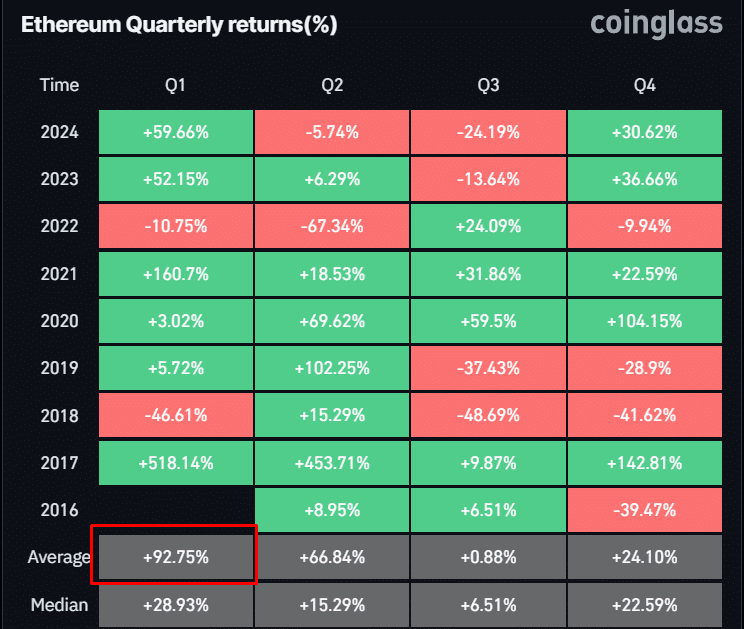

Ethereum’s Q1 2024 returns outperformed its historical quarterly average of +92.75%, marking a substantial recovery compared to Q1 2022’s -10.75%.

This growth was driven by heightened institutional interest and innovations in scaling solutions.

Source: Coinglass

Despite Q2’s modest decline, the resilience of Ethereum’s DeFi ecosystem played a critical role in offsetting bearish sentiment.

Looking ahead, the Q3 drop reflects profit-taking behavior but sets a stable foundation for Q4’s anticipated rebound, historically a strong quarter.

Comparative analysis reveals that Ethereum’s 2024 performance mirrors prior volatility patterns, highlighting its cyclical yet promising trajectory.

As Layer-2 networks integrate deeper into mainstream finance and staking adoption increases, Ethereum’s momentum could redefine market dynamics heading into 2025’s anticipated altseason.

Ethereum’s dominance in post-halving altseasons

Ethereum has historically thrived during Bitcoin-driven altseasons, as evident in its explosive rallies post-2017 and 2020 Bitcoin halvings.

ETH’s high beta to Bitcoin allows it to capture outsized gains when capital rotates into altcoins following BTC’s dominance peaks.

Source: Coinmarketcap

Entering the 2025 cycle, Ethereum’s strategic positioning in the crypto and blockchain space sets it apart.

With Bitcoin’s April halving event driving market-wide liquidity, ETH could outperform due to its expanding utility and deflationary tokenomics.

Ethereum’s price resilience and upward trajectory since 2023 suggest strong investor confidence.

If previous patterns hold, ETH’s growth potential aligns with its enhanced network fundamentals, making it a key player in the next altseason wave.

Ethereum’s 2025 outlook

Ethereum’s growth potential in 2025 hinges on its ability to scale effectively and maintain its leadership in dApps and Layer-2 solutions.

With the anticipated rise of institutional investment following regulatory frameworks — especially by the incoming pro-crypto administration — Ethereum could further solidify its position as a key asset in the crypto ecosystem.

Read Ethereum’s [ETH] Price Prediction 2025–2026

Developments in scalability and increased adoption are expected to drive user engagement and transaction volume.

Additionally, Ethereum’s positioning in a maturing market highlights its long-term relevance in shaping the post-halving cycle and beyond.