Injective: Reasons behind INJ’s latest 10% surge

- INJ recorded a double-digit price growth following OKX listing and the completion of its weekly burn.

- The coin has seen an uptick in demand in the last week.

Injective [INJ] recorded an intraday price rally of 10% on 30th November after leading cryptocurrency exchange OKX announced the coin’s listing on its spot trading markets.

The price hike was also due to the completion of the coin’s weekly burn auction. In a post on X (formerly Twitter), the developer team behind the project informed its community that it burned 3,968.152 INJ coins worth around $65,000 on 30th November.

3/ Yesterday, over $65,000 worth of $INJ was burned ? pic.twitter.com/b59ZKHlx0c

— Injective ? (@Injective_) November 30, 2023

This formed part of the ongoing weekly burns conducted every Wednesday since Injective’s mainnet launch in 2021.

Although the coin has since shed most of the gains, data from CoinMarketCap shows it remained at a 2% high in the last 24 hours at press time.

Traders make new requests for INJ

Following a month-long period of coin accumulation in October, INJ experienced a decline in accumulation in the first three weeks of November.

AMBCrypto found that its key momentum indicators, which track its accumulation and distribution, trended downwards for most of the month.

However, as profit-taking activity slowed towards the end of the month, the demand for INJ began to rise.

The coin’s Relative Strength Index (RSI) and Money Flow Index (MFI), which had fallen to their respective center lines, initiated an uptrend to signal a rise in coin accumulation.

At press time, INJ’s RSI and MFI were 62.11 and 58.63, respectively. At these values, these indicators suggested increased buying activity in the coin’s spot market.

Likewise, when the demand for INJ fell in November, its Chaikin Money Flow crossed below the zero line to signal the high volume of liquidity exit from the market.

With the rise in coin accumulation experienced in the last week, INJ’s CMF was 0.01 at press time, having rallied back above the zero line.

A CMF value above zero is a sign of strength in the market, as it shows a steady inflow of liquidity into the market.

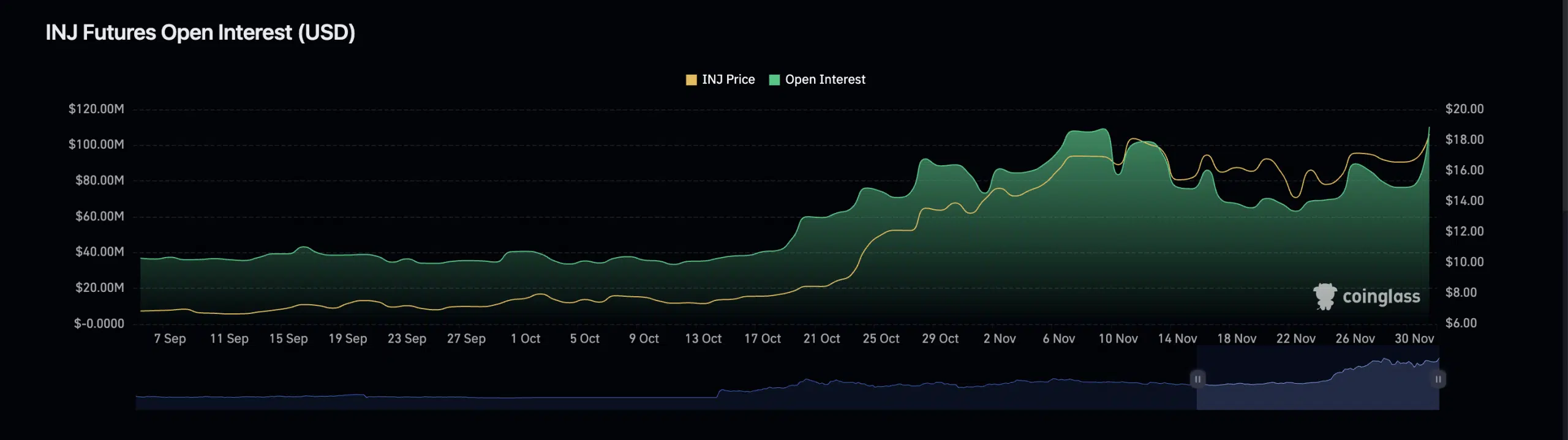

Further, the re-emergence of bullish sentiments in the INJ market presented itself in the form of rising open interest in the coin’s futures market.

At $110.3 million at press time, the coin’s open interest has increased by 74% since 23rd November, data from Coinglass showed.

Realistic or not, here’s INJ’s market cap in SOL’s terms

When an asset’s open interest climbs this way, it indicates that more traders are taking positions in the market.

This is often taken as a sign of growing confidence in the market and could lead to a continuation of the current trend.