Grayscale rebalances DLC fund by reducing all altcoins

The digital asset management firm Grayscale Investments announced the completion of its quarterly review to update the weightings of its Digital Large Cap Fund (DLC). The company claims that the DLC Fund is a passive, rules-based strategy that seeks to provide exposure to the large cap segment of the digital asset class (70% target coverage).

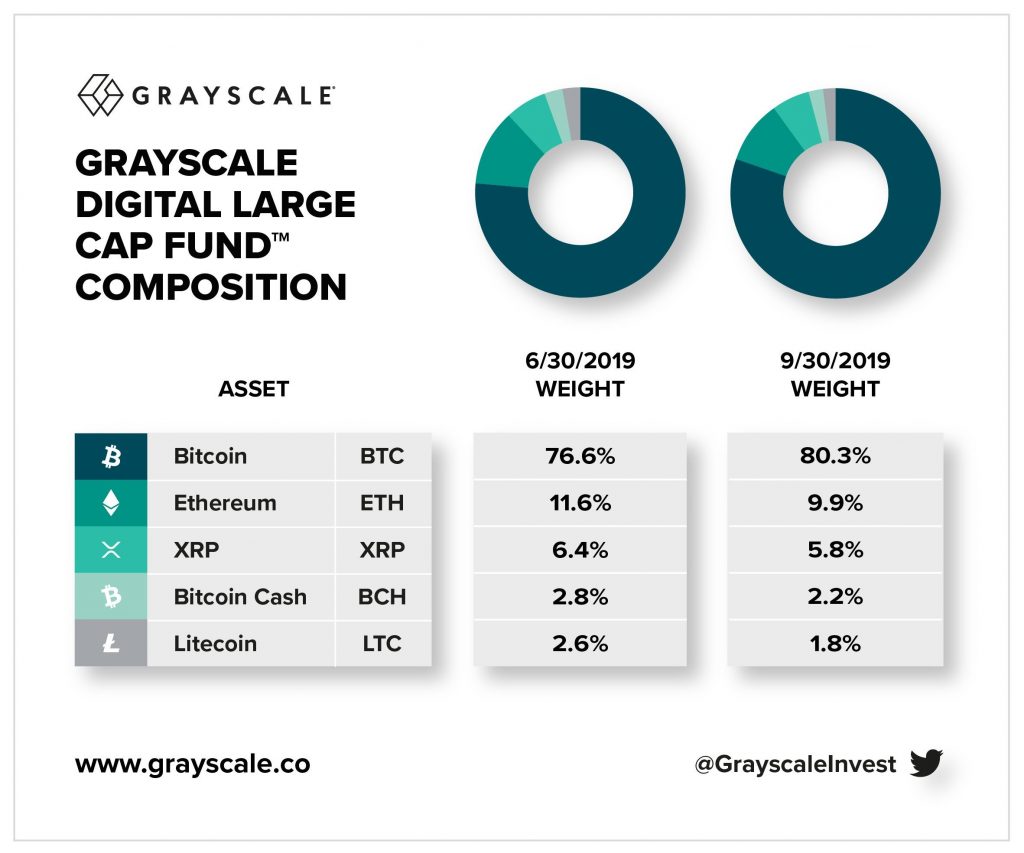

Source: Grayscale

As per the above representation, the assets within the DLC comprises of Bitcoin, Ethereum, XRP, Bitcoin Cash, and Litecoin, with most of it represented by the king crypto. Interestingly enough, the company highlighted that “no new assets qualified for inclusion following DLC Fund’s Quarterly Review (9/30/19),” although the latest composition has seen reduction in all the altcoins between June 30 and September 30, 2019.

Out of the lot, Litecoin suffered the highest with over 30% reduction while XRP witnessed the least displacement of just above 9%. The next update on the Quarterly Review is expected to be available by the end of December 2019. It is important for investors to note that the Grayscale products are not yet registered with the Securities and Exchange Commission (SEC) or any other regulatory agency in any jurisdiction. The company website also states that,

“Investments in the (Grascale) Products are speculative investments that involve high degrees of risk.”

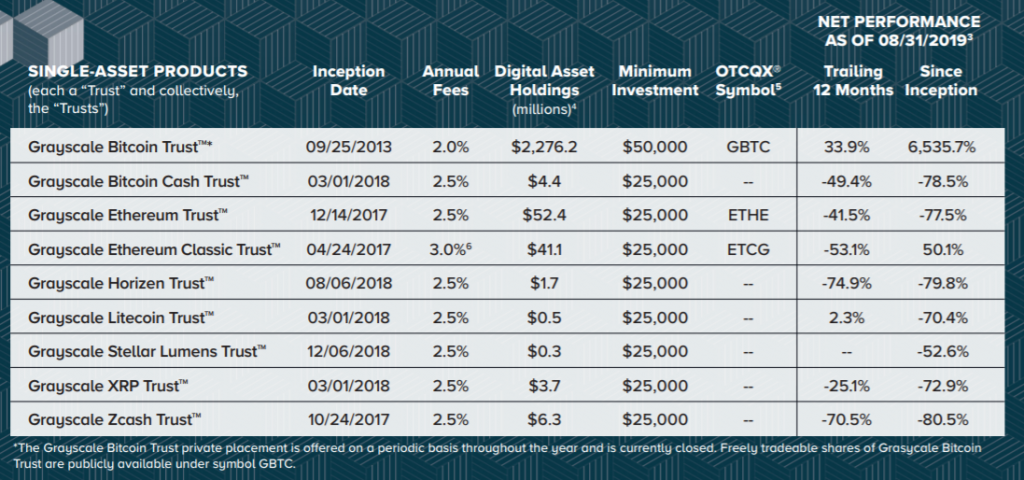

Source: Grayscale

The above screenshot from the September report highlights the massive 6535.7% growth of Grayscale Bitcoin Trust, although the altcoins have displayed poor performance. Considering the previous year, only Bitcoin and Litecoin have shown positive performance.