Is Bitcoin’s correction phase over?

After about $2 billion worth of longs were decimated during the recent crash, the only question that remained was this – “Is the Bitcoin correction over?”

Bitcoin’s correction was incoming, however, nobody knew when to expect it. Moreover, with each surge, Bitcoin’s ATH just got closer. Hence, the cryptocurrency’s recent movements blindsided a lot of users. The sentiments of Greed and FOMO, as usual, took over and the price started climbing without the necessary momentum that would have been obtained if there was a small correction on the charts.

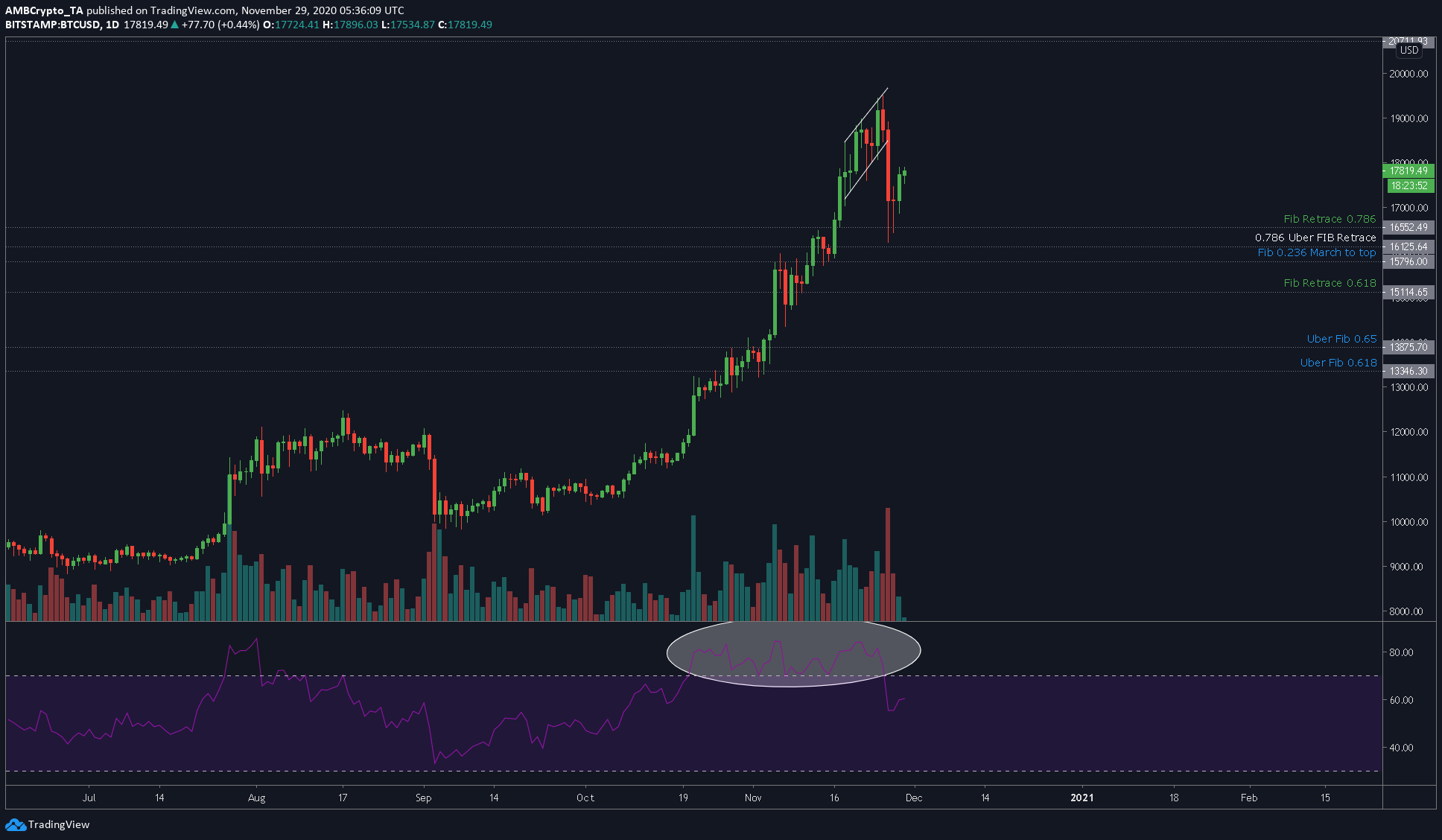

Source: BTCUSD on TradingView

Consider this – The above chart clearly shows that Bitcoin was constantly overbought for most of its recent rally. While this is evidence of the fact that a correction was overdue, it also reveals for how long the crypto’s users were blindsided by BTC’s price movement.

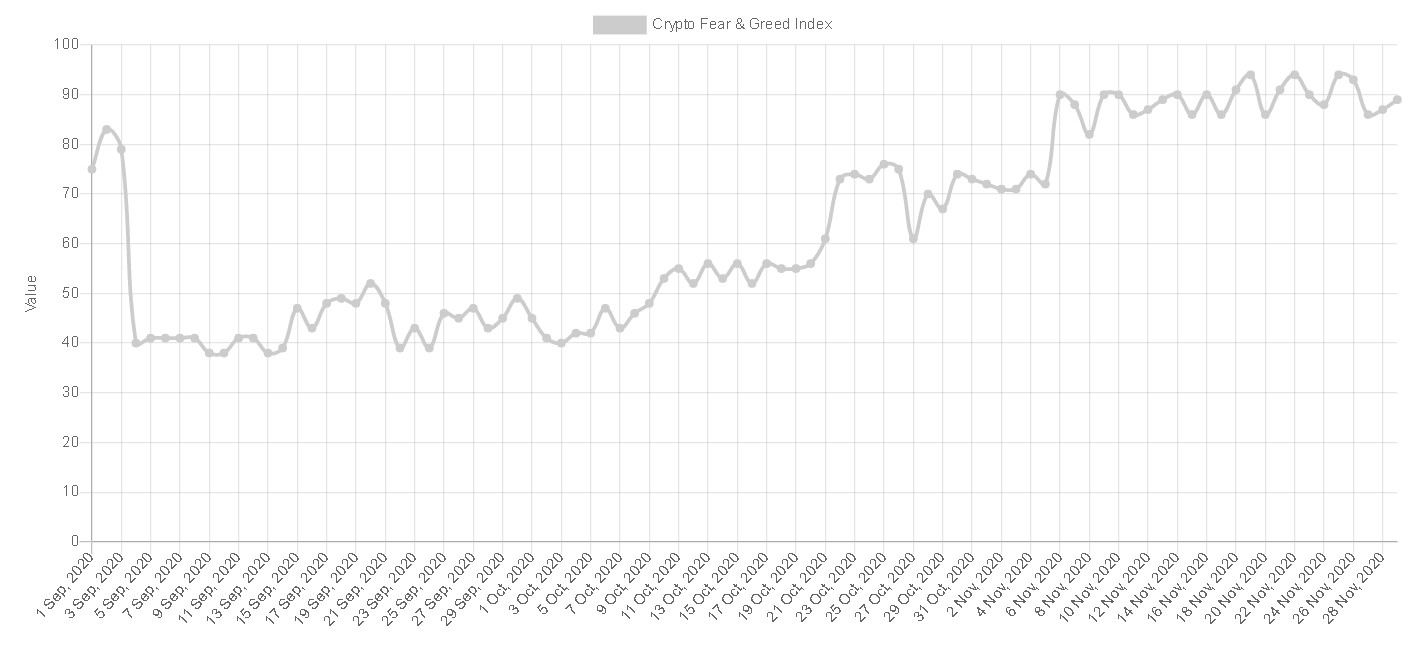

Source: Alternative.me

Consider the next chart too, with the next one highlighting the sentiments of FOMO and Greed at their peak. In fact, these sentiments had been peaking for a while now, which is why yes, a correction was needed, no matter how small, for Bitcoin to have a chance at breaking its ATH on the charts. Since corrections were not forthcoming, a new ATH was not to be.

The whale(s) that shorted the new bull run

There’s more to the story, however. It would seem that all this while, a whale was cooking up his/her short on Bitfinex. In fact, it still isn’t clear if it indeed was a single entity.

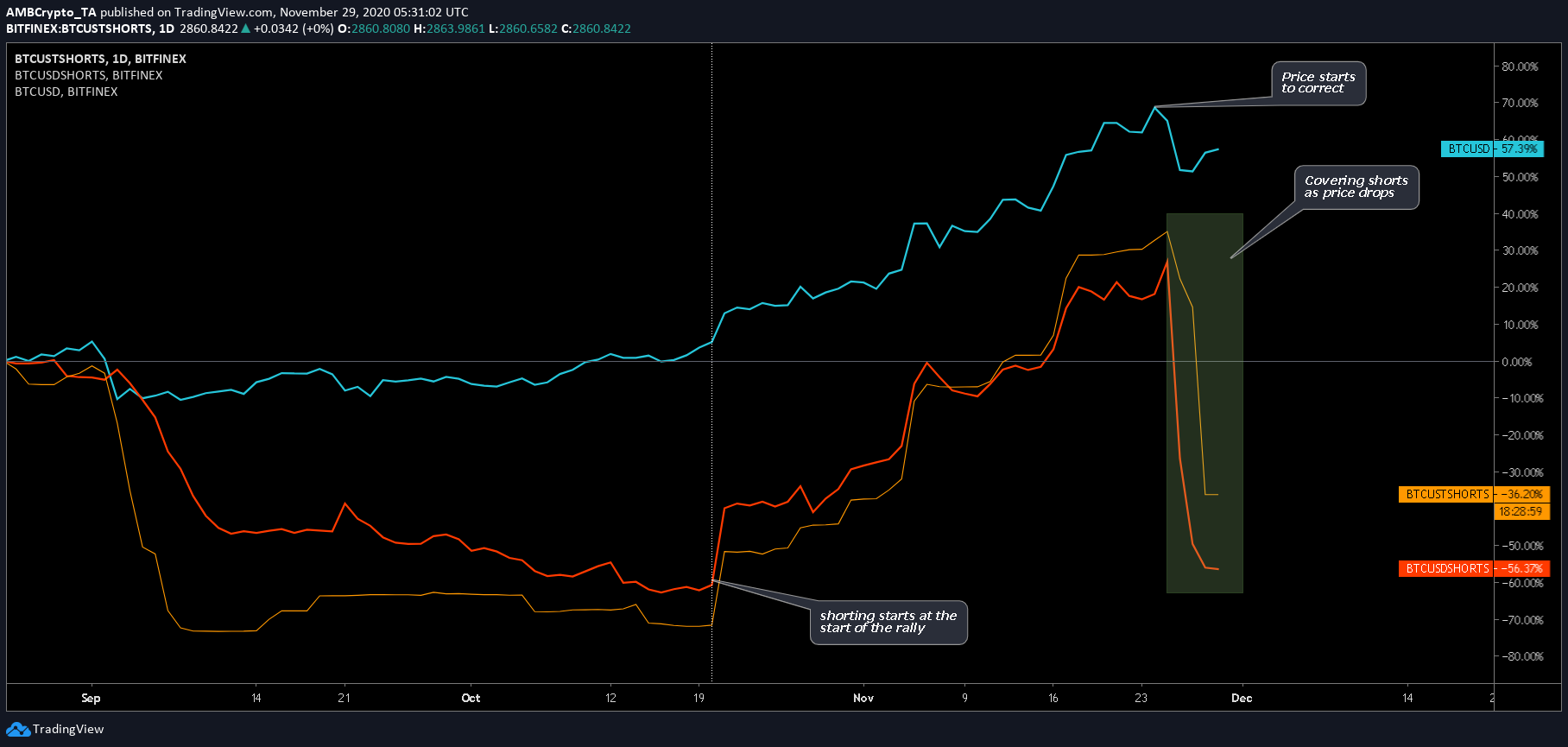

Source: BTCUSD on TradingView

From the attached chart, we can see that the whale has been shorting the market since 19 October. It was after the 19th of October that Bitcoin’s price finally started climbing towards $19,000 from $11,000 on the charts. Now, this is an unusual play for a whale on a few levels.

In fact, there are two ways to interpret why this was unusual,

- The short was a simple, yet naive hedge against, perhaps, a long position

- Just a whale trying to prevent the rally all on his own

When the price dropped on 24 November, the aforementioned whale seemed to have covered most of his/her shorts [both USDT and USD].

So, is the correction still looming?

Perhaps. Right now, the short-to-long ratios on Bitfinex and Binance are unusually high. In light of the two exchanges being two of the largest BTC-USDT trading pair hotspots, the odds for the market’s bulls don’t seem too favorable.

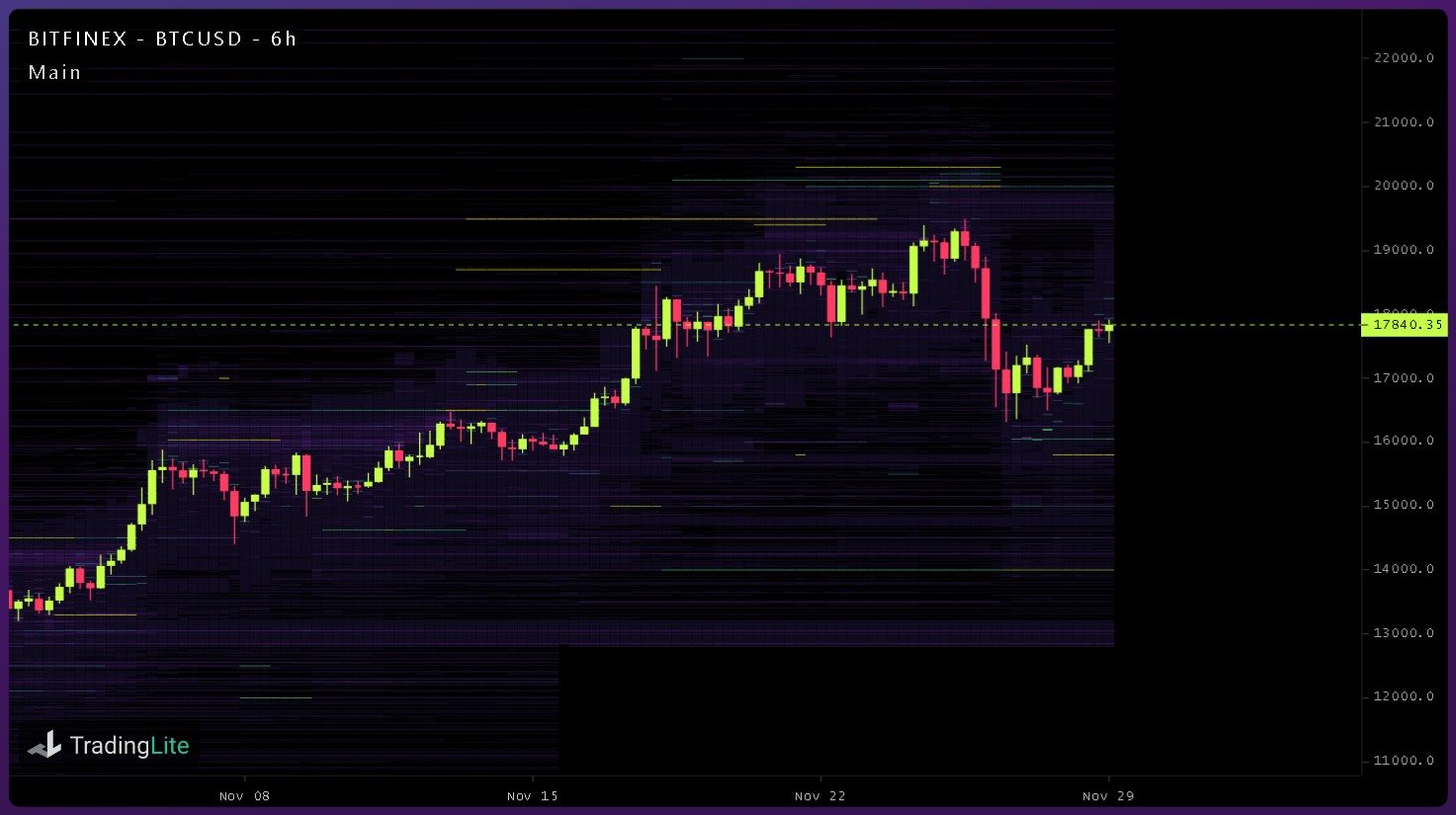

Source: TradingLite

In fact, as the attached chart reveals, there is a high number of sell orders at $19,500 and $18750. Hence, we can expect a free Bitcoin surge up to these levels. It should also be noted, however, that a correction for BTC beyond the said levels will be subject to change.