Here’s one reason why Bitcoin is still below $10K

The price of the largest cryptocurrency, Bitcoin, has largely been restricted under $10k for over a month now, with the crypto noting strong resistance in this range. Ever since the fall in March, Bitcoin has enjoyed strong market momentum that has consistently moved its price upwards, with BTC able to recover its lost value within just a month.

When the world’s largest cryptocurrency breached $9k, the market was awaiting a surge in value with the anticipation of halving. However, when the $10k level was rejected repeatedly, even after the halving, the market’s traders began calling for a correction.

Source: BTC/USD on TradingView

As the halving event concluded on 11 May, many users were moving a hefty amount of coins. Over the past couple of weeks, such movement has only escalated, resulting in the movement of many dormant coins too. Rafael Schultze-Kraft, Co-founder of the data research company, Glassnode, highlighted this trend recently.

Source: Twitter

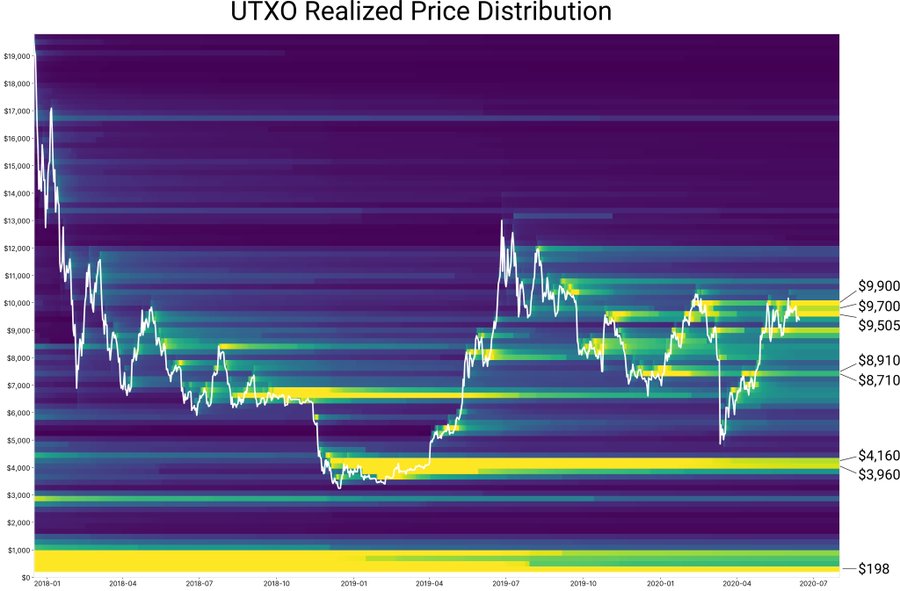

The attached chart highlighted the amount of BTC supply that was realized or last moved, at a given price, and the change over time. The area marked in yellow is the supply of BTC. According to the same, in May and June, the UTXO spent was high between $9,500 and $9,900. As traders’ sentiment about an impending fall in the market gained strength, they might have sold their holdings at a higher price in expectation of a fall in the price of the world’s largest cryptocurrency.

Source: Twitter

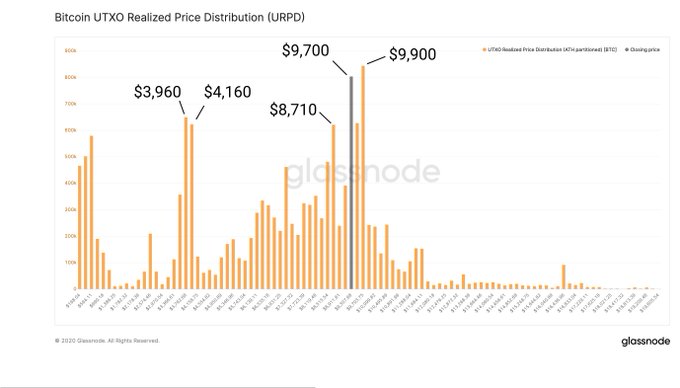

This range was visible in the next chart as it highlighted the daily URPD detailing the price distribution at which the current circulating Bitcoin supply was realized.

As of May, a large proportion of BTC holdings were in profit, indicating a shift from the COVID-19-driven sell-off in March, an event that had also witnessed the percentage of profitable UTXO fall. As per data from Glassnode, UTXO profitability fell to as low as 40% in March and was found to be the lowest since October 2015. Despite the blow, however, at the time of writing, UTXO profitability was back on track and was observed to be rising well.

A rise in the same is an important sign, one that suggests that the underlying market is strong.

Source: Glassnode