Here’s a look at what the Ethereum whales are up to

- ETH addresses with 10,000 or more have increased recently.

- ETH price has remained above $2,000.

Recently, significant Ethereum holders were on the move, leading to a notable rise in accumulation. This increased accumulation has resulted in a notable amount of ETH being withdrawn from exchanges.

Ethereum whales increase accumulation

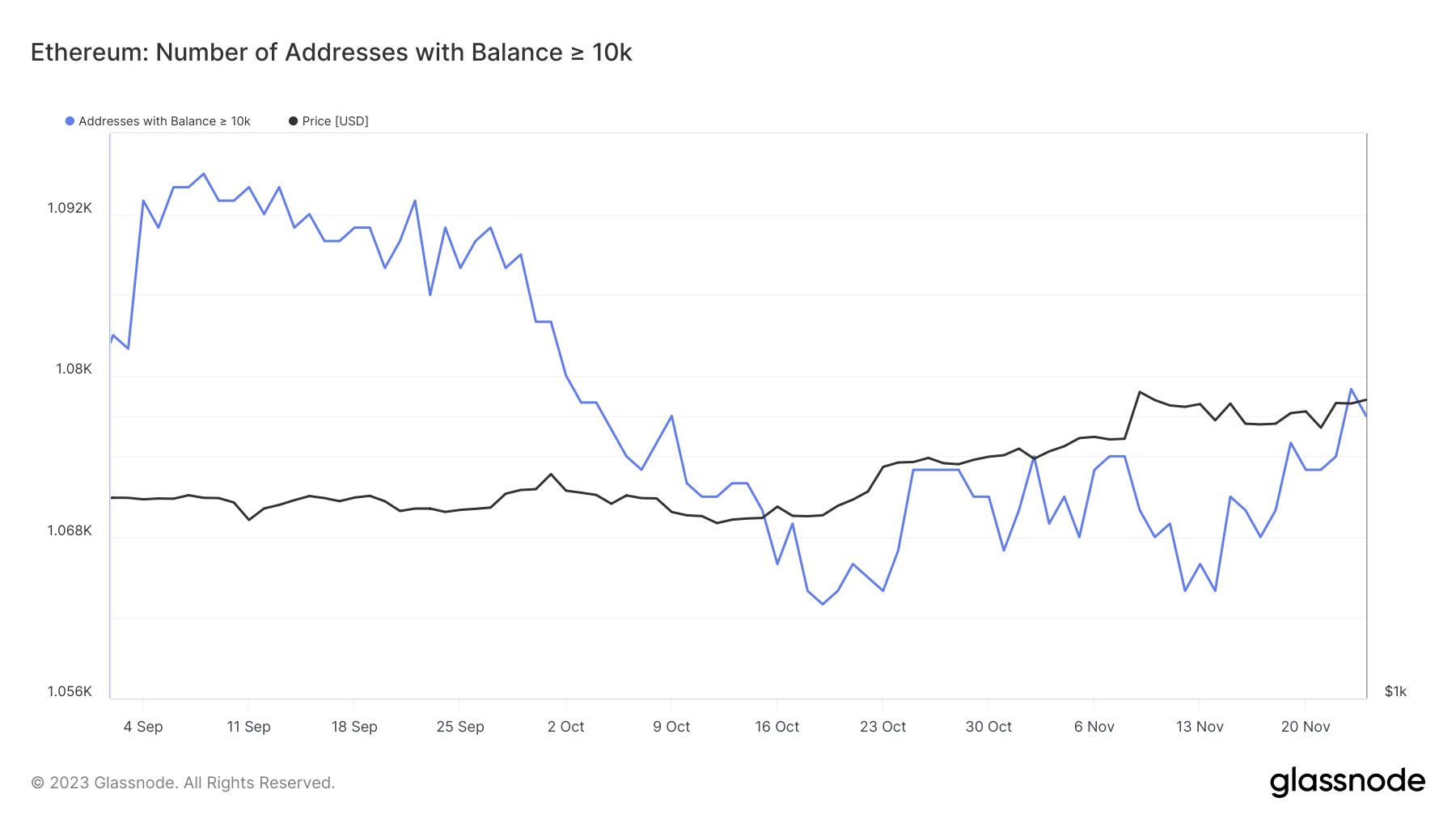

A look at addresses holding around 10,000 Ethereum or more revealed a recent rise in their numbers.

AMBCrypto’s analysis of the Glassnode chart showed that these addresses started to grow towards the end of October. The chart showed a rise after a notable decline that brought the count down from around 1,090 to 1,063.

As of this writing, the number of such addresses has risen to around 1,077. This suggests a rise in whale accumulation. How has the movement of Ethereum on exchanges responded to this increased accumulation?

Exchange netflow mountains negative trend

The analysis of Ethereum’s exchange activity for November showed a higher outflow than inflow. This implied that more ETH was leaving exchanges than entering them.

The statistics suggest a decrease in sell pressure and an uptick in scarcity. Additionally, this reduction in availability tends to increase its value.

According to Glassnode’s exchange netflow data, over 47,000 ETH have been withdrawn from exchanges.

The chart has consistently shown negative values over the past few days, further emphasizing the trend of ETH moving away from exchange platforms.

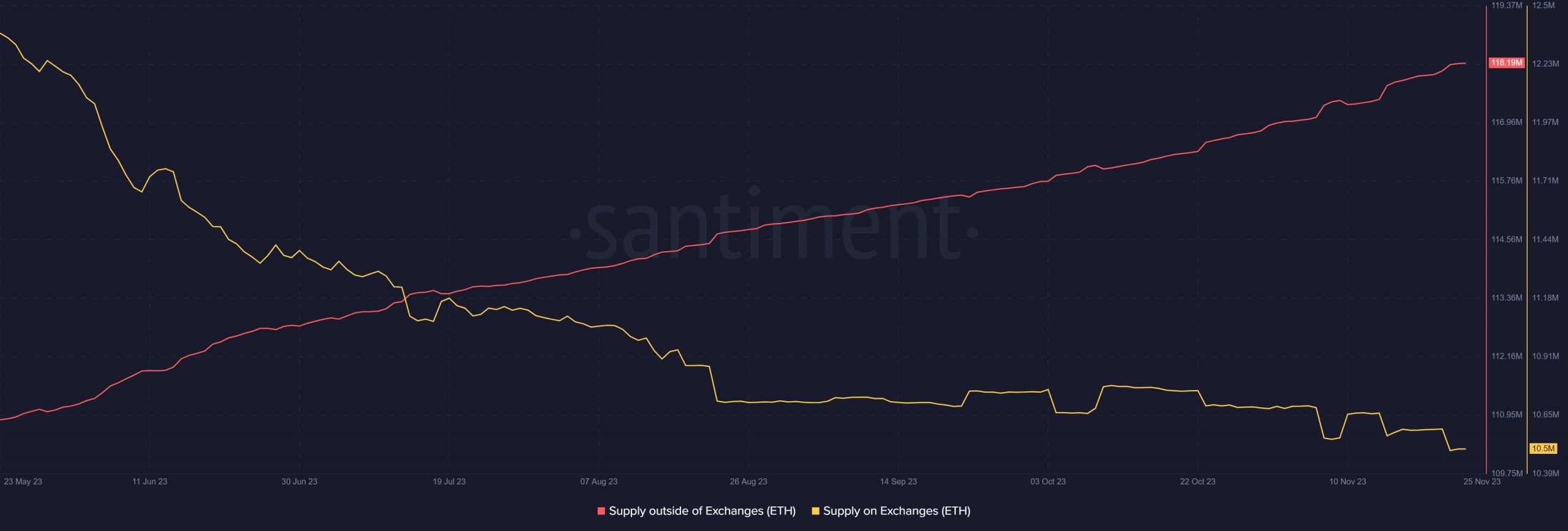

Ethereum supply off exchanges mount

According to an analysis of a Santiment chart, the Ethereum supply on exchanges has experienced a decrease. This indicated a reduction in the available volume of ETH on these platforms.

The chart showed that this decline started around 14th November, with the volume falling from around 10.6 million to about 10.58 million.

Currently, the supply on exchanges is around 10.5 million. Interestingly, as the supply on exchanges reduced, the supply off-exchanges rose, reaching over 118 million.

At the beginning of the current month, the off-exchange volume was around 117 million.

Realistic or not, here’s ETH’s market cap in BTC terms

ETH continues slight uptrends

At the time of this update, Ethereum was experiencing a positive price trend on a daily timeframe chart. Over the past two days, a consistent, albeit slight, price increase could be seen.

Notably, Ethereum was still trading above the $2,000 price range. The positive trend has persisted since the golden cross on the daily timeframe, further confirming the current trend’s strength.