FLOKI jumps 116% in 30 days – Is it too late for retail to join the rally?

Key Takeaways

FLOKI’s price action is looking super bullish, but the increasing shorts are raising doubts among holders. With the longs building below current price, can they trigger rally continuation?

Floki [FLOKI] and other memecoins have recently regained attention after posting strong gains over the past few days.

Although the memecoin market had been declining since its December peak, FLOKI has emerged as one of the most discussed tokens.

So, what’s driving the renewed hype?

FLOKI price looking good

Looking at price change of FLOKI, the memecoin has been down about 29%, at press time, from a year-to-date perceptive. However, FLOKI was up more than 116% in the last month, as per CoinMarketCap.

FLOKI is one of the few memecoins from the previous cycle that has remained active, alongside Dogecoin [DOGE] and Shiba Inu [SHIB].

Its price has shown bullish momentum across multiple timeframes, with the hourly chart especially highlighting its strong upward trend.

The memecoin was above the 200MA (Moving average), with the faster MAs confirming the current sideways movement.

The RSI was neutral, as of writing, suggesting the buying was not yet at its peak.

However, despite this bullish outlook, there rose an alarming signal rose on the derivative markets.

Is retail late again!

According to Unipics on X (formerly Twitter), FLOKI led with the largest short liquidation of the past hour as of press time.

While memecoins led on this front, FLOKI had more than $500K in shorts while DOGE led with the largest long positions of about $1.51 Million. This led to Unipcs raising a deserving argument on his post, saying,

“Why would you even short a chart that looks like this?”

One possible reason for the slowdown is that the rally may be taking a breather.

Retail traders have become more active, which often signals a potential trend reversal—since they typically enter late.

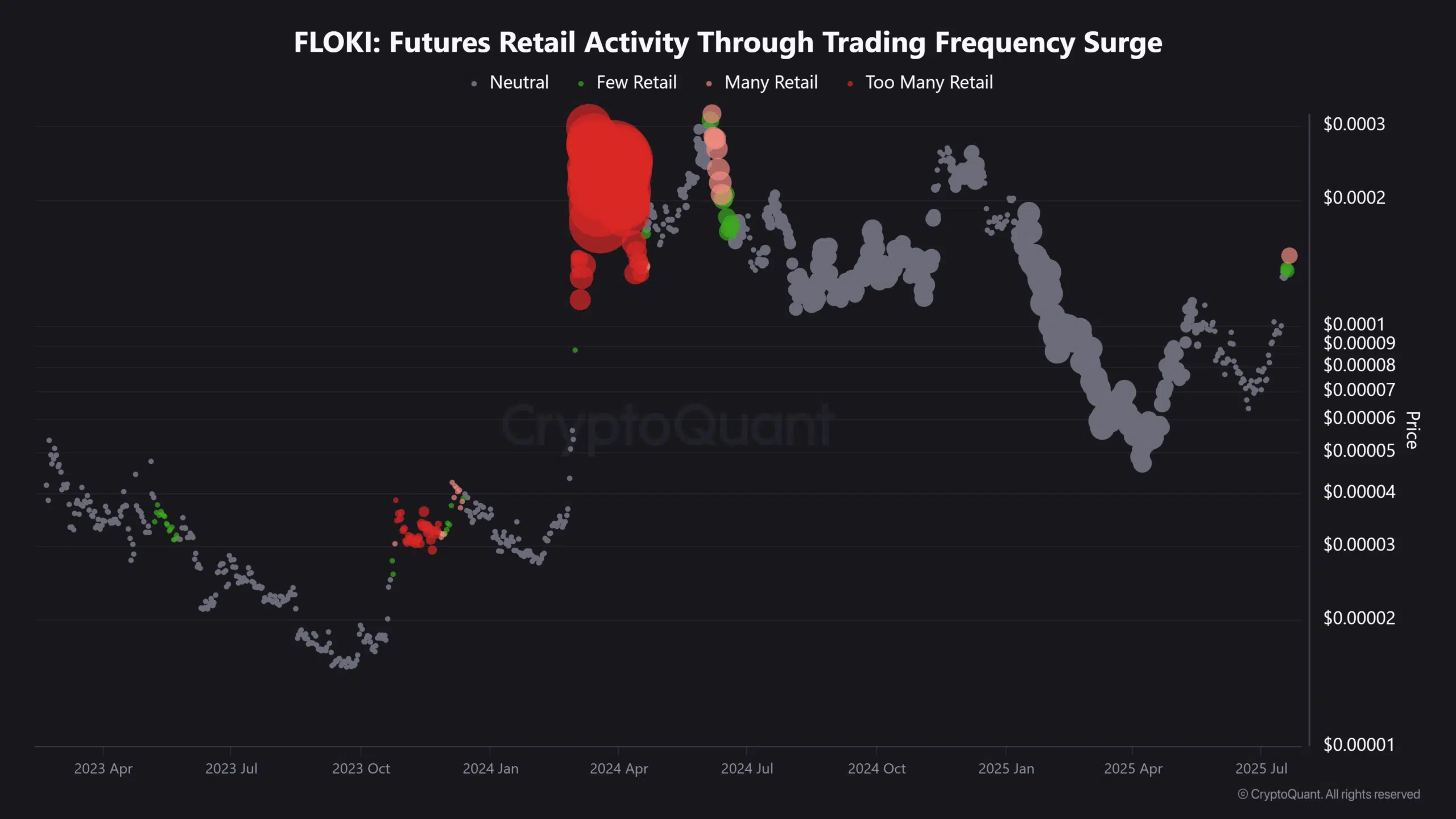

As FLOKI’s price climbed from $0.00009 to $0.00014, Futures trading frequency hit the “Too Many Retail” threshold.

This spike in retail activity likely triggered an increase in short positions.

The big players could be taking their profits, having ridden the aforementioned move. They could also be looking to shake out the retail traders who were rushing in as memecoin hype returns.

Shorts liquidations rising but…

More analysis suggested that the shorts could be driven by participants who had their long orders set below the press time price.

As per CoinGlass data, a massive long liquidation cluster was sitting at $0.000129844 to $0.000136708 zone.

On the other hand, shorts were starting to build above the $0.000155, but not as concentrated as long beneath.

If the shorts succeed in triggering the long cluster zone below, a continuation of the current trend could be reignited. On the flip side, price could still go lower after triggering of the longs to shake out the weak hands.