Is Bitcoin’s 21 million capped supply at risk? BlackRock weighs in

- Bitcoin’s fixed supply remains a key selling point, reinforcing its position as a digital store of value.

- The possibility of altering Bitcoin’s supply cap remains highly theoretical.

Unlike the limitless U.S. dollar, Bitcoin’s 21 million supply cap is its greatest asset. With scarcity baked into its design, every Bitcoin [BTC] becomes more valuable as demand grows. This is precisely why many see Bitcoin as a hedge against inflation.

But what if this scarcity isn’t as fixed as we think? What if, even hypothetically, Bitcoin’s supply cap could be changed? Could the idea of turning Bitcoin into a traditional, inflation-prone asset become a reality?

The debate is heating up – and it’s more real than ever.

Is Bitcoin losing its biggest selling point?

Technically, Bitcoin’s foundation rests on a highly complex blockchain mechanism, making the idea of altering its supply cap seem almost absurd. However, with the recent “Willow” controversy shaking the market, it might be premature to dismiss such statements as pure speculation.

So, when BlackRock, through a video, questions the permanence of Bitcoin’s supply cap, it’s worth examining this narrative closely.

In the video, BlackRock highlighted Bitcoin’s fixed supply of 21 million as a key mechanism to control inflation. However, it also included a cautionary note, stating that there’s “no guarantee” the supply cap will remain unchanged.

But why should this matter to you? What could a change to Bitcoin’s supply cap mean in the long run?

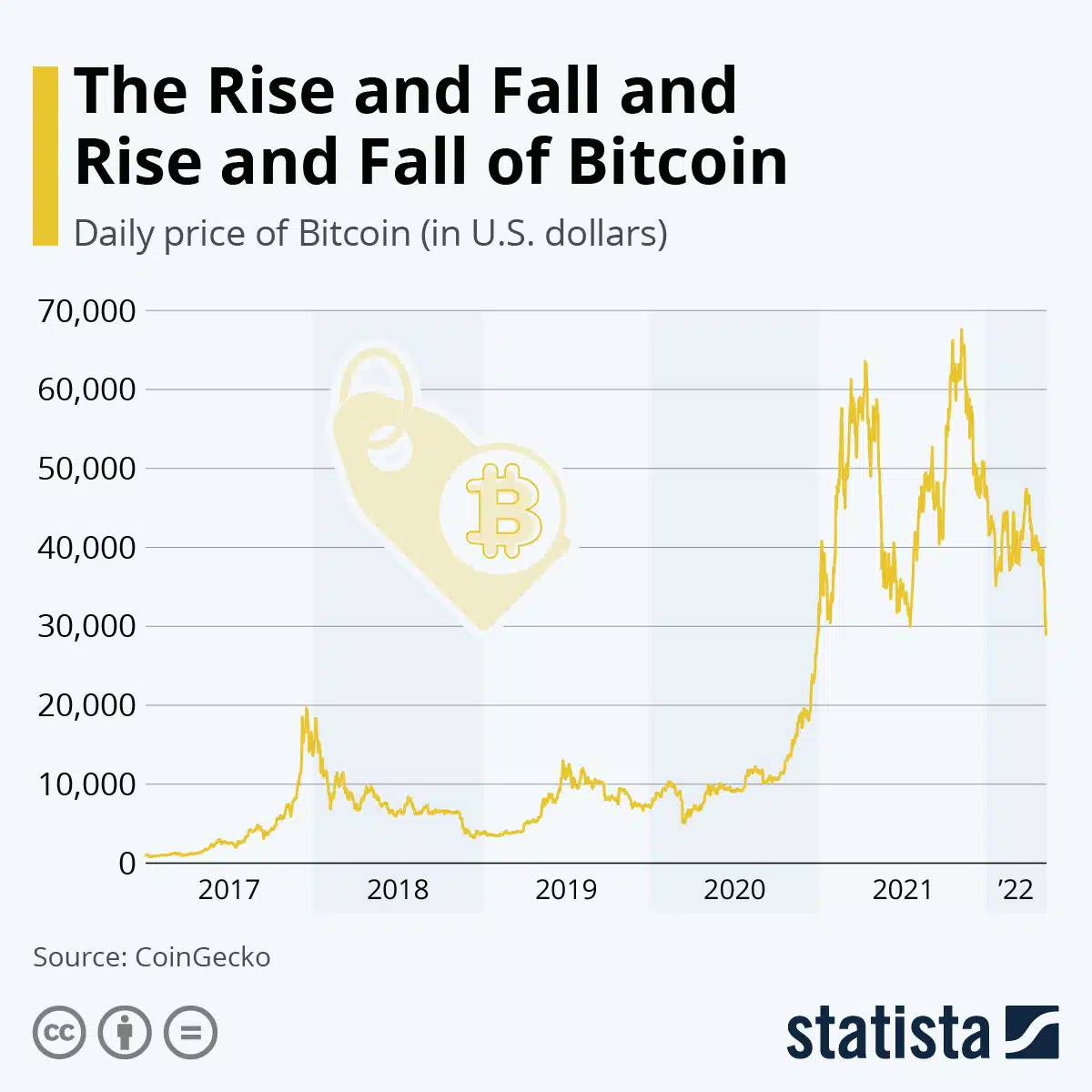

For context, Bitcoin’s explosive rise to an all-time high of $108K is a testament to the power of supply and demand. Unlike fiat currencies that can be printed at will, driving inflation, Bitcoin’s 21 million cap creates real scarcity.

So, in a world where inflation looms large, scarcity makes Bitcoin an attractive hedge – hence why it’s often referred to as “digital gold.” The post-pandemic outlook provides a clear example of this.

From $7,000 in January 2020 to $38,000 in February 2020, Bitcoin surged by a staggering 400% in just one month. This explosive rise wasn’t just a fluke – it was the pandemic that thrust Bitcoin into the spotlight.

With traditional investments (bonds, yields, stocks) faltering under low-interest rates and limited returns, Bitcoin’s fixed supply emerged as the biggest selling point.

So, if the cap were removed, it would no longer be Bitcoin – it would resemble something entirely similar to a traditional, inflation-prone financial system.

So, is Bitcoin’s supply cap at risk?

Clearly, the 21 million cap is central to Bitcoin’s identity. Technically, changing it would require a hard fork, a process demanding consensus from miners, node operators, and investors alike.

But here’s where things get interesting. As Bitcoin’s block rewards continue to halve every few years, miners’ earnings also take a significant hit.

Currently, they earn 3.125 BTC per block, but this reward is halved roughly every four years, with the next halving set for 2028.

As these rewards shrink, miners will need to depend more on higher transaction fees or rising Bitcoin prices to remain profitable. In turn, this might lead to calls for a supply change.

Read Bitcoin’s [BTC] Price Prediction 2024-25

But history suggests that miners alone don’t hold all the power. Take the Blocksize War of 2016-2017: while a majority of miners supported increasing BTC’s block size, the broader community rejected it, opting instead for layer-2 scaling solutions like the Lightning Network.

Therefore, while the possibility of altering Bitcoin’s supply cap remains highly theoretical, the conversation is far from over.

As we look toward 2025, with the Fed chair’s warnings about inflation in mind, could Bitcoin’s scarcity be leveraged to become an even stronger hedge against economic uncertainty? Or will a strengthening dollar pull the rug out from under Bitcoin’s value?

It’s certainly something to think about.