How did Bitcoin react to South American firm’s 24K BTC purchase plan?

- Nilam Resources, a mining company, recently filed an LOI that would allow it to acquire large sums of BTC.

- Bitcoin reacted positively, however sentiment continued to decline.

South American gold mining company Nilam Resources has announced that it would acquire 100% of the common stock of a “special purpose entity” and buy 24,800 Bitcoin [BTC] via it, per a Letter of Intent released on the 26th of March.

Going all in on BTC

As per its Letter of Intent, the company has entered into an LOI with Xyberdata Ltd to secure 100% ownership of the common stock of a special purpose entity, to be named MindWave.

The entity will also possess other undisclosed digital assets, and the digital assets it acquires will function as collateral to secure capital for future projects undertaken by it.

Elaborating on its intent, Nilam Resources aligned itself with prominent global entities such as MicroStrategy, which have made a name for itself by investing in BTC.

Furthermore, the company highlighted the ongoing surge in the crypto market and designates Bitcoin as the “gold standard” and the future of digital transactions.

BTC sees green

This development has proved to be extremely beneficial for Bitcoin as its price has seen a significant uptick in the last few hours, having re-attained the $70,000 price level.

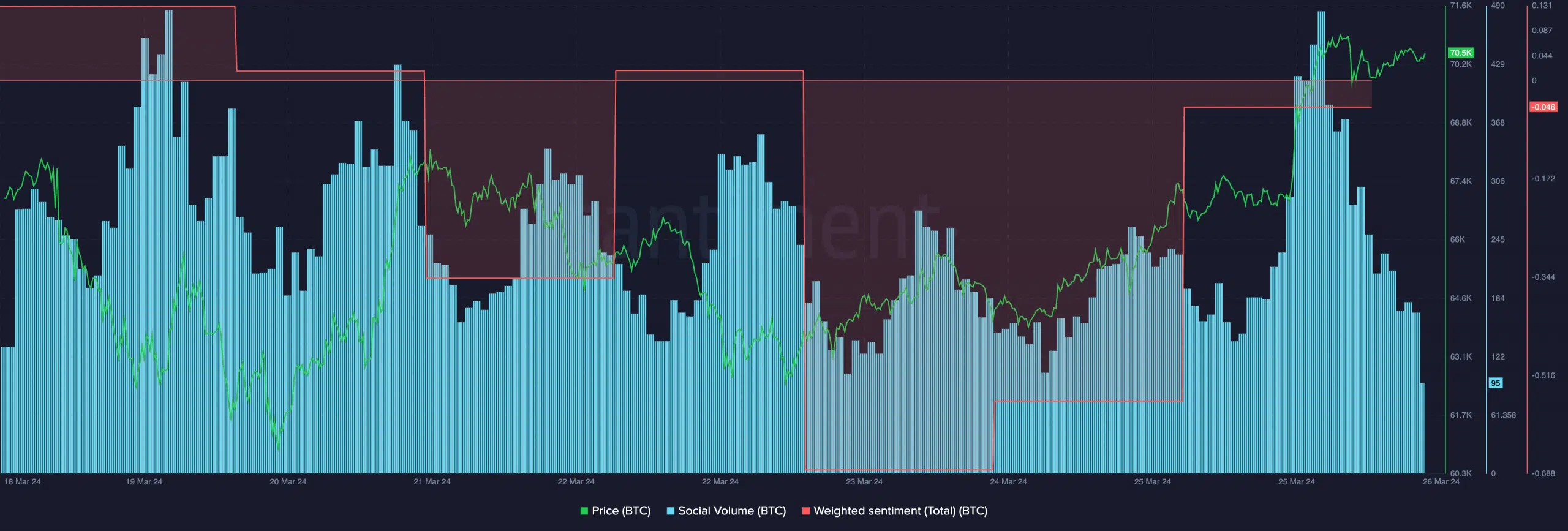

According to AMBCrypto’s analysis of Santiment’s data, there was a surge in the king coin’s Social Volume over the last few days. This indicated that the overall interest in Bitcoin on the social front had grown.

However, Weighted Sentiment had witnessed a decline during this period. This indicated that despite the surge in price and popularity, there were a large majority of people that were skeptical of BTC’s recent surge.

Read Bitcoin’s [BTC] Price Prediction 2024-25

This negative sentiment around Bitcoin may hinder BTC’s ability to rally going forward, especially, as BTC approaches its all-time high of $73,750.07.

This negative sentiment and uncertainty may persist until the much-anticipated halving occurs.

![Illuvium [ILV] crypto nearly doubles after $11 bounce! Can bulls push past $24 next?](https://engamb.b-cdn.net/wp-content/uploads/2025/08/Kelvin-_78_-400x240.webp)