Crypto News

Ethereum tops ESG ranking again while Bitcoin continues to struggle

Ethereum, along with Solana, Polkadot, and Binance Coin earned the perfect “AA” grade in the latest ESG rankings.

- Ethereum outperformed other cryptos with a total score of 78.

- Bitcoin’s low score of 7 on environmental parameters impacted its overall ranking.

Proof-of-stake (PoS) blockchain Ethereum [ETH] stood first in the latest institutional-grade ESG (Environmental, Social, Governance) ranking released by crypto market data provider CCData.

Ethereum becomes investment-friendly

Ethereum was followed by popular altcoin projects like Solana [SOL], Polkadot [DOT], and Binance Coin [BNB]. Interestingly, the world’s largest crypto asset Bitcoin [BTC] was languishing in the 26th position out of the 40 assets that were evaluated.

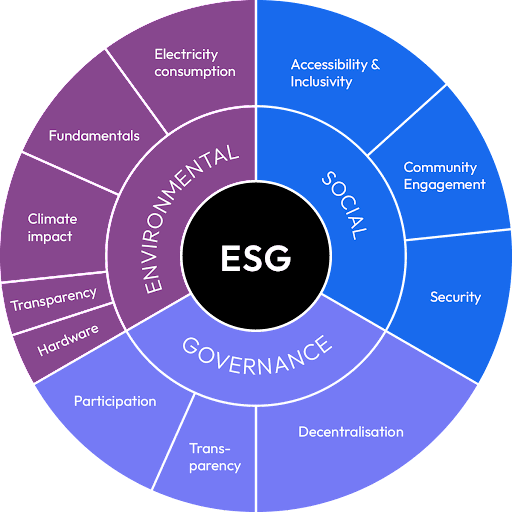

Launched in partnership with the Crypto Carbon Ratings Institute (CCRI), the ESG benchmark assesses some of the most liquid assets of the market across key environmental, social, and governance parameters.

Ethereum outperformed other cryptos with a total score of 78. The asset scored above 28 on the social parameter, the highest on the list, while also doing well on the environmental and governance indices.

Ethereum, along with Solana, Polkadot, and Binance Coin earned the perfect “AA” grade. This was a significant improvement from the previous rankings where only Ethereum scored the AA grade.

Bitcoin’s green credentials not up to the mark

Bitcoin, on the other hand, could only manage a score of 57.37. The crypto’s low score of 7 on the environmental parameter significantly impacted the final score. In fact, this was the lowest rating of any of the assets surveyed.

Unsurprisingly, high energy consumption continues to damage Bitcoin’s green credentials. The proof-of-work (PoW) mechanism makes the network a big power guzzler, resulting in more greenhouse emissions.

Why ESG rankings matter

In recent years, there has been a growing recognition of the importance of ESG factors in investment decision-making. Projects that effectively manage ESG risks and opportunities are more likely to generate sustainable returns over time.

Moreover, regulatory frameworks are also integrating ESG factors into their requirements. With the regulatory climate in some jurisdictions heating up, it made perfect sense for cryptos to concentrate on improving them.