Crypto News

Genesis Capital reports $870 million in new originations for digital lending

Genesis Capital, the institutional lender for Bitcoin and other cryptocurrencies released Q3 reports, which highlighted a “strong, sustained growth in the lending business.” An official tweet from Genesis Global Trading made the information public after stating,

“In Q3, they (Genesis Capital) added $870M in new originations, breaking the previous record of $746M set in the prior quarter.”

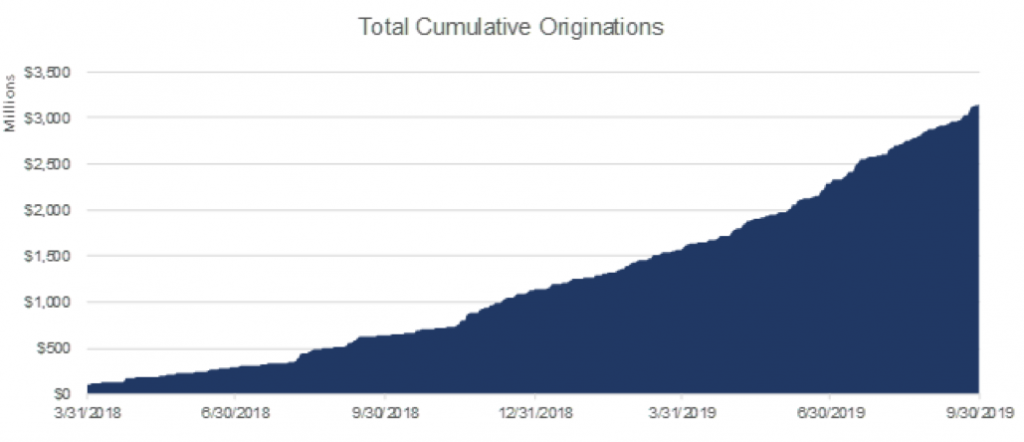

The official report suggested that the company broke its previous record in Q2 reports (of $746 million) by adding $870M in new originations this quarter. As of September 30, 2019, active loans outstanding stood at $450M, roughly flat from the previous quarter despite a significant decrease in Bitcoin’s price.

Source: Genesis Capital

Source: Genesis Capital

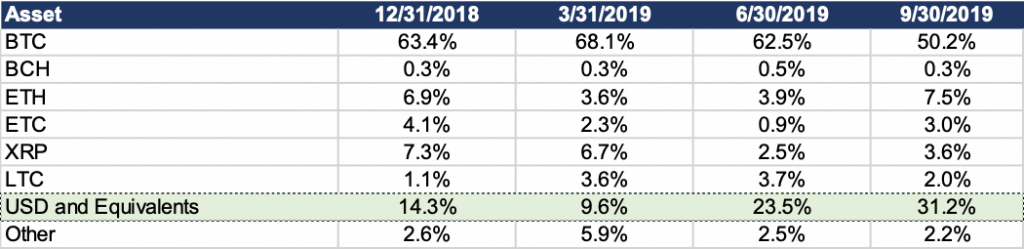

The report highlighted that at the end of Q3, cash loans represented 31.2% of Genesis Capital’s active loan portfolio, up from 23.5% at the end of Q2 and 14.0% at the end of last year. Similar to its Q2, the company experienced a “strong demand internationally to borrow USD,” most of which translated to the procurement of stablecoins such as USDC and PAX.

Source: Genesis Capital

According to the above graph, Genesis started the year at approximately $20 million outstanding and “after seeing moderate growth to $40 million towards the end of Q2, Q3 saw nearly a 4x increase in cash loans outstanding, reaching a high of $160 million in mid-September.”

Based on the report, while the company’s current cash loan book sits at $140 million, Genesis attributed the recent reduction in outstanding loans “to deleveraging after the spot selloff from $10,000 to $8,000 as well as a flattening of forward curves which were formerly in steep contango for the majority of Q3.”

That being said, the Q3 displayed a steep increase in international counterparties comprising of 45% outstanding cash loans, with nearly 70% originating from Asia.