Ethereum remains undervalued despite hike, suggests MVRV ratio

Ethereum’s market was met by a lot of upward momentum on 6 April, with the movement helping the spot price of the digital asset, while also reinstating confidence in the market. The price of the world’s largest altcoin got a boost of 22.29% over a period of 24-hours and was being traded at $172.17, at press time. However, as per observations by data provider Glassnode, the MVRV ratio of Ethereum is under 1.

Source: Glassnode

The data provider noted,

“#Ethereum’s MVRV Ratio, a metric used to assess if price is above or below “fair value”, currently sits at 0.8 – indicating that it is currently undervalued.”

The MVRV ratio is a comparison between the Market Value [Market cap] and Realized Value and is considered by many as a potential way to gauge whether or not market participants are in profit. According to the chart provided by Glassnode, Ethereum’s MVRV had sunk under 0 for the first time in 2018, following which it managed to break above it just twice.

The second time was in 2020; however, due to the volatile market, it dipped back under 0 and at the time of writing, stood at 0.8.

This suggested that despite the price rise, ETH was still undervalued as its realized value was still $202, while the market value was $172, at press time. A breach of the MVRV ratio above 1 could mean that speculators had a higher average market valuation than holders.

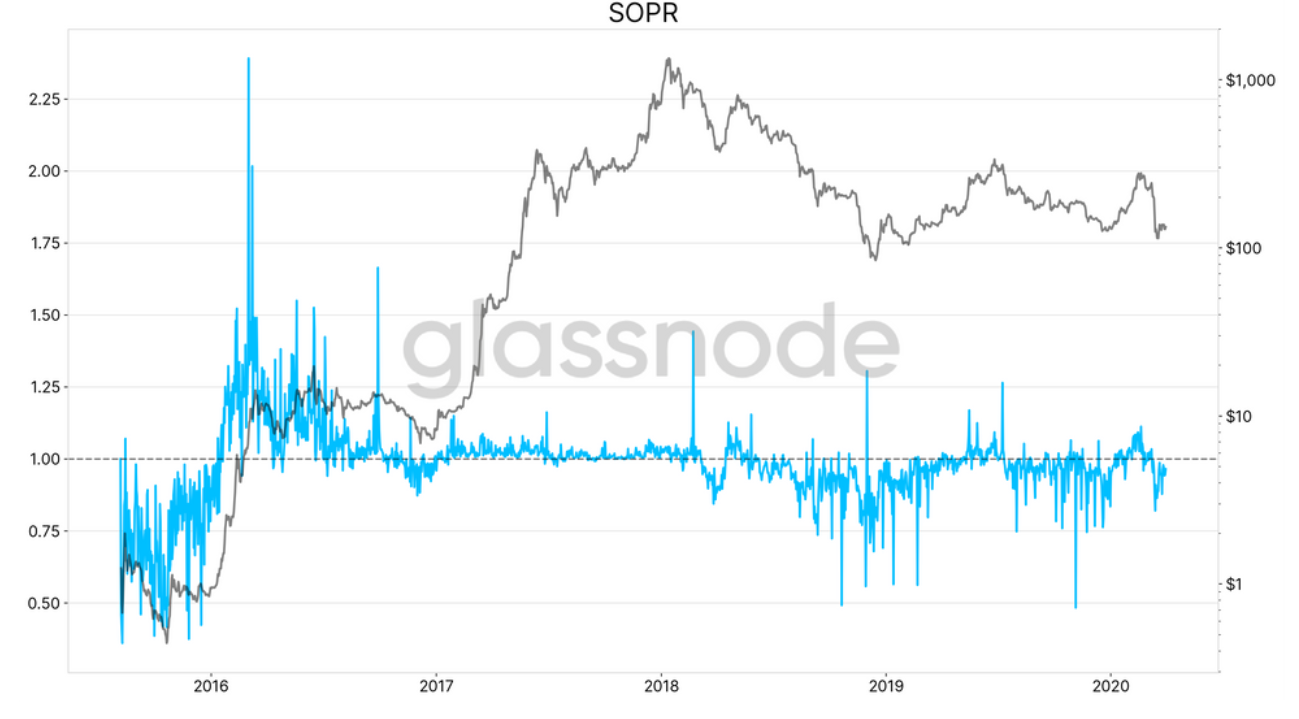

Along with the MVRV ratio, the Spent OutputProfit Ratio [SOPR] also fell under 1, highlighting that owners of spent transactions were not in profit at the time of the transactions. In fact, the traders were incurring losses, while selling Ethereum.

Source: Glassnode

A push above 1 will imply that people are, on average, selling at a profit, as the price sold will be greater than the price paid. During a bear market, as the market corrects prices promptly, the SOPR value is pushed above 1. Thus, an upwards swing could be visible in the Ethereum market.