Here’s what’s keeping Ethereum in the green

After clocking in a new local top at $476, Ethereum’s price has been tepid over the past week. Clocking in a weekly change of 0.96% drop, Ethereum might be indicative of a correction period with Bitcoin but larger market sentiment remained poles apart with respect to the price.

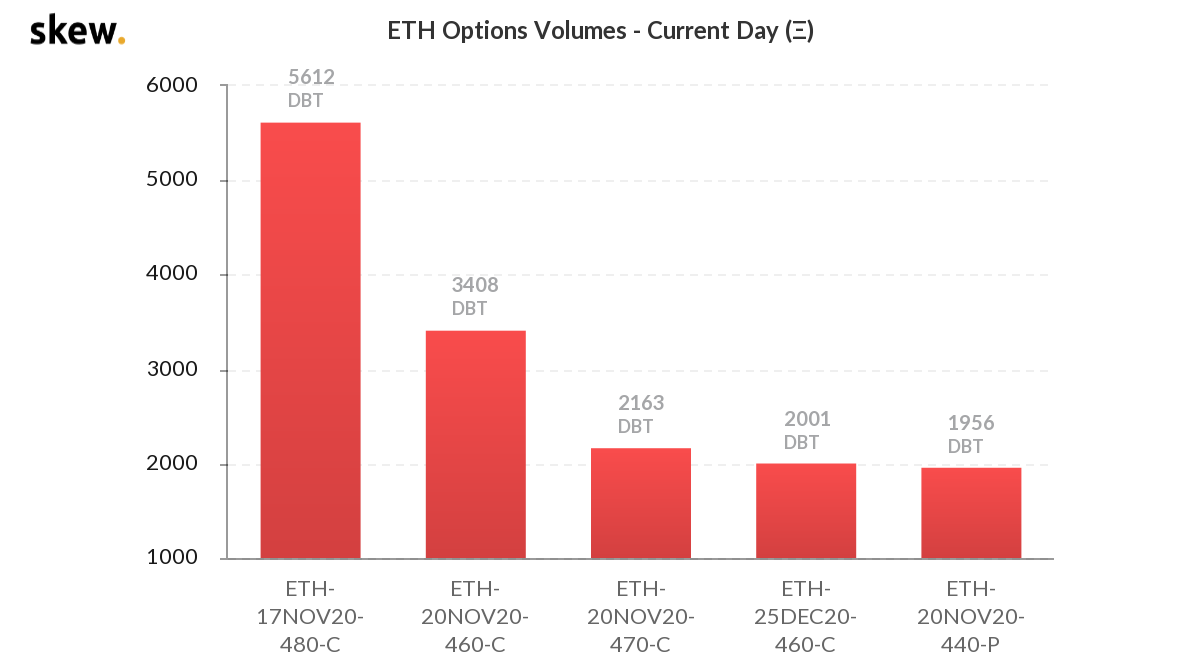

Source: Skew

According to recent Skew data, 13,184 ETH are currently locked in Call Buy contracts with close to 5612 ETH expected to strike out at or above $480. In comparison, only 1956 ETH was under Put Sell order for a retracement down to $440. Such a trend is extremely rare over a week when Ethereum’s price has exhibited a change of 0.96% drop.

While Ethereum’s price chart was suggesting a bearish turn, Ethereum Options were completely trying to flip the narrative. The probability index for ETH was quite positive as well.

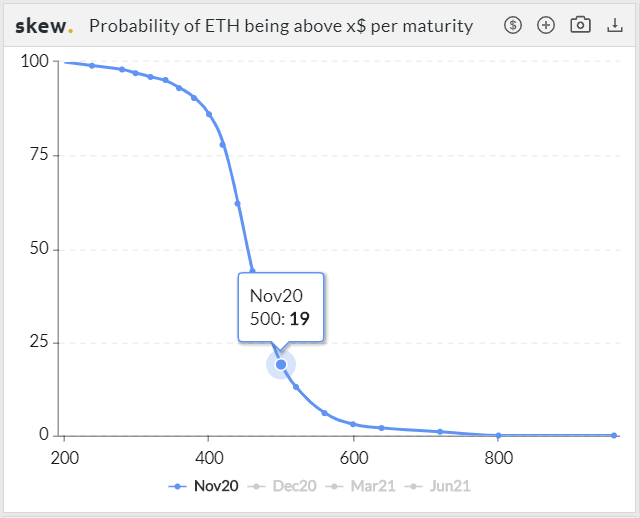

Source: Skew

According to the chart above, 19% of the Options market expected Ethereum to reach $500 before the end of November, and a significant 29% expected a re-test at $480.

Multiple Factors currently keeping Ethereum in the Green?

In the past, Ethereum was extremely reactive to the collective market, which was primarily driven by Bitcoin. However, DeFi’s impact has made a major difference in 2020. DeFi’s market cap on its own held close to $17 billion, and these DeFi tokens were making another comeback.

According to @ThinkingUSD, a notable market analyst, DeFi’s return may assist Ethereum to maintain its rally over the next trading session. He stated,

“DeFi looks pretty neutral to bullish and I think ETH looks primed for a 471 resistance tap. Added to longs. Will add more on 471 breaks and hold as well.”

Low Bitcoin Correlation since September

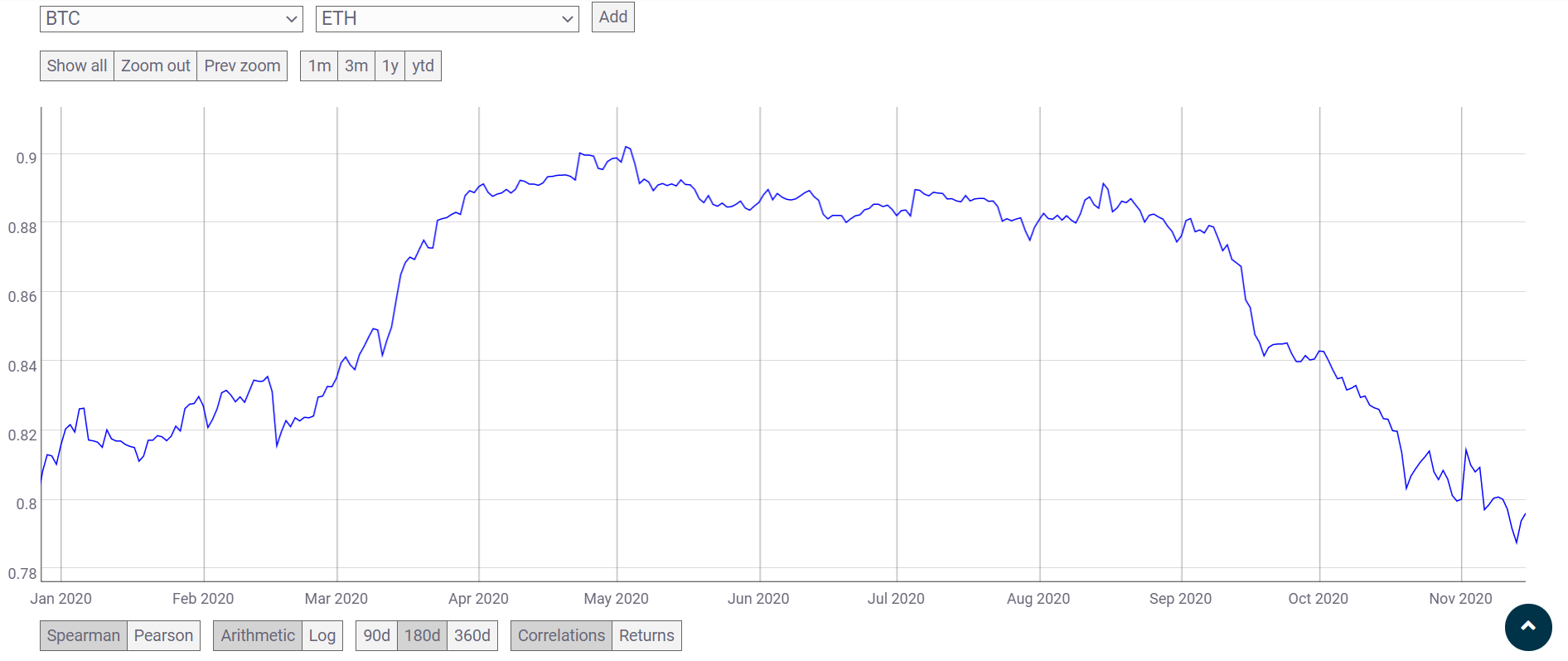

Source: Coinmetrics

After consistently strong correlation during the rally in August, Ethereum is currently at a year-low correlation with Bitcoin. While it may have played to a disadvantage in October, it may help Ethereum to attain its own rally going forward.

For the first time in the digital asset industry, major assets are becoming more responsible for their own price rallies. Ethereum 2.0 is currently creating its own niche in terms of organically taking the project in a new direction.