Ethereum’s higher TX fees not a bullish flex

On 22 June, Eric Conner, a popular Ethereum Proponent, tweeted the following and revealed to his thousands-strong followers,

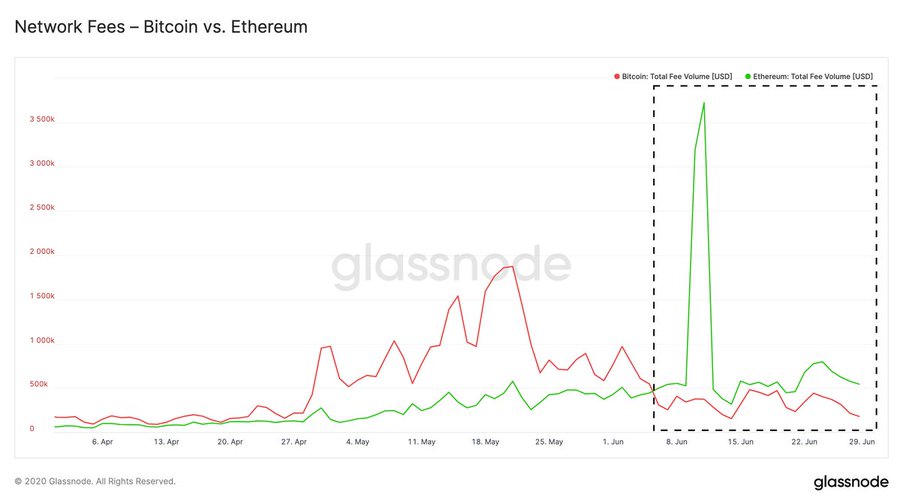

“For 16 straight days, Ethereum users have paid more to use the network than Bitcoin users.”

Source: Twitter

Fast forward to 30 June, this has extended to 24 days, with Glassnode analytics’ platform revealing that Ethereum’s fees have continued to exceed Bitcoin for 3 weeks in a row. Interestingly, the last time Ethereum’s fees were higher than Bitcoin’s for such a series of consecutive days was back in May 2018.

Two years ago, ETH users would have raved about this development over social media. Now, while superficially it would appear to be a bullish sign as higher transaction fees indirectly mean that Ethereum’s blockchain is getting used more than Bitcoin’s, that might not be the case in reality.

As has been reported previously, a majority of the transaction fees on Ethereum was being used for “other contracts” that did not utilize ERC20 or ERC721 standards, meaning Ether is barely being used. Only 10.7 percent of the total fees were spent on actual transactions between possible users in 2020, which is technically not a good color on Ethereum.

Additionally, a recent analysis had revealed that with respect to average fees per category, the most expensive ones were zero-value ETH transactions sent between various ETH EOAs (Externally-Owned Addresses). The report added,

“While it is common to have zero-value ETH transactions when calling smart contracts, the question arises why anyone would initiate transactions to externally owned accounts that transfer no value.”

Now, some of the possibilities were money laundering and proof of address ownership, but these did not actually require higher fees.

The search zeroed in on possible transactions carried out to cancel previous transactions since they required significantly higher fees to prioritize and make a previous transaction invalid.

Can Ethereum still boast of its higher transaction fee statistic?

If the present market is analyzed, it is fair to say that higher transactions iterate a higher use of the blockchain. However, this is not a sign of your native crypto-asset being utilized even more than it already is.

Ethereum could be blooming, but the same has not been the case for Ether and rising transaction fees do not present any bullish signs for ETH’s future. This observation draws commonality with the fact that any type of growth does not mean it has bullish implications, just like any publicity is not exactly ‘good’ publicity.