Fed’s Jerome Powell: ‘We’re not allowed to own Bitcoin’ – No more BTC reserve?

- Powell stated that the law doesn’t allow the Fed to own BTC.

- The community clarified that the US BTC reserve will be under the Treasury Secretary, not the Fed.

Fed chair Jerome Powell’s latest Bitcoin [BTC] reserve comment has made media buzz and confused some quarters of the crypto community.

During his press conference on Wednesday, one of the journalists asked him if he sees any value in the US having a BTC reserve.

In his response, Powell stated,

“We’re not allowed to own Bitcoin. But the Federal Reserve Act says what we can own and we’re not looking for a law change.”

He added that any other law changes were within the purview of Congress and not the Federal Reserve.

Will US have a BTC reserve?

A section of the crypto community was disappointed by Powell’s remarks as some speculated that he might be a roadblock to the BTC reserve plans.

However, others clarified that the BTC reserve plan was designed to be established by the US Treasury Secretary, not the Fed.

According to the BTC reserve bill introduced by Senator Cynthia Lummis, the fourth section anchored the mandate with the Treasury Secretary and read,

“The Secretary shall establish a decentralized network of secure Bitcoin storage facilities distributed across the United States, collectively to be known as the Strategic Bitcoin Reserve for the cold storage of Government Bitcoin holdings”

This is probably why the industry lobbyists pushed for a pro-crypto Treasury secretary and SEC chair in the upcoming Trump administration.

Scott Melker of the Wolf of All Streets also dismissed Powell’s remarks and reiterated that only the Treasury will have a big say in the reserve. He said,

“The Fed is not allowed to own Bitcoin. Good thing it would be the Treasury putting Bitcoin on the balance sheet if Bitcoin was made a reserve asset. This means nothing.”

Despite Powell’s latest comments, he had earlier praised the asset as an alternative and competitor to physical gold and not the US dollar.

However, his recent remarks have raised the question of whether the reserve will become a reality.

Last week, Strike’s Jack Mallers stated that the president-elect could use The Dollar Stabilization Act to issue a day-1 executive order to establish a BTC reserve to protect the US dollar. If so, the US could create the reserve next month after the inauguration.

However, some market pundits believe that the BTC reserve won’t protect the US dollar but destroy it.

So which direction is the market leaning in?

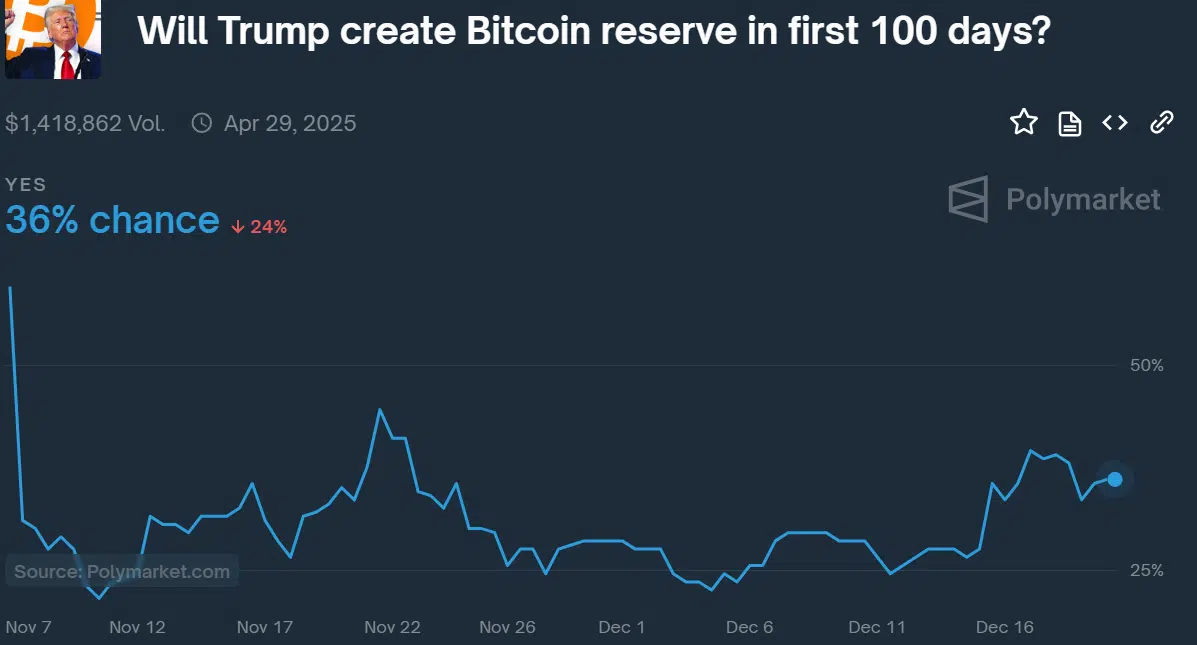

According to prediction site Polymarket, the odds of forming a US BTC reserve jumped to 40% earlier in the week. The surge also saw BTC topped $108K.

Source: Polymarket

But the chances of the reserve slipped 4 points to 34% following Powell’s remarks. BTC also briefly plunged below $100K over the same period.

However, the odds were slightly up at 36% as of this writing, suggesting that the market was still optimistic about the reserve.