Fed vs crypto: Can Bitcoin retain its ‘store of value’ status in 2025?

- The Fed and crypto are at odds again, with the Fed sticking to its no-rate-cut stance.

- Now, all eyes are on the crypto market: Will it emerge as a safe haven, or will it dip even deeper?

It’s only the second week of 2025, and the tension between the Fed and the crypto market is already heating up. With volatility on the rise, Bitcoin [BTC] is facing challenges it has struggled with since day one.

After 15 years, the crypto market is still fighting to be recognized as a stable store of value. AMBCrypto warns that this challenge will only grow as we move further into this volatile year.

The Fed’s ‘cautious’ approach

In less than a month, the crypto market has seen two big shake-offs, both linked to the Fed’s moves on the U.S. economy.

It’s no surprise this has led many to ask: Is the Fed influencing the market, especially when each move lines up with Bitcoin hitting key levels? With such striking similarities, it’s hard not to wonder.

What’s clear, though, is the impact. In just two days, the crypto market cap fell from $3.60 trillion to $3.34 trillion – a 7.22% drop.

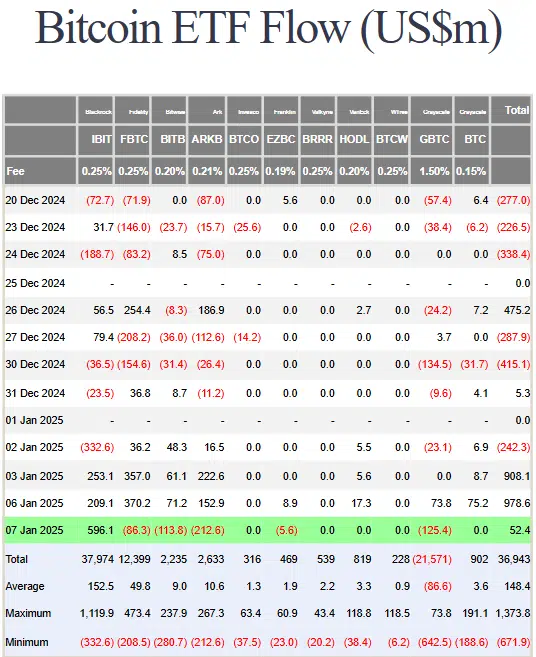

And it might not stop there. Despite a massive $1.2 billion flowing into BTC ETFs over the last three days, Bitcoin still took a near 6% dip in a single trading day – a clear proof of the pressure the crypto market is under.

So, what’s next? We all saw how the crypto market ended Q4, with Bitcoin dipping below $92K, despite all the buzz around the “Santa Claus” rally and New Year optimism.

A similar pattern could unfold in 2025. Even with the approaching inauguration of Trump, a bull run seems uncertain. The stakes are higher than ever, and it’s anyone’s guess how the market will play out.

Still, there’s a glimmer of hope: Can crypto bounce back?

No surprise – the Trump trade is one of the few cards left for crypto to bounce back, and possibly the most valuable. But it’s not without risks.

Trump’s history of bold moves, like China tariffs and tough sanctions, makes it hard to say if his promises to turn the U.S. into a crypto hub will actually happen.

On top of that, the mounting debt crisis means the government may turn to bonds for funding, making it even harder for the Fed to cut rates.

So, what’s the hope?

Read Bitcoin’s [BTC] Price Prediction 2025-26

Either institutional investors will trigger a massive supply shock, or Trump will deliver on his promises to cut taxes, slash regulations, and boost wages, potentially sparking a retail investment surge into crypto.

If not, we end up with a ‘buy the rumor, sell the news’ situation. In fact, 2025 might bury crypto’s ‘store of value’ status even deeper. All eyes are on the Fed now – watch the U.S. economic calendar closely.