Galaxy Digital projects Bitcoin network hashrate growth in H2 – Meaning?

- BTC’s hashrate is projected to grow, partly boosted by public miners

- The hashrate recovered in July, and it could soon extend to hit a record high

Galaxy Digital has forecasted a better and more profitable environment for Bitcoin [BTC] miners in the second half of 2024. Due to the positive outlook, the firm adjusted its initial Bitcoin network hashrate target from 675 – 735 EH (Exa hash) to 725-775 EH.

“We estimated a range of 675 EH to 725 EH for our end-of-2024 hashrate target. We are now revising our growth upwards to between 725 EH and 775 EH”

For perspective, hashrate refers to the computational power used by BTC miners to solve the next block and secure the network. A rising hashrate indicates greater network security and is a sign that more miners are participating in the network.

Public BTC miners to drive hashrate growth

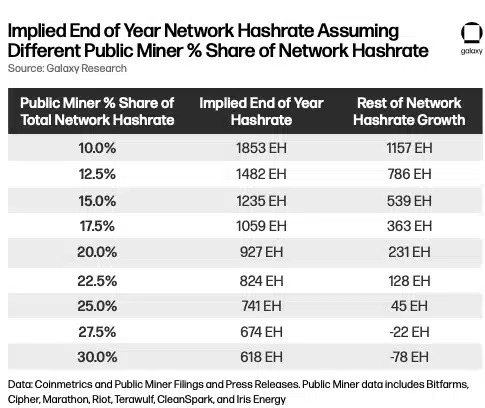

According to the report, public miners currently account for 13% of the network hashrate. However, this share could rise to 15%-30% by the end of the year, This, with a base case of 25% resulting in a 741EH hashrate projection.

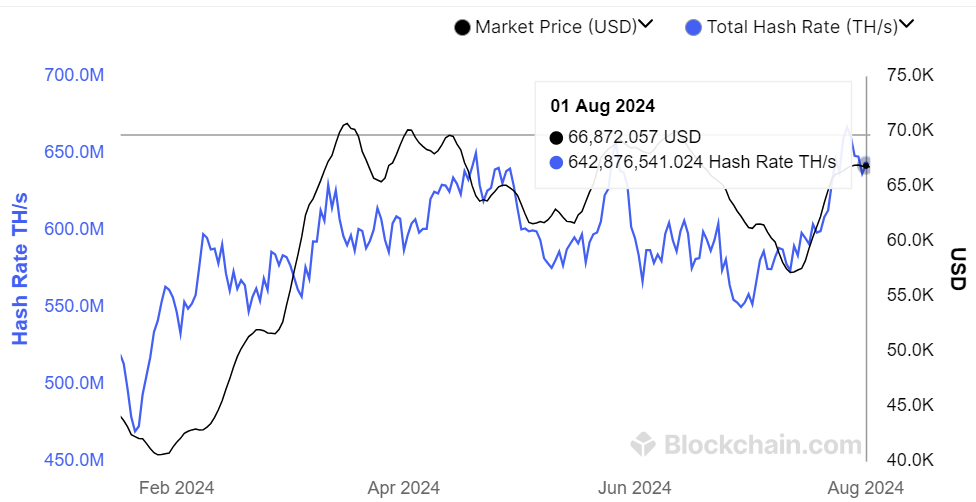

Already, the hashrate has recovered remarkably from July, which coincided with the tapering of the BTC miner crisis (profitability issues). The network hashrate dipped to a low of 550 EH towards the end of June. Since then, however, it has reversed and trended higher, with the same noting a figure of around 640 EH on 1 August.

Source: Blockchain.com

In fact, according to CryptoQuant’s data, the hashrate growth also followed a recent price recovery after a massive decline to below $54k in June. The hashrate trend is now inching closer to its record high on the charts.

“Bitcoin network hashrate is less than 2% from all-time-high. Miners expanding as prices recover.”

The aforementioned positive outlook for Bitcoin’s hashrate is good news for the crypto’s price. It must be noted though that at this time, investor sentiment is fairly cautious about the U.S economy in the short term. The effects of this caution might be felt on the crypto-market too.