Investors beware! Bitcoin’s fall from $108K means THIS for 2025

- Investors are in full “high-risk” mode, scrambling to shield their portfolios from any more losses

- Threat of a market crash is no longer a distant possibility.

A quick look back at the last ten days shows how investors are bracing for a volatile 2025. The crypto market cap tells us a tale too, falling from $3.80 trillion to $3.29 trillion – Marking a sharp 13.42% decline.

However, this may only be the start of what’s to come. Bitcoin’s [BTC] ‘high risk, high reward’ appeal will soon face its biggest test. With the Fed adopting a ‘cautious’ stance, we may just be seeing the tip of a much larger economic storm brewing in the U.S.

Investors are waking up. From the bond market to stocks, the landscape is shifting, and the usual election trends are reversing. So, where does the crypto market, and especially Bitcoin, fit into this evolving picture?

Investor portfolios shift towards risk aversion

Bitcoin’s recent collapse from its $108k all-time high wasn’t a result of an overheated market. In fact, high-caps were still up for grabs. So, who’s to blame? Well, many critics pointed to the FOMC rate cut as the trigger.

Normally, an interest rate cut signals a ‘healthy’ economy, boosting purchasing power by making borrowing cheaper and encouraging spending across the aggregate market. However, investors’ reactions have been far from what you’d expect.

Consider this – The 10-year Treasury yield has surged by 100 basis points since September, hitting a 6-month high – Right alongside a sharp uptick in inflation.

To make matters more concerning, the Fed has raised its 2025 inflation forecast to 2.5%, up from 2.1% in September. Even more worrying, the central bank now expects inflation to hit its 2% target by 2027, instead of 2026 as previously projected.

This brings us to an interesting point – Was this sudden BTC price drop a classic ‘sell-the-news’ moment, one where panicked investors scrambled to tighten their portfolios? An exit driven less by cold hard data and more by the ‘assumption’ that a U.S. recession is on the horizon – A temporary blip, perhaps?

Well, there’s more beneath the surface. Especially since the U.S. could be staring at economic problems soon, a reality you’ll want to keep a close eye on in the days ahead.

A reality check on the debt crisis ahead

The rise in Treasury yields, despite the interest rate cut, marks a clear shift – Retail investors are pulling out of the crypto market. Fearing what’s ahead, they’re flocking to traditional ‘safe havens,’ betting on bigger returns as economic uncertainty builds.

But what’s behind this uncertainty? In 2025, a staggering $7.6 trillion in U.S. debt is due. To manage this, the government must refinance or pay it off by issuing new bonds – Likely with higher interest rates, a move that is a sign of the Fed’s caution.

This could set off a financial crisis, sending shockwaves through the global economy. Higher rates will make borrowing more expensive, slowing investments and economic growth.

So, instead of diversifying, many investors are doubling down on the bond market, hoping to cash in on the financial turmoil that’s coming. The impact on BTC is already showing too, with some analysts predicting that the market correction could turn out to be a “bullish” sign.

However, there’s also fear that we might see a repeat of the brutal 2022 cycle, potentially trapping BTC in another long-term bearish phase.

The one thing that could save BTC investors

From 2022 to 2024, one of the biggest shifts has been the surge of institutional capital pouring into BTC.

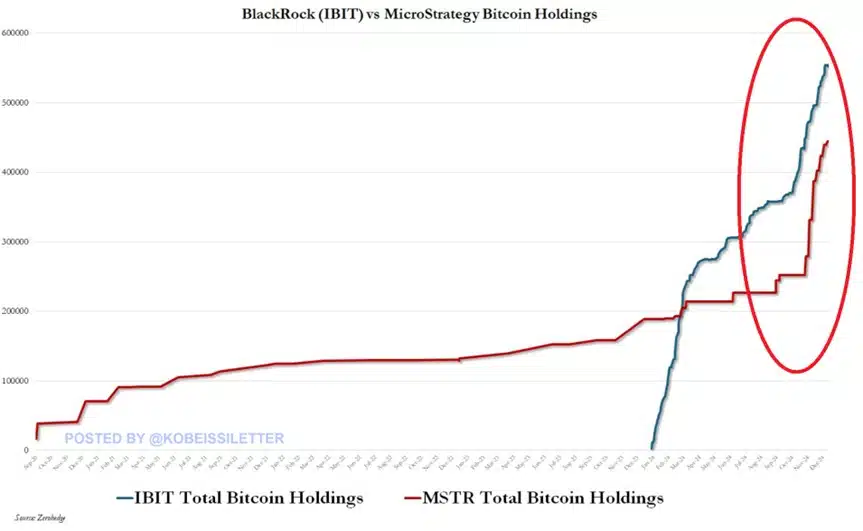

With the combined Bitcoin holdings of the leading crypto ETFs, IBIT, and MicroStrategy (MSTR) now reaching a staggering 996,290 BTC, it’s clear – Institutional investors are all-in on Bitcoin’s long-term potential.

Together, these two giants control nearly 4.7% of the entire Bitcoin supply.

As a massive debt storm brews, these institutional heavyweights will need to take action to support Bitcoin’s flagging appeal – Potentially sparking a supply shock.

Alas, it’s a high-stakes gamble. With 2025 poised for volatility and retail investors flocking to Treasury yields, a repeat of the 2022 cycle feels dangerously close.

Read Bitcoin’s [BTC] Price Prediction 2025-26

The U.S economy is on shaky ground, and the financial system is shifting. Whether Bitcoin will play a role in the new economic order is uncertain.

For now, institutions hold the wheel, and the crypto market might yet pull off another surprise. Tread carefully though, as things are far from stable.