Bitcoin

How deep will bitcoin correct in December?

Bitcoin’s price seems to be losing its foothold as the price suffered a drop of 5% in the last 8 hours. Considering the situation more of this could follow. How much? Perhaps, an average drop of 30% can be expected, especially during bull runs.

Bitcoin Corrections

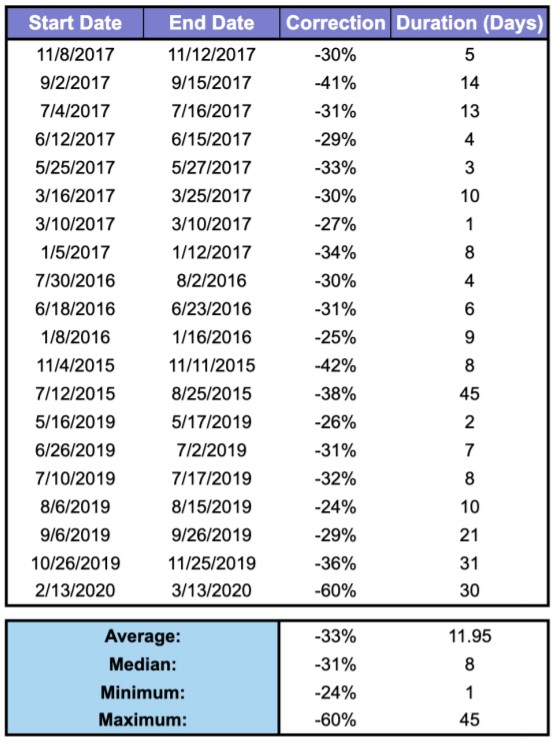

Historically, bitcoin seems to correct during bull runs and it isn’t taboo to expect corrections during the bull run. In fact, we have seen it around 20 times during its previous bull runs.

The highest correction was -60% in March 2020 and lasted about 30 days. The shortest correction, however, was -27% in March 2017; this correction lasted about 45 days.

This time around, we can expect a similar correction, and today’s drop could be the beginning of this phase. Here’s what you can expect.

Once we average all the drops, we get 33% drop, which can be expected if we are being statistical. Optimistically, we could see bitcoin dip 27% or less.

Moreover, looking at monthly returns, we can observe that December hasn’t generally been a good month for returns. December has an average return of 9% from 2011 to 2019.

So, perhaps, this drop is what dampens the bull run in December leading to lower returns. Either way, the point is to watch out for a drop that could potentially wipe out your returns.

Where will the dip end?

BTCUSD TradingView

There is strong support at $18,200 which is being contested at press time. Should this level break, we can expect the price to slide lower to $16,200, where the next confluence of support lies.

Moreover, this drop from Bitcoin’s new ATH to $16,200 would constitute a 20% drop, which almost falls in line with the aforementioned hypothesis.

What can be done?

The best option would be to buy the dip. Dollar-cost averaging these dips would be the best way to prevent huge drawdowns of one’s portfolio. (Read this for DCA)

An alternative method could be to just cash out your positions and sit on the sidelines as bitcoin might head into uncharted waters.