Bitcoin

How is Tether helping Bitcoin’s demand?

Bitcoin is now trading close to $12,000, a level which it breached and broke below two times over the past two weeks. Will it be third time lucky for the world’s top cryptocurrency?

Since breaking over $12,000 on 2 August, for the first time since June 2019, it has been subject to a ‘bull trap.’ Such selling traps happen due to several sell orders being placed at, or close to, a particular price, and once the trading price reaches this point, a large number of sell orders are triggered [typically at lower prices, to secure quick trades], pushing the price down.

Each of Bitcoin’s previous attempts, thankfully for the hodlers, has been succeeded by price improvement and recovery. A reason for this is the nature of supply and demand in the Bitcoin ecosystem with a price increase, which the recent Chainalysis Market Intel report delves into. Despite the price increase, there is strong demand for Bitcoin currently, something that has happened only thrice in the cryptocurrency’s history, including during the 2017-18 bull run and in June 2019.

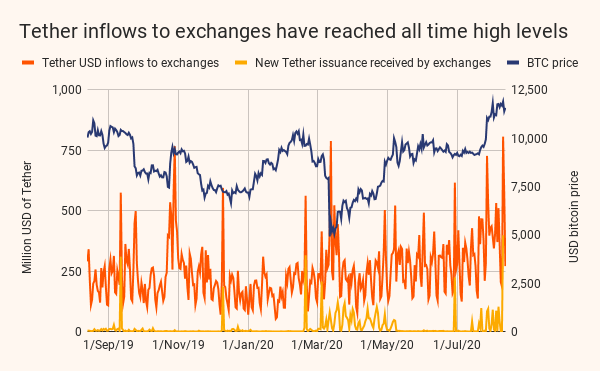

Tether inflows to exchanges | Source: Chainalysis

The first inklings as to the source of this demand are crypto-to-crypto exchanges where the stablecoin Tether is “providing liquidity.” On 10 August, USDT to the value of $806 million flooded into several exchanges, which was 9 percent of the total supply. The report noted that these single day pumps “build on a trend of increasing inflows [into exchanges] since April.” A single USDT has a x19 return on liquidity on an exchange and hence, it’s no wonder that more USDT in the markets implies more trading. The report stated,

“Given that, on average in the last seven days, a Tether received by the median large exchange is traded 19 times, Tether is supporting tens of billions of dollars of liquidity a day.”

Crypto-to-fiat net flow 2019-2020 | Source: Chainalysis

Despite this stablecoin print, crypto-to-fiat exchanges are the bastions of “new demand for Bitcoin,” and not crypto-to-crypto exchanges. The author Philip Gradwell, Chainalysis’s Chief Economist, stated this because Bitcoin is “leaving crypto-to-crypto exchanges and heading to crypto-to-fiat exchanges.” That outflow, in 2019, amounted to a whopping $1.66 billion.

Gradwell mentioned two key reasons for this outflow [or positive net flow for crypto-to-fiat]. Firstly, given the ballooning price, traders intend to cash out into fiat currencies, indicating the supply of Bitcoin. Secondly, buyers looking at this ballooning price want to enter into crypto, via fiat-on-ramps, underlining the demand for Bitcoin. Another important point to note is that of the aforementioned $1.66 billion, $1.12 billion accounted for the net flow since mid-March when the price crashed to below $4,000 and began rising up. The report added,

” As price has increased above $10k, net flows to crypto-to-fiat exchanges have accelerated, with 154 thousand bitcoin moving net since 27 July.”

If this demand was absent in the market, the selling pressure which had been accumulating would’ve ‘reduced the price.’ Going forward, the equation of supply and demand for Bitcoin will be pivotal.