For cryptos like Bitcoin managing risk may be tricky, not impossible, here’s why

“We simply attempt to be fearful when others are greedy and greedy when others are fearful”

Warren Buffet’s quote may sound like a cliche when discussing risk management in a crypto portfolio, nevertheless, it is true. Recently, on-chain analyst @DaanCrypto suggested risk management techniques for crypto traders in a long twitter thread.

Source: Twitter

While these insights are actionable for most traders, just as Daan tweeted, there is no “best” way to manage risk. Statistically, the larger your bid size, the more potential risk / potential reward per position. While rewards are easier to track, limiting risk in the short term is crucial. The risk goes up with a large bid size as it outweighs the potential rewards statistically over a period of 200 days.

Source: Woobull Charts

In this chart by Will Woo, the risk-adjusted returns for Bitcoin over a 4 year period have been calculated and compared against leading altcoin Ethereum and other investment avenues like Bonds and Gold. Bitcoin’s Sharpe Ratio, calculated as ROI/ Risk is consistently above 2. Here volatility is considered a risk. The risk-adjusted return for Ethereum was higher than Bitcoin since 2018. However, Bitcoin’s ROI is higher compared to traditional investment options like Bonds, even when adjusted for risk.

Consider losing 50% of your investment and still booking twice the profit? This is possible only with altcoins, as opposed to Bitcoin, as the cycle of booking high profits is relatively longer for Bitcoin. Profit booking opportunities in Bitcoin are influenced by market cycles and halving events. So turning $100 to $50 and back to $200 is possible, it may take 8 to 18 months in Bitcoin, however, this can happen faster in Altcoins. Risk is high, but it’s a risk that your portfolio is exposed to, for a relatively short duration.

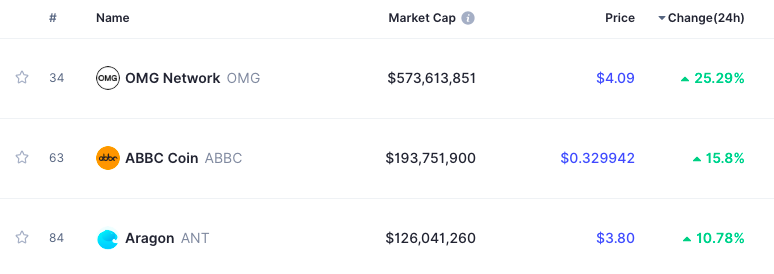

In a single 24 hour window, less popular altcoins with a market cap below $600 M can offer returns of 10-25%.

Source: Coinmarketcap

Managing risk in intra-day trading of altcoins could be a challenge, however with the right portfolio size exposure can be controlled. The risk appetite of traders varies and rather than defining your own risk appetite, you could compare the ROI of various cryptocurrencies, side by side over a period of investment/ trade that interests you.

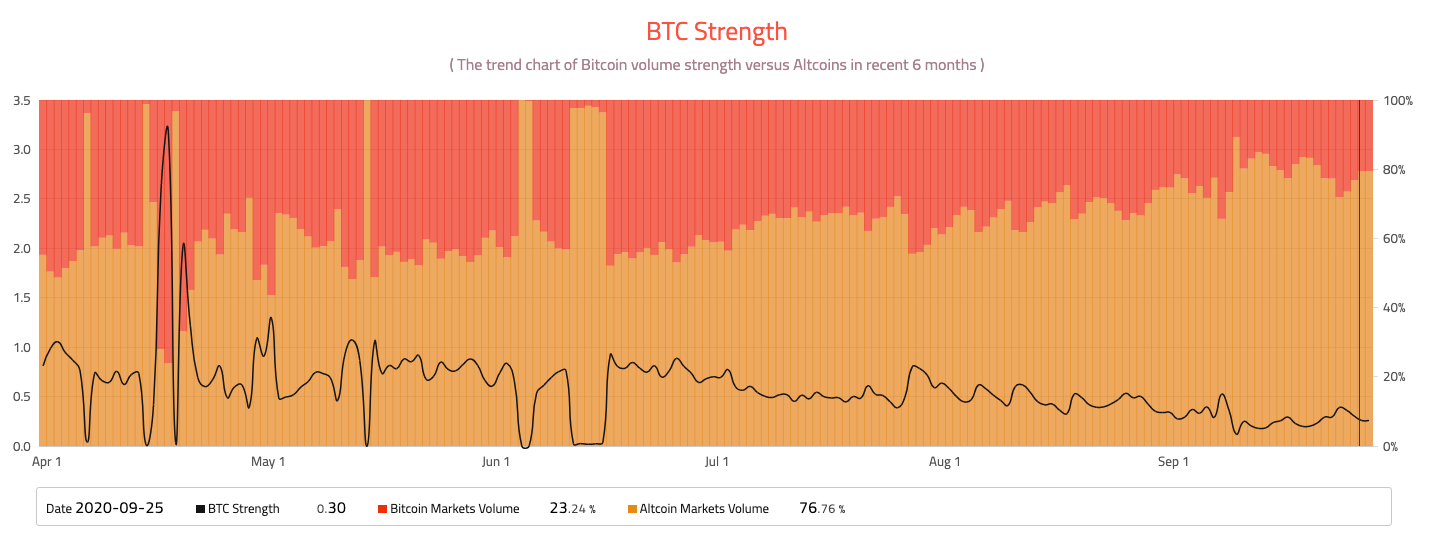

Source: Coinhills

The above BTC strength chart gives insight into BTC and altcoin dominance. When BTC strength is high, it is time to book profits on existing positions as these times are periods of comparatively high returns. Since April 2020, such opportunities have come 6-8 times and HODLers had unrealized gains of 150% or more, corresponding to the spikes in the chart. Though Bitcoin’s dominance has dropped, its strength is above the bearish period of 2018 and this is possibly the right time to manage risk and gear up for higher returns in the following quarter.