.

If LDO fails to attract new investors, the price of the token could be impacted in the long run.