Ethereum

Ethereum: Whales make themselves known amidst price rise

Should the large accumulation continue, then ETH might stabilize above $2,000.

- ETH whales are slowly accumulating.

- The altcoin can be said to be undervalued.

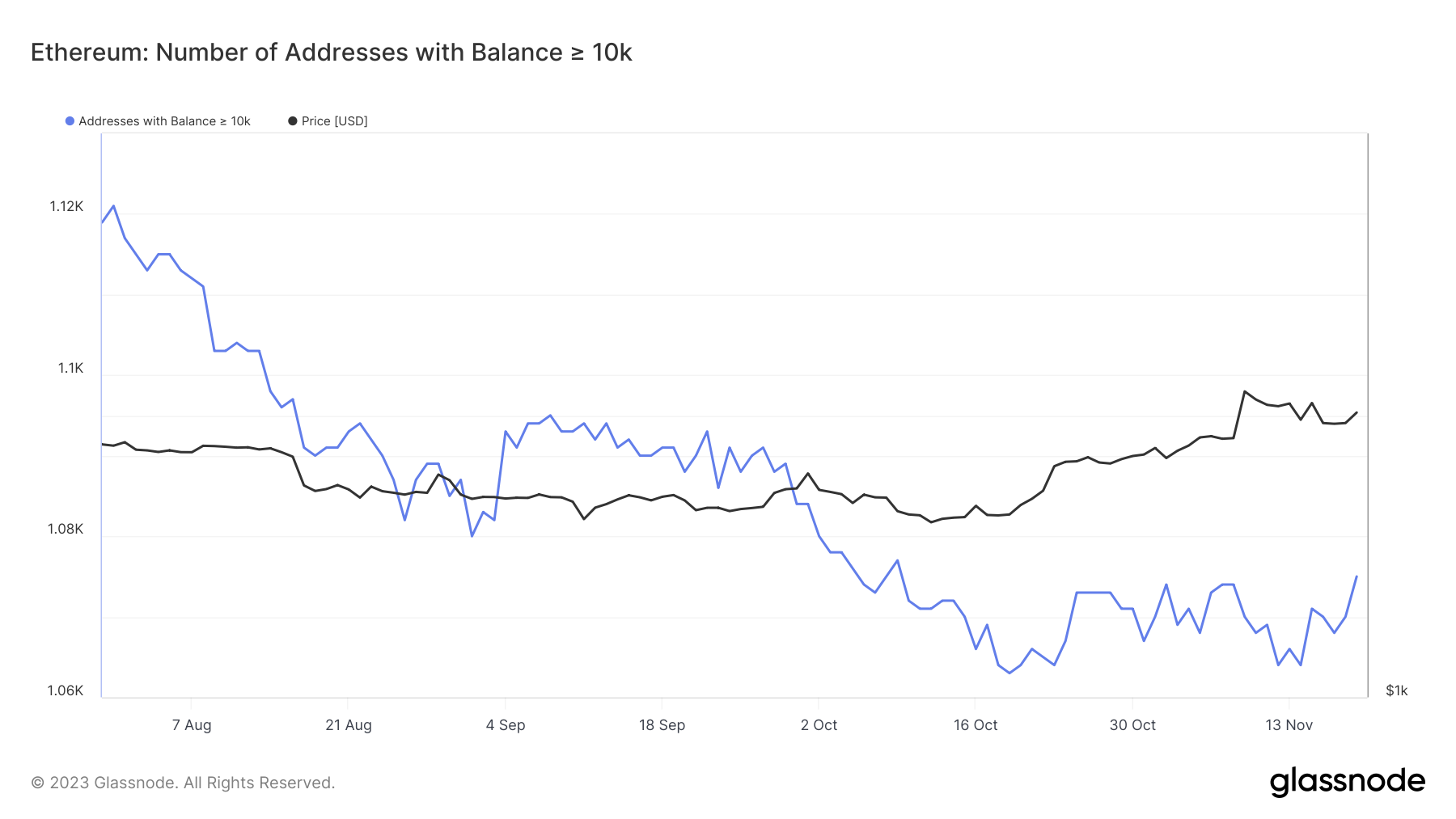

Addresses holding 10,000 Ethereum [ETH] tokens, and more have started topping up the amount of ETH held in the portfolio, AMBCrypto’s assessment of Glassnode’s data revealed. As of the 9th of November, 1064 addresses held 10,000 ETH or more.

But at the time of writing, the count had increased. Although the rate at which the number is climbing seemed slow, it affected ETH’s price. At press time, ETH changed hands at $2,036. This value amounted to a 4.46% increase in the last 24 hours.

Buying is not yet for retail

Recently, there have been complaints from market players about ETH’s slow movement compared to other altcoins. So, the whale accumulation, alongside the increase in price, may have brought some sort of relief to ETH retail holders.

Should the large accumulation continue, then ETH might stabilize above $2,000. In a case where the accumulation becomes rapid, the altcoin might be able to reclaim $2,100. But is this cohort following the same path as the whales?

On evaluating the balance of addresses in the 1-100 Ethereum cohort, AMBCrypto found out that a large part had refrained from accumulating. A situation of this sort implies that retail Ethereum holders are not bullish on the short-term price action.

Furthermore, the Market Value to Realized Value (MVRV) Z-score had risen to 0.40. This metric is a function of the difference between the market cap and the realized cap. It is also responsible for indicating if a cryptocurrency is undervalued or overvalued compared to its fair value.

When the MVRV Z-Score is above seven, it means that investors have made a lot of profit. When the metric is below zero, it indicates that the market is bleeding. Therefore, ETH’s press time MVRV ratio showed that the altcoin is close to being undervalued.

Little by little, ETH moves

So, long-term ETH holders have the opportunity to become profitable, as long as the cryptocurrency remains in their portfolio. For the short term, one metric that could be valuable to evaluate is the Seller Exhaustion Constant.

Realistic or not, here’s ETH’s market cap in BTC’s terms

Using the 30-day price volatility, the Seller Exhaustion Constant detects if a cryptocurrency has the potential to create high losses or otherwise. At the time of writing, the metric was 0.055. A close look at the chart below showed that it had exited the danger zone (red) at the time of writing.

Therefore, ETH’s price at $2,000 could be considered healthy for buying. Also, the altcoin may resist a significant plunge in as much as the Seller Exhaustion Constant does not fall to the reading it was around the first few weeks in October.