Ethereum becomes the third Cross collateral asset on Binance Futures

Binance exchange has added another important asset to Cross Collaterals- Ethereum [ETH]. Ethereum was the third asset to be added to this list after Bitcoin [BTC] and Binance USD [BUSD]. With Ethereum as another option to choose from, it would allow users to collateralize their crypto assets to borrow against ETH.

The release from Binance stated:

“Binance Futures will add ETH as an option to use as cross collateral in the Futures wallet interface starting 2020/09/28 7:00 AM (UTC).”

With Ethereum as cross collateral, users who do not want to hold stablecoins like USDT can collateralize their crypto-assets to participate in the futures market using ETH.

The growing demand for ETH in the Decentralized Finance [DeFi] ecosystem has been maintained but it has also been a troublemaker for Ethereum users. The DeFi protocols have been working towards implementing Layer 2 scaling solutions as the gas cost rises and the network witnesses congestion. Many prominent DeFi platforms like Uniswap, Aave, and Synthetix are striving and getting closer to launch their scaling solutions, but until then the problem of a congested network prevails. However, it was a relief to traders to see options apart from DeFi being introduced for the second-largest coin.

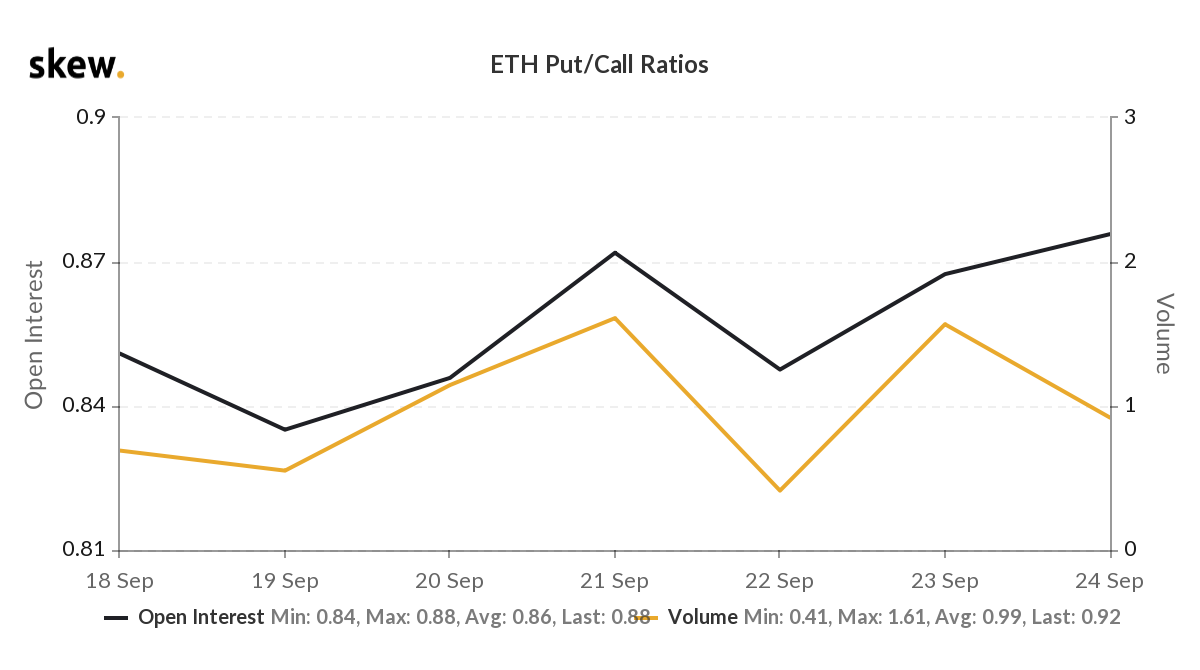

The market has been already tense given the large ETH options expiry taking place today. Data from Skew suggested that nearly 468.1k ETH options by open interest were going to expiry on Friday and while the market has been in a recovery phase, a price swing is expected. Although the direction of the price swing cannot be determined, the volatility will witness a significant increase. Currently, puts have been taking precedence over calls as suggested by the Put/Call ratio which remained high at 0.88.

Source: Skew

Whereas the strike price has remained high at $410, but there was an equally high strike rate of $200. This showed the divide among the traders in the market.