Institutions backing Bitcoin: what to expect

Although the market was shaken as the regulatory hammer struck BitMEX at the start of October, it has since recovered. Bitcoin, the largest asset did notice sudden pressure given the panic in the market, but it managed to hold on and recover in the following days and reach a value of $11,731, which was unseen in a while.

Even when Square announced its investment in Bitcoin, the market absorbed the news and did not act too volatile. This has been a feature that was pointed as an issue by many traditional investors, but over time Bitcoin has gained maturity and along with it, the trust of institutional investors.

Bakkt, CME, LMAX Digital

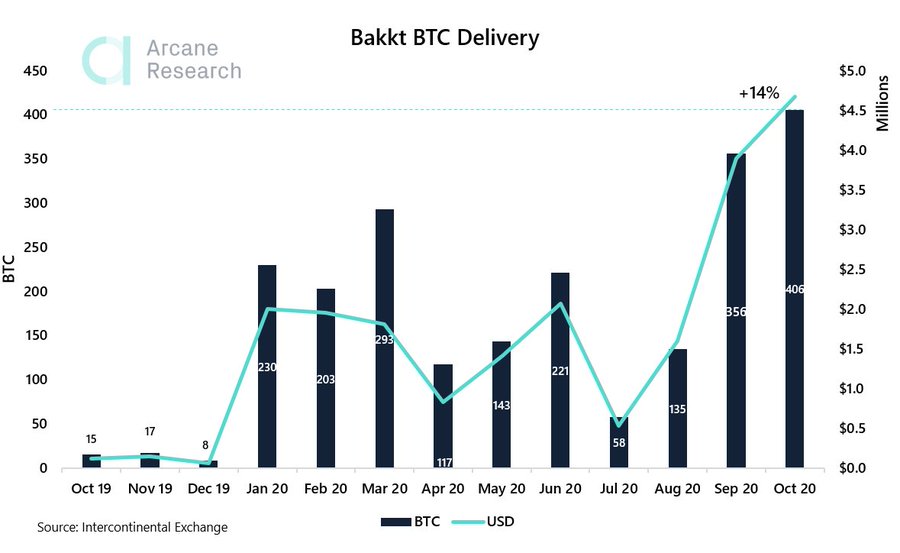

According to data provider Arcane Research, the Bakkt Bitcoin exchange witnessed another record-high month from September to October. The rise in interest from institutions mainly followed the interest of companies like Microstrategy and Square.

Source: Twitter

Since the exchange is dedicated to institutional investors in the U.S. the above rise in volume suggested the growing appetite among institutions for BTC.

Arcane highlighted this growth by noting that there were 400 BTC contracts to expire in October on Bakkt. This was an increase of 14% from September. Whereas, the Open interest in Bakkt saw a gradual rise since mid-September. The OI on 15 October was around $18 million, however, it noted a decline of $3 million on 16 October.

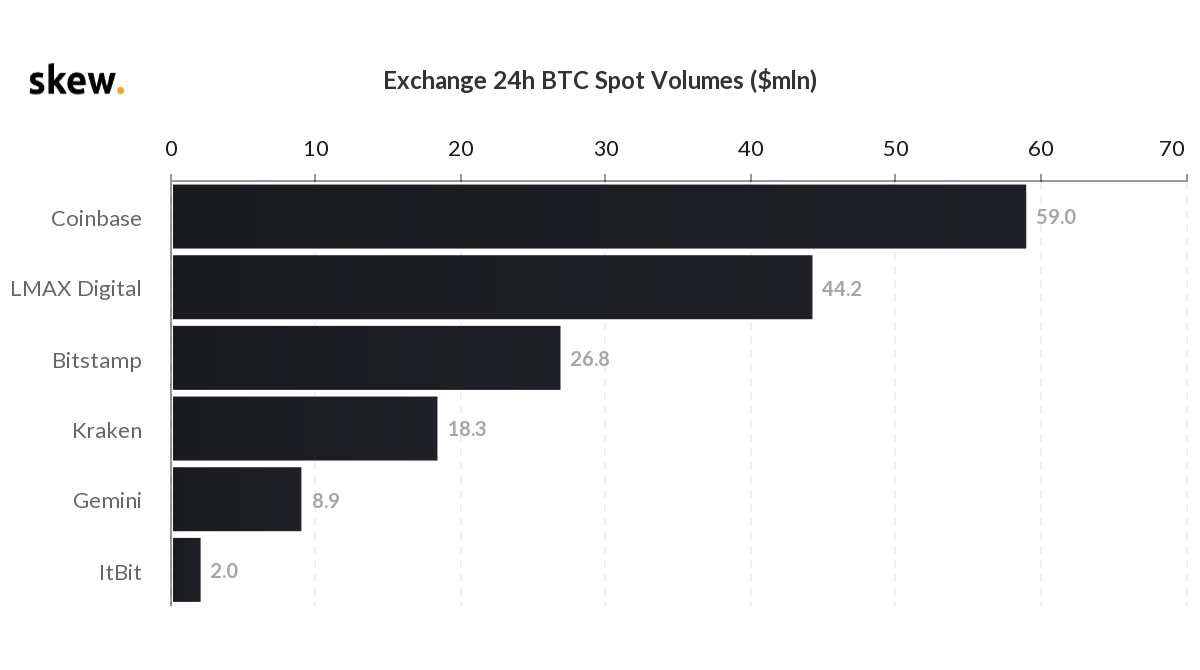

Apart from Bakkt, other widely used platform by institutions were LMAX Digital and CME, which also have been noting an increased volume in October. According to Skew, LMAX Digital ranked second in terms of 24-hour BTC spot volume, after Coinbase.

Source: Skew

LMAX Digital was however exceeding the daily volume of other prominent retail exchanges like Bitstamp, Kraken, and Gemini. Whereas the CME interest showed a strong upwards trend since the beginning of the month. It has moved from $345 million to $515 million, on 16 October. These were pretty evident indications of a strong demand coming from the institutions for BTC.