For crypto users, trusts may help save taxes

Bitcoin has seen increased interest from institutional investors in the past few years. While the increased regulatory clarity has enabled more investors into the crypto market, there still continues to be significant ambiguity in areas like regulations related to taxation and has become quite a challenge when it comes to compliance.

In a recent episode of the Bitcoin Magazine podcast, Founder and CEO of Platinum Trust Group – Bruce Mack spoke about how and why crypto users should leverage a trust to protect their assets and Bitcoin in particular. Highlighting how crypto is a taxed venture, Mack noted that many users in the space have very little understanding of what their tax liabilities are. He noted,

“With a proprietary trust, like our trust where we have 58 copyrights. Because of the structure of the trust, utilizing IRS code 643. It so states that capital gains taxes end up being, if you will, deferred in perpetuity.”

He went on to add that in such a scenario by using such trust funds certain taxes are deferred generationally. He argued, “The ability to have the deferral component that is within the precepts and corpus of the trust gives the ability to be able to move forward or kick that tax can generationally”. Highlighting the significant amounts of state tax individuals who deal in crypto will have to pay Mack noted that,

“If you’re in California and your highly compensated individual, and you did real well with your Bitcoin. You could be looking at as much as 53.8% in short term capital gains versus longterm capital gains.”

While forming a trust to keep one’s gains intact and store crypto may be an alternative long time investors will soon be considering, however according to Mack, the nature of the trust and whether or not the user has control within it is an important aspect to consider. He noted,

“Many of the trusts that are out there unfortunately, they’re self-settled trust. Many of them have provisions in them that there has to be a third party trustee that administers over the trust. I would like to caution everyone when you ain’t got control you could have a problem.”

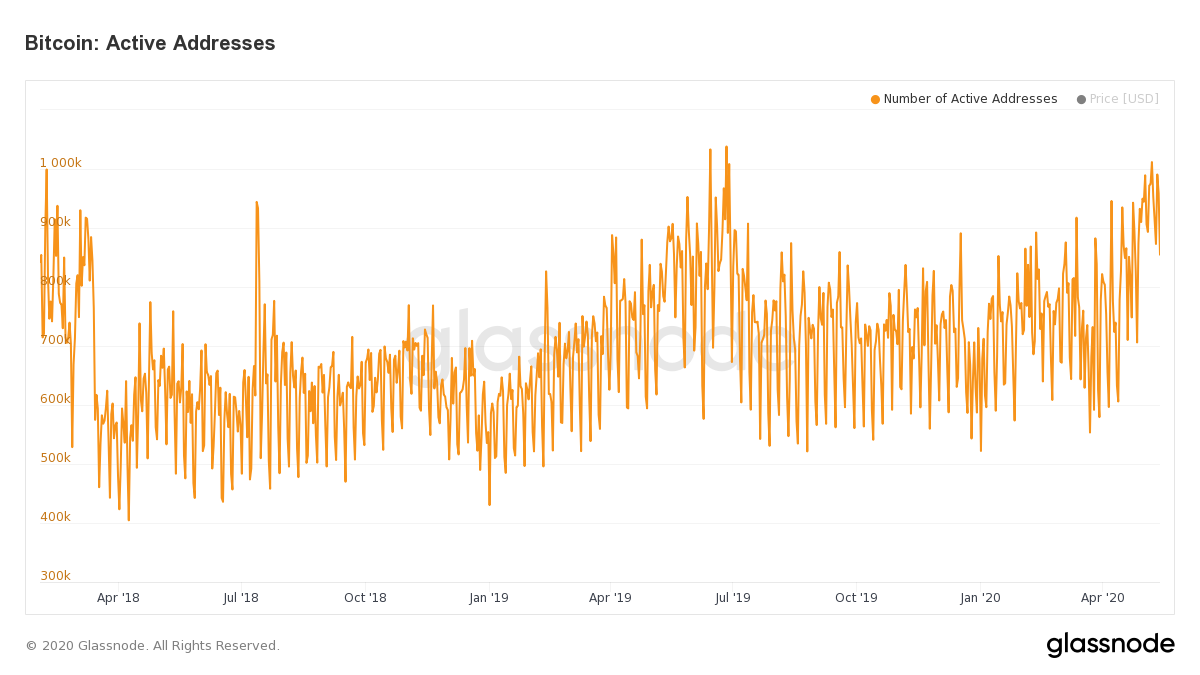

Source: Glassnode

Interestingly in the past few years, Bitcoin adoption has seen a steady rise. Market data provided by Glassnode highlights how there has been a systematic growth in active BTC addresses since 2018 and as more individuals come into the picture, trusts may play a greater part in securing Bitcoin, providing tax relief and in inter-generational wealth transfer that includes crypto.