Injective: Assessing odds of INJ breaking the $16 price target

Key Takeaways

INJ’s transactions hit a yearly-high as it rallied 14% and broke key resistance. Holder composition and negative netflows support bullish momentum and further price appreciation.

Injective [INJ] has recorded a yearly-high of 45.8 million weekly transactions, underscoring consistent user demand and adoption.

This metric highlights a strong uptrend throughout the year, suggesting expanding usage across its decentralized finance applications.

Moreover, the steady increase in transaction activity reflects growing network utility. Despite broader market uncertainty, Injective’s fundamentals appear to be strengthening. Midweek, INJ traded around $14.91 following the recent surge.

This surge in on-chain interactions could provide the necessary support for sustained bullish momentum, making INJ a token to watch closely in the current market cycle.

Can a 14% weekly rally set the tone for INJ’s breakout?

INJ has rallied 14% over the past week, breaking out of a falling wedge pattern and was hovering near the $15.70 resistance, at press time. The weekly RSI reading has pushed above 53, reflecting renewed buyer strength.

This technical breakout opens the door for a potential climb toward $16.16 and possibly even $35.37 if the momentum persists. Furthermore, the breakout aligns with the broader rise in on-chain activity.

If bulls maintain pressure above $15, INJ may continue this rally in the coming sessions, particularly if volume and user metrics remain elevated.

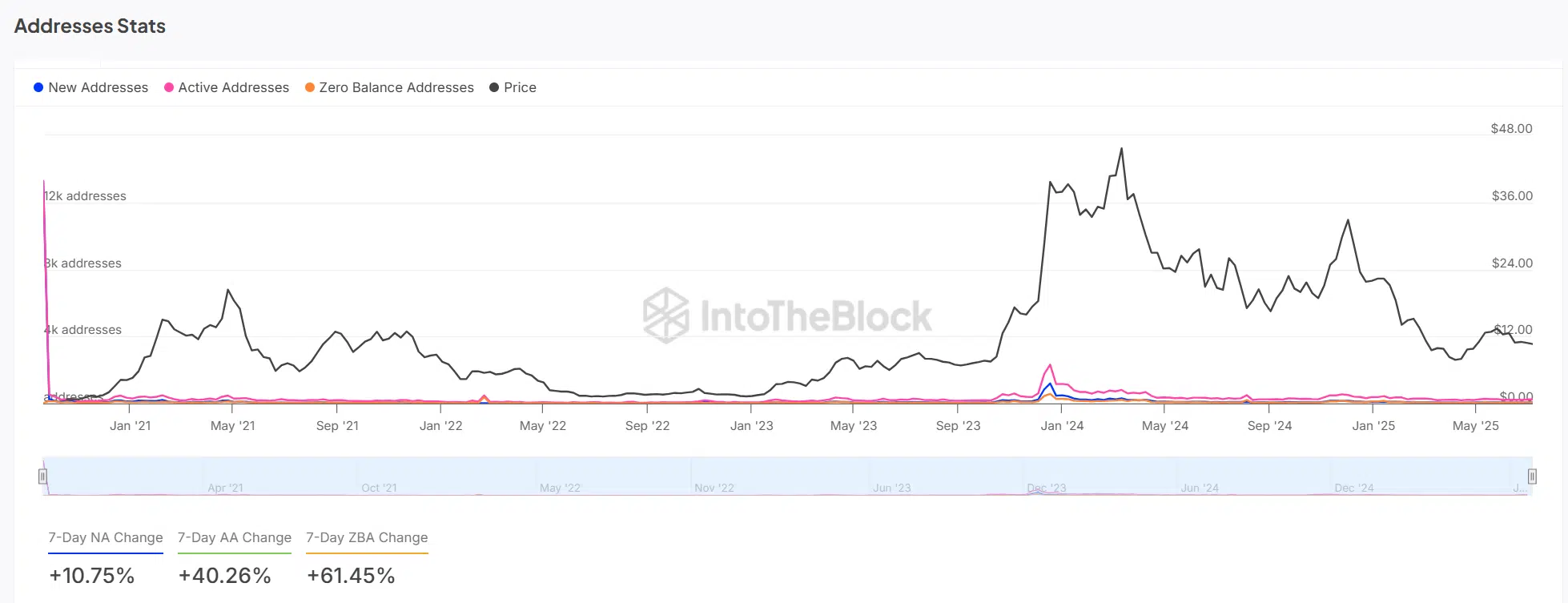

Are address spikes hinting at rising network demand?

Address data shows notable growth, with New Addresses rising 10.75% and Active Addresses spiking 40.26% over the past seven days. This sharp uptick indicates that user participation on the Injective network is accelerating.

Additionally, such growth often foreshadows upcoming price movement, especially when supported by broader bullish trends. These address spikes follow a pattern of increased user interaction and on-chain utility.

Thus, the current data reflects growing investor attention and confidence in the protocol, which may fuel further upside for INJ if sustained in the short term.

Are mid-tier holders taking the reins from whales?

While whale holdings declined by 0.66% in the last thirty days, investor-tier wallets (smaller than whales but larger than retail) grew by 5.32%.

This shift suggests increased confidence among mid-term holders, often associated with longer holding periods and lower sell-side pressure.

Meanwhile, retail holdings dipped slightly by 0.54%, as of writing, hinting at consolidation among smaller participants.

Therefore, the evolving ownership distribution indicates healthier market dynamics and growing decentralization, potentially supporting INJ’s stability as it eyes higher resistance levels.

Could exchange outflows support INJ’s price momentum?

INJ continues to record sustained negative netflows, with the latest data showing $652.99K in outflows from exchanges.

This consistent trend of withdrawals typically reflects reduced selling intent and growing investor confidence.

Furthermore, prolonged negative netflows decrease available supply on exchanges, tightening liquidity and enabling more robust price surges.

This outflow behavior reinforces the ongoing bullish narrative, especially when coupled with rising transaction activity and technical breakout confirmation.

Is INJ ready for a sustained rally?

INJ appears well-positioned for a sustained rally. The 14% weekly surge, breakout above key resistance, and strong on-chain fundamentals all support continued upside.

Rising user activity, consistent negative netflows, and a shift toward mid-term holders further strengthen the bullish outlook.

If momentum persists, INJ is likely to reclaim $16.16 soon and could potentially target the $35 region in the medium term.