High Bitcoin outflows might be boon for Prime Brokerage

It has not been an ideal period for Bitcoin exchanges over the past few months.

Ever since the market suffered a major collapse in March of 2020, the number of Bitcoin on exchanges has continued to decline. Now, according to Glassnode‘s latest insights report, BTC outflow is reaching a new low.

Source: Glassnode

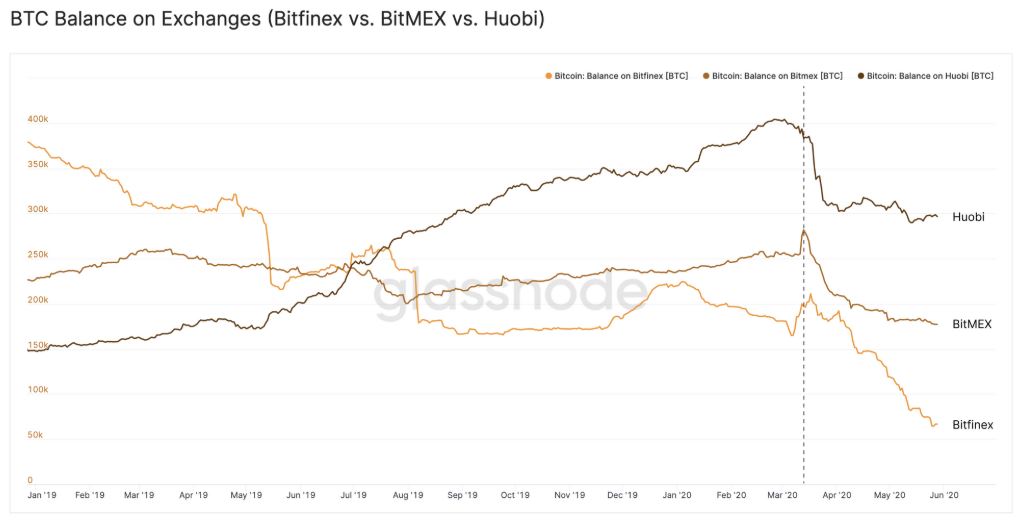

As illustrated in the attached chart, the balance of Bitcoin on collective exchanges has reached its lowest point over the past 12 months, with a total of 320,000 BTC found to have left exchanges since Black Thursday.

Is BitMEX still suffering the most?

Now, common consensus and several other reports have stated that the entire conundrum started with BitMEX’s mishap back in March. As one of the world’s largest derivatives exchanges, BitMEX suffered one of the steepest declines since 13 March. However, contrary to expectations, the biggest outflow with respect to volume was registered by Bitfinex.

Source: Glassnode

According to the report, Bitfinex noted over 133,000 BTC in outflows, a figure that was followed by BitMEX’s 105,000 BTC and Huobi with 97,000 BTC in outflows. The report additionally said,

“In contrast, Coinbase remains the most popular exchange for holding BTC, with a current balance of 968,000 BTC, having decreased by only 0.2% since Black Thursday.”

The possible rise of prime brokerage

Now, the cause behind the collective decline has not been pinpointed yet by the industry, but many believe that a lack of trust in exchanges is brewing among Bitcoin users.

BitMEX faced two DDoS attacks which delayed user requests and caused disruption to its service, disruptions during which users were not able to respond to the rapidly dropping market.

Keeping that in mind, Avi Felman of BlockTower Capital, had recently stated,

“There are few alternatives to holding bitcoins on an exchange if you want to trade, but new offerings in the prime brokerage space will lead to greater outflows from exchange-specific wallets.”

Now Felman made a fair point here talking about prime brokerage.

A recent study done by Binance had argued that a rise in custody solutions could possibly improve institutional participation, especially in light of the fact that only 2.6 percent kept their BTC assets with third-party custody solutions while 92.10 percent had their crypto-assets stored in exchanges.

Here, it is also important to note that the same report suggested that exchanges are widely considered to be the least secure place for digital asset holders.

Since the exchanges seem to be losing the plot now, it can be speculated that crypto prime brokerages such as Tagomi and BitGo’s stock could improve if exchanges continue to register high BTC outflows.