Bitcoin

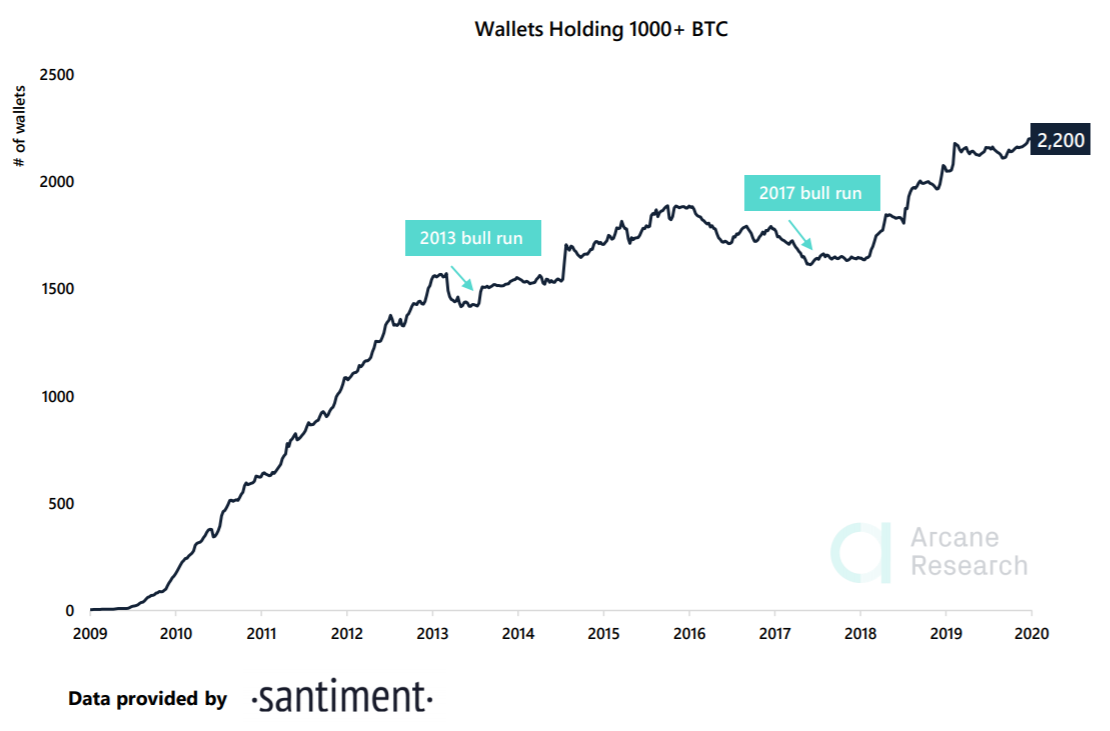

Forget 2013, 2017 – 2020’s Bitcoin whales are different

The cryptocurrency market has for long been eagerly waiting for an opportunity to participate in a rallying market, especially since the Bitcoin halving in May. Now, it would seem that it has finally got this opportunity. At the time of writing, the market was noting a rising number of BTC holders, especially among whales. In fact, recent data would suggest that wallets holding more than 1,000 BTC, equivalent to $11.8 million or more, have been reporting an all-time high on the charts.

The aforementioned rise in holding stats suggests that large BTC holders are currently not interested in realizing profits. Instead, they are waiting for the Bitcoin market to register another hike on the charts. This is an interesting observation as during the 2013 and 2017 bull runs, when the market was in its full glory, traders had been quick to realize their gains. The fact that they are now holding on to their BTC affirms that there is more growth to be witnessed by the market.

Apart from the aforementioned development, the use of Bitcoin in DeFi has also registered a rise on the charts recently. The trading volume reported by real BTC was $12.2 billion last week, a sign of the significant increase in volume on decentralized exchanges.

Source: Arcane Research

At press time, the Total Value Locked in DeFi had surpassed $7 billion, whereas the weekly volume had shot up by 575% since the last week of June. The trend has not shown any sign of stopping with Uniswap dominating the space and accounting for more than half of the total DEX volume. DEX’s volume had been surging since July, and so was the total value locked in WBTC.

In fact, DeFiPulse data reported the TVL in WBTC on 1 July was $79.929 million, a figure that rose to a peak witnessed on 21 August at $365.201 million. The volume has since fallen a little, but it remained strong at $356.202 million, at the time of writing.

Source: DeFi Pulse

Finally, the demand for WBTC has been on a rise and was noting strong growth on the charts. This was indicative of the growing demand for BTC in DeFi and as the market prepares for the next hike, we may see this trend continue.