Analysis

Ethereum short-term price analysis: June 19

Ethereum is home to a plethora of tokens due to its functionality and has also led to the rise of DeFi. While total value locked in Decentralized Finance reached a new high of $1.2 billion, ETH is dropping in value. At press time, the ETH token is worth $229.54 and has a market cap of $25 billion with a 1.25% decline in its price in the last 24 hours.

Ethereum’s 1-day chart

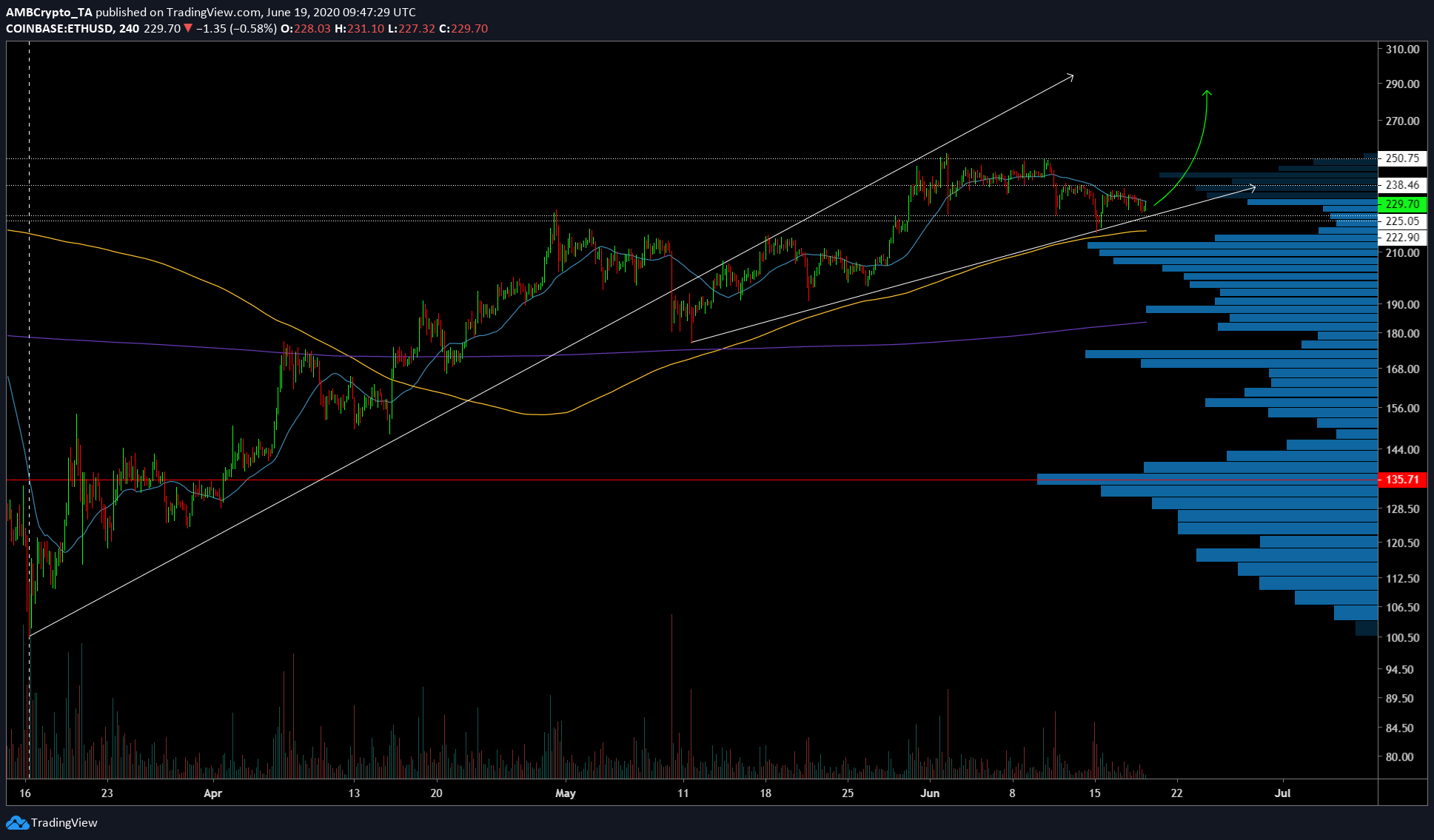

Regardless of the recent drop, the token shows promise with upside ranging beyond $250. The chart attached [below] shows the price moving sideways and slightly higher since the Black Thursday.

Source: ETH/USD, TradingView

One sloping resistance and support can be seen in the above chart; together, they forming broadening wedge and from the looks of it, the next step for ETH would be surge higher. As the price tests the sloping support, the buyers are expected to exhaust the sellers and push the price higher. Additionally, the VPVR indicator shows the existence of strong support around the current level [$220 to $205]. To help the buyers, the 50 DMA [yellow] and the 200 DMA [purple] are all below the price, hence, acting as support.

Furthermore, the reducing volume bars indicate the exhaustion of buyers, hence, the time for the buyers to push ETH higher is right. Preventing this move is the 5 DMA [blue], which has been resisting the higher price action since June 15.

Additionally, the RSI also showed support at the neutral zone [50], indicating a bounce at the aforementioned price levels are more than likely. Hence, if the price does follow through on the clear bullish path, it will encounter important levels, which could be the targets for this move.

Conclusion

The first resistance/target level price will encounter is $238.46, following this will be the $250.75 level. Beyond the $250 level, the price has a freeway to surge up to $275. Hence, the pragmatic targets for the short-term price movement of ETH include a 3.71% surge to $238 and a 9.45% surge to $250.75.