Here’s Binance CEO’s take on how to ‘sort of slow down crypto-adoption’

When it comes to cryptocurrency adoption, the past year has been dominated by the fact that institutional investors are now pouring into the digital asset market. In light of growing regulatory clarity and products like those offered by Grayscale that make traditional investors feel right at home when dealing with crypto, the last 12 months have demonstrated that the realms of traditional finance and the digital assets market are bridging the gap.

In a recent interaction with Charlie Shrem, Changpeng Zhao [CZ], Founder and CEO of Binance, elaborated on how the mistakes made in traditional finance are spilling into the crypto and digital assets market.

With the pandemic and the fact that economies have been substantially disrupted, governments have gone on a fiat currency printing spree, which in the long run, can reduce value quite dramatically. Interestingly, CZ noted that while fiat printing has plagued the world of traditional finance, something similar is also happening in the digital assets market. He said,

“The government has no choice, but to print large quantities of new money which devalues everybody else’s holdings. So I think with crypto now, to be honest, if you look at all the new token issuances, all the new token rebates, that’s the same as printing money.”

This has, in turn, helped assets like Bitcoin exhibit its ability to retain value. While the USD still continues to be a fairly robust currency, increased issuance may reduce its value, a problem assets like Bitcoin don’t necessarily have to worry about. Further, CZ argued that innovations in decentralized finance can, in theory, be implemented in the domain of traditional finance. He said,

“I think in theory, everything that we’re doing now on decentralized finance could have been done on centralized.. stocks, equity etc. The biggest problem there I actually think is the printing unlimited amount of money, making people poor over time.”

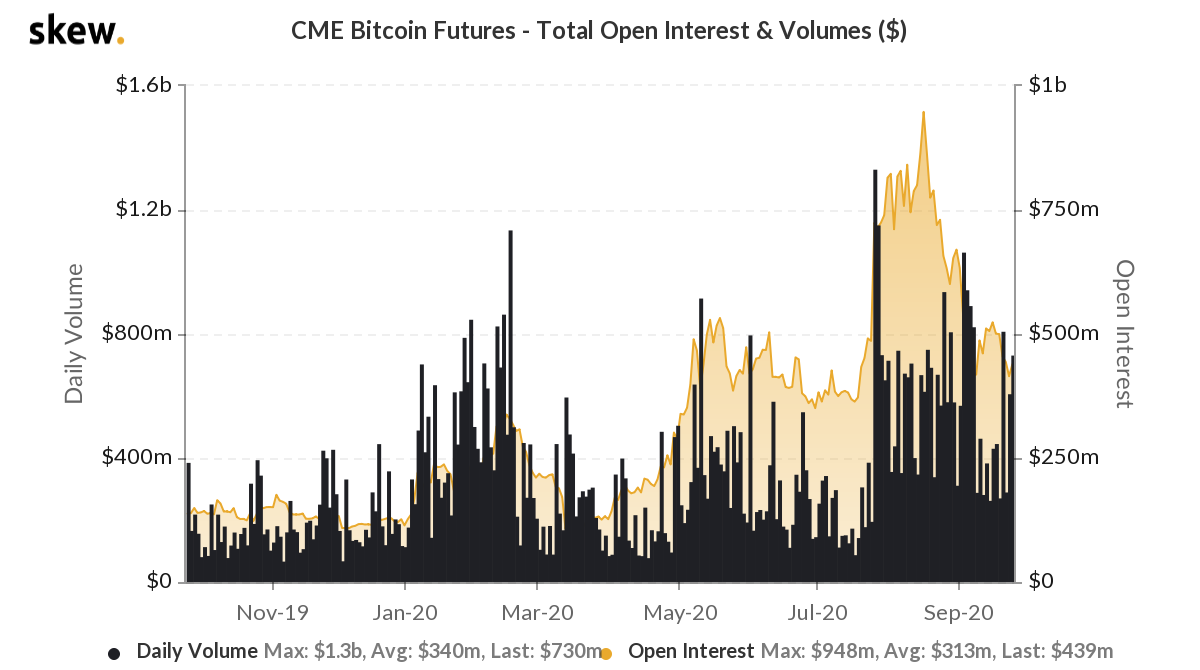

Source: skew

However, over the past few years, there has been a strong wave of new investors accustomed to the traditional markets finding their way into the crypto-ecosystem. Market data provided by Skew shows that the Open Interest for Bitcoin Futures on the CME has grown from $138 million to $439 million over the past year, while also establishing a high of $948 million a few months ago.

The Binance CEO added that while this increased adoption of crypto-assets like Bitcoin is promising, if the traditional market were to offer greater freedom akin to crypto, the digital assets market may see a significant drop in adoption levels. He concluded,

“I think the best way to sort of slow down the crypto adoption is to make the traditional finance better with a high degree of freedom, ease of use, low transaction fees…If all of those features can be brought into the traditional finance people will have less incentive to adopt blockchain currencies.”